OfficeMax 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OFFICEMAX®2010 ANNUAL REPORT

Table of contents

-

Page 1

OFFICEMAX 2010 ANNUAL REPORT ® -

Page 2

... customer retention in the Contract segment, and vigorously defending our key contracts through enhanced service. We will evolve our sales culture from personal relationships to performance-based relationships with clients. We will also work to stem declines in the base business through new products... -

Page 3

... President of Aramark International, Chief Globalization Ofï¬cer and Executive Vice President of the corporation. Previously, Mr. Saligram held various leadership positions at InterContinental Hotels Group and SC Johnson Wax. Mr. Saligram started his career in advertising at the Leo Burnett Company... -

Page 4

... sustained productivity. SALES AT-A-GLANCE CONTRACT SEGMENT / $3.63 BILLION $ 7 .2 10% 33% BILLION / FY10 APPROXIMATELY 30,000 ASSOCIATES APPROXIMATELY 1,000 RETAIL STORES IN U.S. & MEXICO GLOBAL B-TO-B OPERATIONS IN: • North America • Australia • New Zealand 68% U.S. 32% International 32... -

Page 5

... BRANDS NEW CHANNEL STRATEGIES S INTEGRATED SOLUTIONS MARKETING, SUPPLY CHAIN N AND RETAIL GLOBAL REACH DIVERSITY AND INCLUSION N OFFICEMAX GOODWORKS SM M Ofï¬ceMax associate, Art PRIVATE BRANDS Our exclusive private brands feature thousands of ofï¬ce products, all with a 100% quality guarantee... -

Page 6

... most ofï¬ce supply purchases. SOURCES: Center for Women's Business Research and fastcompany.com Several years ago, we began to explore women's buying tendencies and the products they desire. Out of this research, we considered the best way to offer stylish products that inspire work and increase... -

Page 7

... MOMENTUM THROUGH PRIVATE BRANDS ADDITIONAL PRIVATE BRANDS Brenton Studio® & Eastleigh® Furniture for home and ofï¬ce EngageTM Technology accessories 4WRK® Calculators and technology accessories CanterburyTM Stationery, note cards and envelopes SchoolioTM Back-to-School products With hundreds... -

Page 8

..., program negotiations, and product and relationship management. With teams of experts in both the United States and China, we have extensive experience in sourcing ofï¬ce supplies and other retail products for independent wholesalers, retailers and distributors. VI | 2010 OFFICEMAX ANNUAL REPORT -

Page 9

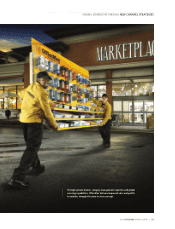

GAINING MOMENTUM THROUGH NEW CHANNEL STRATEGIES Through private brands, category management expertise and global sourcing capabilities, Ofï¬ceMax delivers improved sales and proï¬ts to retailers through the store-in-store concept. ® 2010 OFFICEMAX ANNUAL REPORT | VII -

Page 10

... management, enterprise printing, IT equipment, furniture and more. AWARDS Through our Integrated Solutions, Ofï¬ceMax is able to provide businessto-business customers-including those in healthcare, government and education-with more than just ofï¬ce supplies. This program helps customers... -

Page 11

... Solutions 3 Ofï¬ceMax ImPress digital print and document services 4 Managed Print Services 5 Furniture and space planning 6 Cleaning and breakroom products 7 Environmentally responsible products and services 8 Global sourcing 9 Diversity and inclusion 8 9 2 7 4 1 6 5 3 2010 OFFICEMAX ANNUAL... -

Page 12

... to improve store in-stocks with lean inventory levels. To overcome this challenge, the supply chain team collaborated with store operations and merchandising to determine what process and system changes needed to be made to pack more products in a truck trailer. X | 2010 OFFICEMAX ANNUAL REPORT -

Page 13

...marketing and supply chain efï¬ciency, customers are shopping in store and ï¬nding the products they need. And, our stores continue to evolve and provide innovative services. In 2010, Ofï¬ceMax ImPress® Print and Document Services was repositioned as the Ofï¬ceMax ImPress Print Center. Located... -

Page 14

... ofï¬ce products company, Lyreco. AWARDS SERVICE QUALITY MEASUREMENT GROUP'S NORTH AMERICAN SERVICE QUALITY AWARDS OF EXCELLENCE 2010 World Class Service Highest Customer Satisfaction in the Retail & Service Industry Ofï¬ceMax Ofï¬ceMax associate, Maureen XII | 2010 OFFICEMAX ANNUAL REPORT -

Page 15

... With retail stores and distribution centers located in 47 U.S. states, Puerto Rico, U.S. Virgin Islands, Canada and Mexico, Ofï¬ceMax offers value across borders. In Canada, customers shop multinational products and private label brands through 30 Ofï¬ceMax Grand & Toy ofï¬ce product stores... -

Page 16

... INCLUSION Creating a new way of doing business through diversity. At Ofï¬ceMax, our commitment to diversity and inclusion is lived out in three areas: ® our company and associates, our products and vendors and our services to customers. DIVERSITY AWARDS TOP 50 ORGANIZATIONS FOR MULTICULTURAL... -

Page 17

... that support K-12 education; and works with partners such as Adopt-A-Classroom and the Kids in Need Foundation. Every year, associates have the opportunity to donate to Adopt-A-Classroom or the United Way-and the company helps by matching each donation with funds of its own. 2010 OFFICEMAX ANNUAL... -

Page 18

XVI | 2010 OFFICEMAX ANNUAL REPORT -

Page 19

...Shares Outstanding as of February 11, 2011 85,058,285 Document incorporated by reference Portions of the registrant's proxy statement relating to its 2011 annual meeting of shareholders to be held on April 13, 2011 ("OfficeMax Incorporated's proxy statement") are incorporated by reference into Part... -

Page 20

..., Executive Officers and Corporate Governance ...Executive Compensation ...Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters ...Certain Relationships and Related Transactions, and Director Independence ...Principal Accountant Fees and Services ...PART IV... -

Page 21

... supplies and paper, print and document services, technology products and solutions and office furniture to large, medium and small businesses, government offices and consumers. OfficeMax customers are served by approximately 30,000 associates through direct sales, catalogs, the Internet and retail... -

Page 22

...in Canada, Hawaii, Australia and New Zealand. Contract sales for 2010, 2009 and 2008 were $3.6 billion, $3.7 billion and $4.3 billion, respectively. Retail Retail is a retail distributor of office supplies and paper, print and document services, technology products and solutions and office furniture... -

Page 23

... network our distribution centers into an integrated system enables us to serve large national accounts that rely on us to deliver consistent products, prices and services to multiple locations, and to meet the needs of medium and small businesses at a competitive cost. We believe our Retail segment... -

Page 24

... Notes to Consolidated Financial Statements in "Item 8. Financial Statements and Supplementary Data" of this Form 10-K. Identification of Executive Officers Information with respect to our executive officers is set forth as the last item of Part I of this Form 10-K. Employees On December 25, 2010... -

Page 25

...-party vendors. We use and resell many manufacturers' branded items and services and are therefore dependent on the availability and pricing of key products and services including ink, toner, paper and technology products. As a reseller, we cannot control the supply, design, function, cost or vendor... -

Page 26

... international office products markets are highly and increasingly competitive. Customers have many options when purchasing office supplies and paper, print and document services, technology products and solutions and office furniture. We compete with contract stationers, office supply superstores... -

Page 27

...our information security may adversely affect our business. Through our sales and marketing activities, we collect and store certain personal information that our customers provide to purchase products or services, enroll in promotional programs, register on our website, or otherwise communicate and... -

Page 28

... of our requirements of paper for resale from Boise Cascade, L.L.C., or its affiliates or assigns, currently Boise White Paper L.L.C., on a long term basis. The price we pay for this paper is market based and therefore subject to fluctuations in the supply and demand for the products. Our purchase... -

Page 29

... than ten new store openings in the U.S. and Mexico and 10-20 store closings in the U.S. Our facilities by segment are presented in the following table. Contract As of the end of the year, Contract operated 44 distribution centers in 21 states, Puerto Rico, Canada, Australia and New Zealand. The... -

Page 30

Retail also operated three large distribution centers in Alabama, Nevada and Pennsylvania; and one small distribution center in Mexico through our joint venture. ITEM 3. LEGAL PROCEEDINGS Information concerning legal proceedings is set forth in Note 16, "Legal Proceedings and Contingencies," of the... -

Page 31

... as vice president, finance for Best Buy Co., Inc., a retailer of consumer electronics, home office products, entertainment software, appliances and related services, from 2002 to 2005. On November 10, 2008, Circuit City filed a voluntary petition for relief under Chapter 11 of the United States... -

Page 32

PART II ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES Our common stock is listed on the New York Stock Exchange (the "Exchange"). The Exchange requires each listed company to make an annual report available to its shareholders. ... -

Page 33

... Standard & Poor's SmallCap 600 Specialty Retail Index and OfficeMax. 350 OfficeMax Incorporated 300 250 DOLLARS S&P SmallCap 600 Index S&P 600 Specialty Retail Index 200 150 100 50 0 2005 2006 2007 2008 2009 2010 ANNUAL RETURN PERCENTAGE Years Ending Company\Index Name Dec 06 Dec 07 Dec 08... -

Page 34

... Financial Statements and Supplementary Data" of this Form 10-K. 2010(a) 2009(b) 2008(c) 2007(d) 2006(e) (millions, except per-share amounts) Assets: Current assets ...Property and equipment, net ...Goodwill ...Timber notes receivable ...Other ...Total assets ...Liabilities and shareholders' equity... -

Page 35

...tax income related to a paper agreement with affiliates of Boise Cascade Holdings, L.L.C. we entered into in connection with the Sale. This agreement was terminated in early 2008. • $1.1 million after-tax loss related to the sale of OfficeMax's Contract operations in Mexico to Grupo OfficeMax, our... -

Page 36

... both years, adjusted net income available to OfficeMax common shareholders for 2010 was $77.3 million, or $0.89 per diluted share, compared to $18.6 million, or $0.24 per diluted share, for 2009. Results of Operations, Consolidated ($ in millions) 2010 2009 2008 Sales ...Gross profit ...Operating... -

Page 37

...per income common common (loss) shareholders share (millions, except per-share amounts) As reported ...Store asset impairment charge ...Store closure and severance charges ...Interest income from a legacy tax escrow ...Boise Cascade Holdings, L.L.C. distribution ...Release of income tax uncertainty... -

Page 38

... (loss) shareholders share (millions, except per-share amounts) As reported ...Goodwill and other asset impairment charge ...Timber note impairment charge ...Total impairment charges ...Store closure and severance charges and other adjustments ...Boise Cascade Holdings, L.L.C. distribution ...As... -

Page 39

... of sales in 2010 compared to 24.1% of sales in 2009. The gross profit margins increased in both our Contract and Retail segments due to our profitability initiatives and reduced inventory shrinkage expense. We benefited from $15 million of inventory shrinkage reserve adjustments due to the positive... -

Page 40

...share. We recorded $31.2 million of charges in our Retail segment related to store closures. We also recorded $18.1 million of severance and other charges, principally related to reorganizations of our U.S. and Canadian Contract sales forces, customer fulfillment centers and customer service centers... -

Page 41

... supplies and paper, technology products and solutions, office furniture and print and document services. Contract sells directly to large corporate and government offices, as well as to small and medium-sized offices in the United States, Canada, Australia and New Zealand. This segment markets... -

Page 42

... of office supplies and paper, print and document services, technology products and solutions and office furniture. In addition, this segment contracts with large national retail chains to supply office and school supplies to be sold in their stores. Our retail office supply stores feature OfficeMax... -

Page 43

... managed-print-services, customer service centers and business-to-business website, partially offset by favorable trends in workers compensation and medical benefit expenses as well as lower payroll costs from the reorganization of our U.S. sales force and U.S. customer service operations. Contract... -

Page 44

Retail ($ in millions) 2010 2009 2008 Sales ...Gross profit ...Gross profit margin ...Operating, selling and general and administrative expenses ...Percentage of sales ...Segment income Percentage of sales ...Sales by Product Line Office supplies and paper ...Technology products ...Office furniture... -

Page 45

...opened 12 retail stores and closed 18, ending the year with 933 retail stores. Grupo OfficeMax, our majority-owned joint venture in Mexico, closed six stores, ending the year with 77 retail stores. Retail segment gross profit margin declined 0.6% of sales (60 basis points) to 27.4% of sales for 2009... -

Page 46

... sales, while our Contract segment's international businesses' inventories increased primarily due to the timing of purchases related to vendor pricing and product availability. Cash from operations benefitted from lower receivables, primarily due to the decline in sales, with days sales outstanding... -

Page 47

... In 2011, we expect to have approximately five new store openings in Mexico, offset by approximately 15 store closings in the U.S. Financing Activities Our financing activities used cash of $28.5 million in 2010, $60.6 million in 2009 and $86.1 million in 2008. Common and preferred dividend payments... -

Page 48

... unused line fee at an annual rate of 0.25% on the amount by which the maximum available credit exceeded the average daily outstanding borrowings and letters of credit. On September 30, 2009, Grand & Toy Limited, the Company's wholly owned subsidiary based in Canada, entered into a Loan and Security... -

Page 49

... recourse against OfficeMax, and the Securitization Notes have been reported as non-recourse debt in our Consolidated Balance Sheets. On September 15, 2008, Lehman filed for bankruptcy. Lehman's bankruptcy filing constituted an event of default under the $817.5 million Installment Note guaranteed by... -

Page 50

... according to the contractual terms of the Wachovia Guaranteed Installment Notes, the notes are stated in our Consolidated Balance Sheet at their original principal amount of $817.5 million. Wachovia was acquired by Wells Fargo & Company in a stock transaction in 2008. An additional adverse impact... -

Page 51

... assumptions related to discount rates, rates of return on investments, future compensation costs, healthcare cost trends, benefit payment patterns and other factors. Changes in assumptions related to the measurement of funded status could have a material impact on the amount reported. Pension... -

Page 52

... purchase its requirements for office paper from Boise Paper or its successor until December 2012, at prices approximating market levels. In accordance with the paper supply contract, the purchase price in Canadian dollars is indexed to the U.S. dollar up until the first business day of the month in... -

Page 53

... assets available to pay benefits, contribution levels and expense are also impacted by the return on the pension plan assets. The pension plan assets include OfficeMax common stock, U.S. equities, international equities, global equities and fixed-income securities, the cash flows of which change as... -

Page 54

...13.1 million in our Retail segment related to facility closures, of which $11.7 million was related to the lease liability and other costs associated with closing eight domestic stores prior to the end of their lease terms, and $1.4 million was related to other items. In 2009, we recorded charges of... -

Page 55

...the closing of the sale of our paper, forest products and timberland assets in 2004 continue to be our liabilities. We have been notified that we are a "potentially responsible party" under the Comprehensive Environmental Response, Compensation and Liability Act (CERCLA) or similar federal and state... -

Page 56

... high-grade corporate bonds (rated Aa1 or better) with cash flows that generally match our expected benefit payments in future years. We base our long-term asset return assumption on the average rate of earnings expected on invested funds. We believe that the accounting estimate related to pensions... -

Page 57

... and Asbestos Reserves Environmental and asbestos liabilities that relate to the operation of the paper and forest products businesses and timberland assets prior to the sale of the paper, forest products and timberland assets continue to be liabilities of OfficeMax. We are subject to a variety of... -

Page 58

... fair value of our reporting units, intangibles and fixed assets based upon discounted future operating cash flows using a discount rate reflecting a market-based, weighted average cost of capital. In estimating future cash flows, we use our internal budgets and operating plans, which include many... -

Page 59

... 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA OfficeMax Incorporated and Subsidiaries Consolidated Statements of Operations Fiscal year ended December 25, December 26, December 27, 2010 2009 2008 (thousands, except per-share amounts) Sales ...Cost of goods sold and occupancy costs ...Gross profit... -

Page 60

OfficeMax Incorporated and Subsidiaries Consolidated Balance Sheets December 25, December 26, 2010 2009 (thousands) ASSETS Current assets: Cash and cash equivalents ...Receivables, net ...Inventories..., net ...Investments in affiliates ...Timber notes receivable ...Deferred income taxes ...Other... -

Page 61

OfficeMax Incorporated and Subsidiaries Consolidated Balance Sheets December 25, December 26, 2010 2009 (thousands, except share and per-share amounts) LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Current portion of debt ...Accounts payable ...Income tax payable ...Accrued expenses and... -

Page 62

... and Subsidiaries Consolidated Statements of Cash Flows December 25, 2010 Fiscal year ended December 26, December 27, 2009 2008 (thousands) Cash provided by operations: Net income (loss) attributable to OfficeMax and noncontrolling interest ...Non-cash items in net income (loss): Earnings from... -

Page 63

... For the Fiscal Years ended December 25, 2010, December 26, 2009 and December 27, 2008 Accumulated Total Retained Other OfficeMax Common Additional Earnings Comprehensive ShareNonShares Preferred Common Paid-In (Accumulated Income holders' controlling Outstanding Stock Stock Capital Deficit) (Loss... -

Page 64

... offices and consumers. OfficeMax customers are served by approximately 30,000 associates through direct sales, catalogs, the Internet and a network of retail stores located throughout the United States, Canada, Australia, New Zealand and Mexico. The Company's common stock is traded on the New York... -

Page 65

... sale of products is recognized at the time both title and the risk of ownership are transferred to the customer, which generally occurs upon delivery to the customer or third-party delivery service for contract, catalog and Internet sales, and at the point of sale for retail transactions. Service... -

Page 66

... the related product is sold. Merchandise Inventories Inventories consist of office products merchandise and are stated at the lower of weighted average cost or net realizable value. The Company estimates the realizable value of inventory using assumptions about future demand, market conditions... -

Page 67

...2010 and December 26, 2009, the Company held an investment in Boise Cascade Holdings, L.L.C. ("Boise Investment") which is accounted for under the cost method. See Note 9, "Investments in Affiliates," for additional information related to the Company's investments in affiliates. Capitalized Software... -

Page 68

... return for a theoretical portfolio of high-grade corporate bonds (rated Aa1 or better) with cash flows that generally match our expected benefit payments in future years. The long-term asset return assumption is based on the average rate of earnings expected on invested funds, and considers several... -

Page 69

...2010, $211.3 million in 2009 and $232.1 million in 2008, and is recorded in operating, selling and general and administrative expenses in the Consolidated Statements of Operations. Pre-Opening Expenses The Company incurs certain non-capital expenses prior to the opening of a store. These pre-opening... -

Page 70

...13.1 million in our Retail segment related to facility closures, of which $11.7 million was related to the lease liability and other costs associated with closing eight domestic stores prior to the end of their lease terms, and $1.4 million was related to other items. In 2009, we recorded charges of... -

Page 71

... closure reserve account activity during 2010, 2009 and 2008 was as follows: Total (thousands) Balance at December 29, 2007 ...Charges to income ...Changes to estimated costs included in income ...Cash payments ...Accretion ...Balance at December 27, 2008 ...Charges related to stores closed in 2009... -

Page 72

... reorganizations. In 2009, we recorded $18.1 million of severance and other charges, principally related to reorganizations of our U.S. and Canadian Contract sales forces, our customer fulfillment centers and our customer service centers, as well as a streamlining of our Retail store staffing. These... -

Page 73

... Lehman Guaranteed Installment Note as further information regarding our share of the proceeds, if any, from the Lehman bankruptcy estate becomes available. On April 14, 2010, Lehman filed its Debtors' Disclosure Statement with the United States Bankruptcy Court for the Southern District of New York... -

Page 74

... impairment of the trade names in the Retail reporting unit of $107.1 million, before taxes. Based on the Company's assessment and testing, no impairment of indefinite-lived intangible assets was required in 2009 or 2010. In 2010, 2009 and 2008, the Company also performed impairment testing for... -

Page 75

... as adjusted, by weighted average shares outstanding as follows: 2010 2009 2008 (thousands, except per-share amounts) Net income (loss) available to OfficeMax common shareholders ...Average shares-basic(a) ...Restricted stock, stock options and other(b) ...Average shares-diluted ...Net income (loss... -

Page 76

... operations as shown in the Consolidated Statements of Operations includes the following components: 2010 2009 (thousands) 2008 Current income tax (expense) benefit: Federal ...State ...Foreign ...Total ...Deferred income tax (expenses) benefit: Federal ...State ...Foreign ...Total ... $ 9,507 $ 60... -

Page 77

... are reported in our Consolidated Balance Sheets as follows: 2010 2009 (thousands) Current deferred income tax assets ...Long-term deferred income tax assets ...Total ... $ 92,956 284,529 $377,485 $114,186 300,900 $415,086 As discussed in Note 4, "Timber Notes/Non-Recourse Debt," at the time of... -

Page 78

... on the Company's industrial revenue bonds. The reconciliation of the beginning and ending gross unrecognized tax benefits is as follows: 2010 2009 (thousands) 2008 Unrecognized tax benefits balance at beginning of year ...Increase related to prior year tax positions ...Decrease related to prior... -

Page 79

... rentals include amounts related to closed stores and other facilities that are accounted for in the integration activities and facility closures reserve. 9. Investments in Affiliates In connection with the sale of the paper, forest products and timberland assets in 2004, the Company invested $175... -

Page 80

...liability associated with its share of allocated earnings. During 2009 and 2008, the Company received tax-related distributions of $2.6 million and $23.0 million, respectively. The larger distribution in 2008 reflected the gain on the sale by Boise Cascade, L.L.C. of a majority interest in its paper... -

Page 81

... unsecured, consists of both recourse and non-recourse obligations as follows at year-end: 2010 (thousands) 2009 Recourse debt: 6.50% notes, paid in 2010 ...7.35% debentures, due in 2016 ...Medium-term notes, Series A, with interest rates averaging 7.9%, due in varying amounts periodically through... -

Page 82

... no borrowings under the Company's credit agreements in 2010 or 2009. Other At the end of fiscal year 2010, Grupo OfficeMax, our 51%-owned joint venture in Mexico, had total outstanding borrowings of $13.1 million. This included $7.8 million outstanding under a 60-month installment note due in the... -

Page 83

Cash Paid for Interest Cash payments for interest, net of interest capitalized and including interest payments related to the timber securitization notes, were $68.9 million in 2010, $71.8 million in 2009 and $90.0 million in 2008. 11. Financial Instruments, Derivatives and Hedging Activities Fair ... -

Page 84

... were no transactions on the last trading day of the fiscal year (the "measurement date") to use in determining the fair value. The fair value of the Company's debt was estimated based on quoted market prices near the measurement date when available or by discounting the future cash flows of each... -

Page 85

...: Pension Benefits Other Benefits 2010 2009 2010 2009 (thousands) Change in benefit obligation: Benefit obligation at beginning of year ...Service cost ...Interest cost ...Actuarial loss ...Changes due to exchange rates ...Benefits paid ...Benefit obligation at end of year ...Change in plan assets... -

Page 86

... as follows: 2010 Pension Benefits 2009 $1,263,206 1,263,206 1,078,383 $1,225,972 1,225,762 1,013,455 2008 2010 (thousands) Other Benefits 2009 2008 Service cost ...$ 3,164 $ 4,506 $ 2,132 $ 263 $ 184 $ 237 Interest cost ...74,213 75,858 78,041 1,213 1,137 1,164 Expected return on plan assets... -

Page 87

...% The following table presents the weighted average assumptions used in the measurement of net periodic benefit cost as of year-end: Pension Benefits 2010 2009 2008 Other Benefits United States 2010 2009 2008 2010 Canada 2009 2008 Discount rate ...Expected long-term return on plan assets ... 6.15... -

Page 88

...-cost manner than trading securities in the underlying portfolios. In 2009, we contributed 8,331,722 shares of OfficeMax common stock to our qualified pension plans. At the end of 2010, the plan held 3,152,809 million shares with a value of $55.8 million. Generally, quoted market prices are used... -

Page 89

... the pension plan assets by level within the fair value hierarchy as of December 25, 2010. Level 1 Level 2 (thousands) Level 3 Money market funds ...Equity securities: OfficeMax common stock ...U.S. large-cap ...U.S. small and mid-cap ...International ...Fixed Income: Corporate bonds ...Government... -

Page 90

... to eligible participants in prior years. Total Company contributions to the defined contribution savings plans were $3.2 million in 2010, $1.3 million in 2009 and $8.0 million in 2008. 13. Shareholders' Equity Preferred Stock At December 25, 2010, 686,696 shares of 7.375% Series D ESOP convertible... -

Page 91

... below. The Company recognizes compensation expense from all share-based payment transactions with employees in the consolidated financial statements at fair value. Compensation costs related to the Company's share-based plans were $13.2 million, $8.5 million and $0.3 million for 2010, 2009 and 2008... -

Page 92

... compensation program for certain of its executive officers that allowed them to defer a portion of their cash compensation. Previously, these executive officers could allocate their deferrals to a stock unit account. Each stock unit is equal in value to one share of the Company's common stock... -

Page 93

... Stock options granted under the OfficeMax Incentive and Performance Plan generally vest over a three year period. In 2010, 2009 and 2008, the Company recognized $5.2 million, $2.4 million and $0.2 million, respectively, of pre-tax compensation expense and additional paid-in capital related to stock... -

Page 94

... supplies and paper, technology products and solutions, print and document services and office furniture. Contract sells directly to large corporate and government offices, as well as to small and medium-sized offices in the United States, Canada, Australia and New Zealand. This segment markets... -

Page 95

... customer that accounts for 10% or more of consolidated trade sales. Segment sales to external customers by product line are as follows: 2010 2009 (millions) 2008 Contract Office supplies and paper ...Technology products ...Office furniture ...Total ...Retail Office supplies and paper ...Technology... -

Page 96

... of business. As previously disclosed, we have liabilities associated with retirement and benefit plans. In connection with the sale of our paper, forest products and timberland assets in 2004, the Company entered into a paper supply contract with a former affiliate of Boise Cascade, L.L.C., Boise... -

Page 97

Guarantees The Company provides guarantees, indemnifications and assurances to others. Indemnification obligations may arise from the Asset Purchase Agreement between OfficeMax Incorporated, OfficeMax Southern Company, Minidoka Paper Company, Forest Products Holdings, L.L.C. and Boise Land & Timber ... -

Page 98

... financial data is as follows: First(a) 2010 2009 Second(b) Third Fourth(c) First(d) Second(e) Third(f) (millions, except per-share and stock price information) Fourth(g) Sales ...Gross Profit ...Percent of sales ...Operating income ...Net income (loss) available to OfficeMax common shareholders... -

Page 99

...consolidated financial statements and an opinion on the Company's internal control over financial reporting based on our audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform... -

Page 100

...Board of Directors regarding the preparation and fair presentation of published financial statements. Our management, with the participation of our chief executive officer and chief financial officer, assessed the effectiveness of our internal control over financial reporting as of December 25, 2010... -

Page 101

...to all OfficeMax employees and directors, including our senior financial officers. The Code is available, free of charge, on our website at investor.officemax.com by clicking on "Code of Ethics." You also may obtain copies of this Code, free of charge, by contacting our Investor Relations Department... -

Page 102

... 2003 Plan. See Note 13, "Shareholders Equity," of the Notes to Consolidated Financial Statements in "Item 8. Financial Statements and Supplementary Data" of this form 10-K for additional information related to our equity compensation plans. ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS... -

Page 103

...the Report of Independent Registered Public Accounting Firm are presented in "Item 8. Financial Statements and Supplementary Data" of this Form 10-K Consolidated Balance Sheets as of December 25, 2010 and December 26, 2009. Consolidated Statements of Operations for the years ended December 25, 2010... -

Page 104

..., thereunto duly authorized. OfficeMax Incorporated By /s/ RAVICHANDRA SALIGRAM Ravichandra Saligram Chief Executive Officer Dated: February 21, 2011 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the... -

Page 105

...the three-year period ended December 25, 2010, and the effectiveness of internal control over financial reporting as of December 25, 2010, which report appears in the December 25, 2010 annual report on Form 10-K of OfficeMax Incorporated. /s/ KPMG LLP KPMG LLP Chicago, Illinois February 21, 2011 85 -

Page 106

... File Number Number Filing Date Filed Herewith Exhibit Description Form 2.1 Asset Purchase Agreement dated July 26, 2004, between Boise Cascade Corporation (now OfficeMax Incorporated), Boise Southern Company, Minidoka Paper Company and Forest Products Holdings, L.L.C., and Boise Land & Timber... -

Page 107

Exhibit Number Exhibit Description Form Incorporated by Reference Exhibit Filing File Number Number Date Filed Herewith 10.4 Installment Note for $817,500,000 between Boise Land & Timber II, L.L.C. (Maker) and Boise Cascade Corporation (now OfficeMax Incorporated) (Initial Holder) dated ... -

Page 108

...Deferred Compensation Plan, as amended through September 26, 2003 Nonbusiness Use of Corporate Aircraft Policy, as amended Supplemental Early Retirement Plan for Executive Officers, as amended through September 26, 2003 Boise Cascade Corporation (now OfficeMax Incorporated) Supplemental Pension Plan... -

Page 109

... Unit Award Agreement Executive Officer Severance Pay Policy Form of Executive Officer Change in Control Severance Agreement Amendment to OfficeMax Incorporated 2005 Directors Deferred Compensation Plan Form of Amendment of OfficeMax Incorporated Executive Savings Deferral Plan Form of 2009 Annual... -

Page 110

... of 2010 Restricted Stock Unit Award Agreement (Performance Based) Form of 2010 Director Restricted Stock Unit Award Agreement Form of 2010 Restricted Stock Unit Award Agreement (Time Based) Employment Agreement between OfficeMax Incorporated and Ravi Saligram dated October 13, 2010 Form of Annual... -

Page 111

... 906 Certifications of Chief Executive Officer and Chief Financial Officer of OfficeMax Incorporated 8-K 001-05057 10.6 10/19/2010 10.71†8-K 001-05057 10.7 10/19/2010 11 12 13 14(3) 16 18 21 22 23 24 31.1 31.2 32 X X X X X †Indicates exhibits that constitute management contracts... -

Page 112

... Compensation and Benefits Trust was filed as exhibit 10 in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2001. Each of the documents referenced in this footnote is incorporated herein by reference. (3) Our Code of Ethics can be found on our website investor.officemax.com... -

Page 113

... financial information; and any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. /S/ RAVICHANDRA SALIGRAM Ravichandra Saligram Chief Executive Officer b. Date: February 21, 2011 -

Page 114

... and report financial information; and any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. /S/ BRUCE BESANKO Bruce Besanko Chief Financial Officer b. Date: February 21, 2011 -

Page 115

... Certificate pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, 18 U.S.C., Section 1350. It accompanies OfficeMax Incorporated's annual report on Form 10-K (the "Report") for the fiscal year ended December 25, 2010. I, Ravichandra Saligram, OfficeMax Incorporated's chief executive officer... -

Page 116

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 117

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 118

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 119

... and Investor Relations Jeff Johnson Senior Vice President, Human Resources Deb O'Connor Senior Vice President, Finance and Chief Accounting Ofï¬cer Ravi Saligram President and Chief Executive Ofï¬cer Reuben Slone Executive Vice President, Supply Chain Ryan Vero Executive Vice President and Chief... -

Page 120

263 Shuman Blvd. Naperville, IL 60563-1255 ofï¬cemax.com | 877.969.OMAX (6629)