OfficeMax 2009 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2009 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

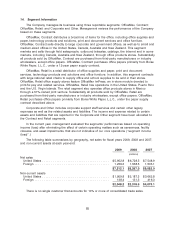

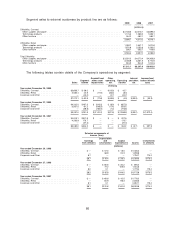

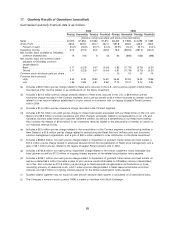

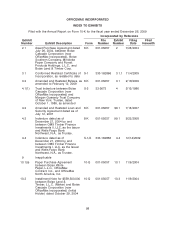

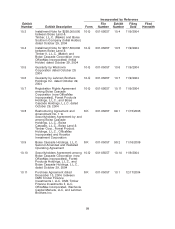

17. Quarterly Results of Operations (unaudited)

Summarized quarterly financial data is as follows:

2009 2008

First(a) Second(b) Third(c) Fourth(d) First(e) Second(f) Third(g) Fourth(h)

(millions, except per-share and stock price information)

Sales ....................... $1,912 $1,658 $1,832 $1,810 $2,303 $ 1,985 $ 2,096 $ 1,883

Gross Profit ................... 465.6 394.9 434.7 442.4 587.8 483.6 526.5 456.5

Percent of sales ............... 24.4% 23.8% 23.7% 24.4% 25.5% 24.4% 25.1% 24.2%

Operating income ............... 27.5 (27.5) 25.2 (29.2) 78.6 (902.6) (681.5) (430.7)

Net income (loss) available to OfficeMax

common shareholders ........... 13 (18) 6 (3) 62 (895) (433) (396)

Net income (loss) per common share

available to OfficeMax common

shareholders(i)

Basic ...................... 0.17 (0.23) 0.07 (0.04) 0.82 (11.79) (5.70) (5.21)

Diluted ..................... 0.17 (0.23) 0.07 (0.04) 0.81 (11.79) (5.70) (5.21)

Common stock dividends paid per share . — — — — .15 .15 .15 .15

Common stock prices(j)

High ...................... 8.44 9.49 13.92 14.50 25.64 22.22 16.23 10.96

Low....................... 1.86 2.88 4.81 9.58 17.12 13.41 9.14 2.84

(a) Includes a $9.9 million pre-tax charge related to Retail store closures in the U.S., and a pre-tax benefit of $2.6 million

recorded as other income related to tax distributions on the Boise Investment.

(b) Includes a $21.3 million pre-tax charge primarily related to Retail store closures in the U.S., a $6.9 million pre-tax

severance charge recorded in the Contract segment, and a pre-tax benefit of $4.4 million recorded as interest income

related to a tax escrow balance established in a prior period in connection with our legacy Voyageur Panel business

sold in 2004.

(c) Includes a $1.5 million pre-tax severance charge recorded in the Contract segment.

(d) Includes a $17.6 million non-cash pre-tax charge to impair fixed assets associated with our Retail stores in the U.S. and

Mexico and $9.6 million of pre-tax severance and other charges, principally related to reorganizations of our U.S. and

Canadian Contract sales forces and customer fulfillment centers, as well as a streamlining of our Retail store staffing.

Also includes the release of $14.9 million in tax uncertainty reserves related to the deductibility of interest on certain of

our industrial revenue bonds.

(e) Includes a $2.4 million pre-tax charge related to the consolidation of the Contract segment’s manufacturing facilities in

New Zealand, a $1.8 million pre-tax charge related to restructuring the Retail field and ImPress print and document

services management organization, and a gain of $20.5 million related to a tax distribution on the Boise Investment.

(f) Includes a $935.3 million non-cash pre-tax charge related to impairment of goodwill, trade names and fixed assets, a

$10.2 million pre-tax charge related to employee severance from the reorganization of Retail store management, and a

gain of $3.1 million pre-tax, related to the legacy Voyageur Panel business sold in 2004.

(g) Includes a $735.8 million non-cash pre-tax impairment charge related to the timber installment notes receivable due

from Lehman as well as $17.2 million of ongoing interest expense on the related securitization notes payable.

(h) Includes a $429.1 million non-cash pre-tax charge related to impairment of goodwill, trade names and fixed assets, as

well as a related $6.5 million favorable impact to joint venture results attributable to OfficeMax common shareholders,

net of tax. Also includes an $11.9 million pre-tax charge for field/corporate reorganizations and reductions in force,

consisting primarily of severance costs, a $4.7 million pre-tax charge related to Retail lease terminations and store

closures, and $3.2 million of ongoing interest expense on the timber securitization notes payable.

(i) Quarters added together may not equal full year amount because each quarter is calculated on a stand-alone basis.

(j) The Company’s common stock (symbol OMX) is traded on the New York Stock Exchange.

89