OfficeMax 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ownership accounts for its affiliate’s members, and the Company does not have the ability to significantly

influence its operating and financial policies. This investment is included in investments in affiliates in the

Consolidated Balance Sheets.

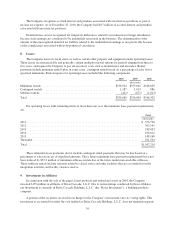

Through its investment in Boise Inc., Boise Cascade Holdings, L.L.C. indirectly owned an interest in Boise

White Paper, L.L.C. (“Boise Paper”). OfficeMax is obligated by contract to purchase its North American

requirements for cut-size office paper from Boise Paper. During 2010, Boise Cascade Holdings, L.L.C. sold its

remaining investment in Boise Inc. As a result of the sale, Boise Paper is no longer a related party to the

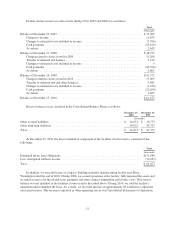

Company, and as such, amounts previously presented as related party receivables of $6.5 million and related

party payables of $37.1 million at December 26, 2009 have been reclassified to “Receivables, net” and

“Accounts Payable”, respectively.

The Boise Investment represented a continuing involvement in the operations of the business we sold in

2004. Therefore, approximately $180 million of gain realized from the sale was deferred. This gain is expected to

be recognized in earnings as the Company’s investment is reduced.

Throughout the year, we review the carrying value of this investment whenever events or circumstances

indicate that its fair value may be less than its carrying amount. At year-end, we reviewed certain financial

information of Boise Cascade Holdings, L.L.C., including estimated future cash flows as well as data regarding

the valuation of comparable companies, and determined that there was no impairment of this investment. The

Company will continue to monitor and assess this investment.

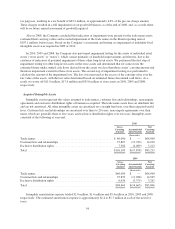

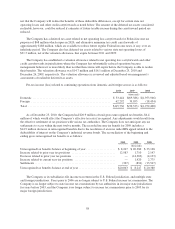

The non-voting securities of Boise Cascade Holdings, L.L.C. accrue dividends daily at the rate of 8% per

annum on the liquidation value plus accumulated dividends. Dividends accumulate semiannually to the extent

not paid in cash on the last day of June and December. The Company recognized dividend income on this

investment of $7.3 million in 2010, $6.7 million in 2009 and $6.2 million in 2008. The dividend receivable was

$30.2 million at December 25, 2010, and was recorded in other non-current assets in the Consolidated Balance

Sheets.

The Company receives distributions on the Boise Investment for the income tax liability associated with its

share of allocated earnings. During 2009 and 2008, the Company received tax-related distributions of

$2.6 million and $23.0 million, respectively. The larger distribution in 2008 reflected the gain on the sale by

Boise Cascade, L.L.C. of a majority interest in its paper and packaging and newsprint businesses. No

distributions were received in 2010.

60