OfficeMax 2010 Annual Report Download - page 41

Download and view the complete annual report

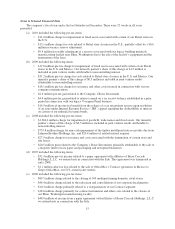

Please find page 41 of the 2010 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• In the fourth quarter, the U.S. Internal Revenue Service conceded an issue under appeals regarding the

deductibility of interest on certain of our industrial revenue bonds. Upon the resolution of this matter,

we released $14.9 million in tax uncertainty reserves which increased net income (loss) available to

OfficeMax common shareholders by $0.18 per diluted share.

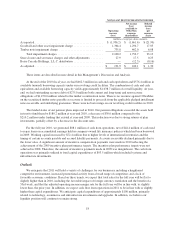

Interest expense was $76.4 million in 2009 compared to $113.6 million for 2008. The decline in interest

expense was principally due to the Lehman bankruptcy on September 15, 2008, and the resulting payment

defaults on the timber note receivable guaranteed by Lehman and the related securitization notes payable. For

2008, we recorded $33.7 million in interest expense on the Lehman securitization notes payable. We did not

accrue any interest on this non-recourse obligation in 2009.

Interest income was $47.3 million and $57.6 million for the years ended 2009 and 2008, respectively. This

decline reflects the $13.1 million reduction of interest income recorded on the timber note receivable guaranteed

by Lehman in 2009 as compared to 2008, partially offset by $4.4 million of interest income recognized in 2009

related to a tax escrow balance established in a prior period in connection with the sale of our legacy Voyageur

Panel business. As a result of Lehman’s September 2008 bankruptcy filing, we recorded no interest income on

the Lehman portion of the timber notes receivable in 2009. In 2008, we accrued and collected approximately

$13.1 million in interest income on the Lehman timber note receivable for the period from January 1 through

April 29, 2008. In 2009, approximately $40.8 million of interest income and $39.8 million of interest expense

was recorded relating to the Wachovia portion of the timber notes receivable and associated securitized

obligation. See the “Timber Notes/Non-Recourse Debt” section that follows in this Management’s Discussion

and Analysis of Financial Condition and Results of Operations.

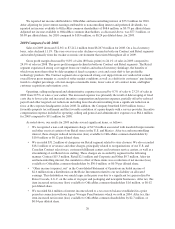

For 2009, we recognized an income tax benefit of $28.8 million on a pre-tax loss of $30.3 million (effective

tax benefit rate of 94.8%) compared to an income tax benefit of $306.5 million on a pre-tax loss of

$1,972.4 million (effective tax benefit rate of 15.5%) for 2008. Income taxes and the related effective rates for

both years were affected by several significant items that caused our actual tax benefits to vary from the amount

based on our reported pre-tax accounting income and the statutory U.S. federal tax rate of 35%. In 2009, the

recorded tax benefit included $14.9 million from the release of a tax reserve upon the resolution of our claim that

interest on certain of our industrial revenue bonds was fully tax deductible. In 2008, the goodwill and other assets

impairment charge of $1.4 billion unfavorably impacted the tax benefit rate as the book basis of these assets was

higher than the amortizable tax basis which resulted in a 4.6% tax benefit on the charge. In addition, in 2008 the

Company also recognized a tax benefit resulting from a favorable U.S. Internal Revenue Service settlement. The

effective tax rate in both years was also impacted by the effects of state income taxes, income items not subject

to tax and non-deductible expenses and the mix of domestic and foreign sources of income.

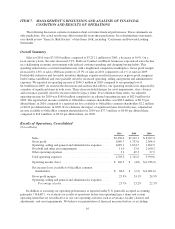

We reported a net loss attributable to OfficeMax and noncontrolling interest of $1.6 million for 2009. After

adjusting for joint venture earnings attributable to noncontrolling interest and preferred dividends, we reported a

net loss available to OfficeMax common shareholders of $2.2 million or $(0.03) per diluted share for 2009.

Excluding the effects of the significant items discussed above, adjusted net income available to OfficeMax

common shareholders was $18.6 million or $0.24 per diluted share for 2009 compared to $100.1 million or $1.30

per diluted share for 2008.

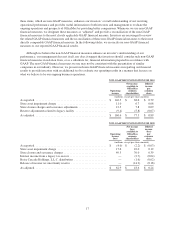

Segment Discussion

We report our results using three reportable segments: Contract; Retail; and Corporate and Other.

Our Contract segment distributes a broad line of items for the office, including office supplies and paper,

technology products and solutions, office furniture and print and document services. Contract sells directly to

large corporate and government offices, as well as to small and medium-sized offices in the United States,

Canada, Australia and New Zealand. This segment markets and sells through field salespeople, outbound

telesales, catalogs, the Internet and in some markets, including Canada, Australia and New Zealand, through

office products stores.

21