OfficeMax 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

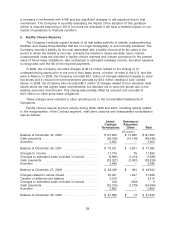

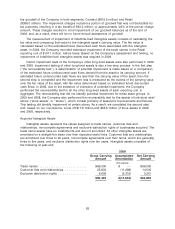

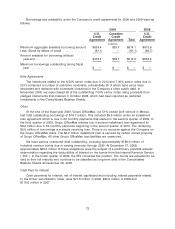

such as maintenance and insurance. Rental payments include minimum rentals plus, in some

cases, contingent rentals based on a percentage of sales above specified minimums. Rental

expense for operating leases included the following components:

2009 2008 2007

(thousands)

Minimum rentals ................................... $355,662 $ 348,629 $ 331,066

Contingent rentals ................................. 1,013 886 908

Sublease rentals ................................... (671) (1,013) (1,515)

$356,004 $348,502 $330,459

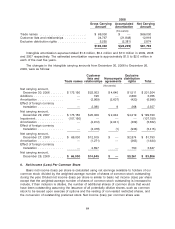

For operating leases with remaining terms of more than one year, the minimum lease payment

requirements are:

(thousands)

2010 ........................................................... $ 363,443

2011 ........................................................... 320,539

2012 ........................................................... 265,341

2013 ........................................................... 213,460

2014 ........................................................... 166,223

Thereafter ....................................................... 403,086

Total ........................................................... $1,732,092

These minimum lease payments do not include contingent rental payments that may be due

based on a percentage of sales in excess of stipulated amounts. These future minimum lease

payment requirements have not been reduced by $33.6 million of minimum sublease rentals due in

the future under noncancelable subleases. These sublease rentals include amounts related to

closed stores and other facilities that are accounted for in the integration activities and facility

closures reserve.

The Company capitalizes lease obligations for which it assumes substantially all property rights

and risks of ownership. The Company did not have any material capital leases during any of the

periods presented.

9. Investments in Affiliates

In connection with the sale of the paper, forest products and timberland assets in 2004, the

Company invested $175 million in the Boise Investment. A portion of the securities received in

exchange for the Company’s investment carry no voting rights. This investment is accounted for

under the cost method as Boise Cascade Holdings, L.L.C. does not maintain separate ownership

accounts for its affiliate’s members, and the Company does not have the ability to significantly

influence its operating and financial policies. This investment is included in investments in affiliates

in the Consolidated Balance Sheets.

The Boise Investment represented a continuing involvement in the operations of the business

we sold in 2004. Therefore, approximately $180 million of gain realized from the sale was deferred.

This gain is expected to be recognized in earnings as the Company’s investment is reduced.

Throughout the year, we review the carrying value of this investment whenever events or

circumstances indicate that its fair value may be less than its carrying amount. At year-end, we

reviewed certain financial information of Boise Cascade Holdings, L.L.C., including estimated future

cash flows as well as data regarding the valuation of comparable companies, and determined that

69