OfficeMax 2010 Annual Report Download - page 40

Download and view the complete annual report

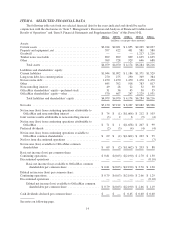

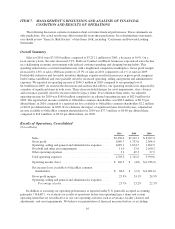

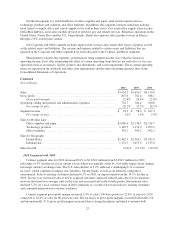

Please find page 40 of the 2010 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We reported net income attributable to OfficeMax and noncontrolling interest of $73.9 million for 2010.

After adjusting for joint venture earnings attributable to noncontrolling interest and preferred dividends, we

reported net income available to OfficeMax common shareholders of $68.6 million, or $0.79 per diluted share.

Adjusted net income available to OfficeMax common shareholders, as discussed above, was $77.3 million, or

$0.89 per diluted share, for 2010 compared to $18.6 million, or $0.24 per diluted share, for 2009.

2009 Compared with 2008

Sales for 2009 decreased 12.8% to $7,212.1 million from $8,267.0 million for 2008. On a local currency

basis, sales declined 11.1%. The year-over-year sales declines occurred in both our Contract and Retail segments

and resulted primarily from the weaker economic environment that existed throughout all of 2009.

Gross profit margin decreased by 0.8% of sales (80 basis points) to 24.1% of sales in 2009 compared to

24.9% of sales in 2008. The gross profit margins declined in both our Contract and Retail segments. The Retail

segment experienced strong cost support from our vendors and reduced inventory shrinkage, the benefits of

which were more than offset by deleveraging of fixed occupancy costs and a mix shift to less profitable

technology products. The Contract segment also experienced strong cost support from our vendors but earned

overall lower gross margins as a result of softer market conditions as well as a shift in its customers’ purchasing

trends to a higher percentage of lower-margin consumable items, lower sales of off-contract items, and higher

customer acquisition and retention costs.

Operating, selling and general and administrative expenses increased by 0.7% of sales to 23.2% of sales in

2009 from 22.5% of sales a year earlier. The increased expense was primarily the result of deleveraging of fixed

costs due to lower sales and increased incentive compensation and pension expenses, partially offset by reduced

payroll and other targeted cost reductions including lower headcount resulting from a significant reduction in

force at the corporate headquarters in late 2008. In addition, the Company benefited $10.0 million from a

favorable property tax settlement and the favorable resolution of a prior dispute with a service provider. Incentive

compensation expense included in operating, selling and general and administrative expenses was $64.4 million

for 2009 compared to $9.1 million for 2008.

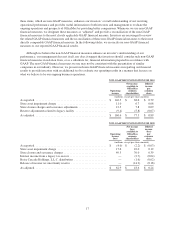

As noted above, our results for 2009 include several significant items, as follows:

• We recognized a non-cash impairment charge of $17.6 million associated with leasehold improvements

and other assets at certain of our Retail stores in the U.S. and Mexico. After tax and noncontrolling

interest, these charges reduced net income (loss) available to OfficeMax common shareholders by

$10.0 million or $0.12 per diluted share.

• We recorded $31.2 million of charges in our Retail segment related to store closures. We also recorded

$18.1 million of severance and other charges, principally related to reorganizations of our U.S. and

Canadian Contract sales forces, customer fulfillment centers and customer service centers, as well as a

streamlining of our Retail store staffing. These charges are recorded by segment in the following

manner: Contract $15.3 million, Retail $2.1 million and Corporate and Other $0.7 million. After tax

and noncontrolling interest, the cumulative effect of these items was a reduction of net income (loss)

available to OfficeMax common shareholders by $30.0 million, or $0.39 per diluted share.

• “Other income (expense), net” in the Consolidated Statement of Operations included income of

$2.6 million from a distribution on the Boise Investment related to our tax liability on allocated

earnings. This distribution was much larger in the prior year due to a significant tax gain realized by

Boise Cascade, L.L.C. on the sales of its paper and packaging and newsprint businesses. After tax, this

item increased net income (loss) available to OfficeMax common shareholders $1.6 million, or $0.02

per diluted share.

• We recorded $4.4 million of interest income related to a tax escrow balance established in a prior

period in connection with our legacy Voyager Panel business which we sold in 2004. After tax, this

item increased net income (loss) available to OfficeMax common shareholders by $2.7 million, or

$0.04 per diluted share.

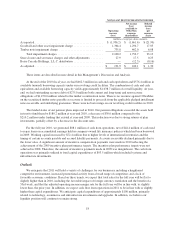

20