OfficeMax 2010 Annual Report Download - page 58

Download and view the complete annual report

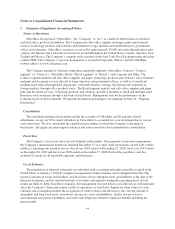

Please find page 58 of the 2010 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.possible impairment. In assessing impairment, we are required to make estimates of the fair values the assets. If

we determine the fair values are less than the carrying amount recorded on our Consolidated Balance Sheets, we

must recognize an impairment loss in our financial statements. We are also required to assess our long-lived

assets for impairment whenever an indicator of possible impairment exists. In assessing impairment, the

statement requires us to make estimates of the fair value of the assets. If we determine the fair values are less

than the carrying value of the assets, we must recognize an impairment loss in our financial statements.

The measurement of impairment of indefinite life intangibles and other long-lived assets includes estimates

and assumptions which are inherently subject to significant uncertainties. In testing for impairment, we measure

the estimated fair value of our reporting units, intangibles and fixed assets based upon discounted future

operating cash flows using a discount rate reflecting a market-based, weighted average cost of capital. In

estimating future cash flows, we use our internal budgets and operating plans, which include many assumptions

about future growth prospects, margin rates, and cost factors. Differences in assumptions used in projecting

future operating cash flows and in selecting an appropriate discount rate could have a significant impact on the

determination of fair value and impairment amounts.

Recently Issued or Newly Adopted Accounting Standards

There were no recently issued or newly adopted accounting standards that were applicable to the preparation

of our consolidated financial statements for 2010 or that may become applicable to the preparation of our

consolidated financial statements in the future.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET

RISK

Information concerning quantitative and qualitative disclosures about market risk is included under the

caption “Disclosures of Financial Market Risks” in “Item 7. Management’s Discussion and Analysis of Financial

Condition and Results of Operations” in this Form 10-K and is incorporated herein by reference.

38