OfficeMax 2009 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2009 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

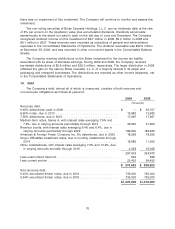

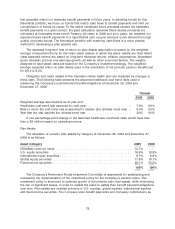

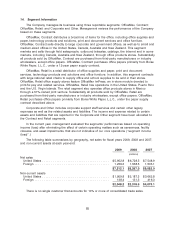

Other changes in plan assets and benefit obligations recognized in other comprehensive

income:

Pension Benefits Other Benefits

2009 2008 2009 2008

(thousands)

Accumulated other comprehensive income at

beginning of year ........................ $ 590,213 $ 253,917 $ (31,895) $ (32,593)

Net loss (gain) ........................... $(139,677) $ 350,403 $ 1,432 $ (2,573)

Amortization of net (loss) gain ................ (10,330) (14,107) (147) $ (269)

Amortization of prior service (cost) credit ........ — — 4,001 3,997

Canadian rate adjustment ................... — — (18) (457)

Accumulated other comprehensive income at end

of year ............................... $ 440,206 $590,213 $(26,627) $(31,895)

The estimated net loss and prior service cost for the defined benefit pension plans that will be

amortized from accumulated other comprehensive income into net periodic benefit cost over the

next fiscal year are $13.4 million and none, respectively. The estimated net loss and prior service

credit for the other defined benefit postretirement plans that will be amortized from accumulated

other comprehensive income into net periodic benefit cost over the next fiscal year is $0.2 million

and $4.0 million, respectively.

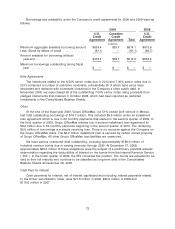

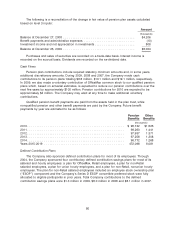

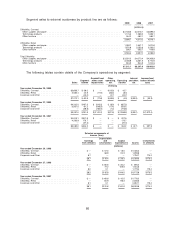

Assumptions

The assumptions used in accounting for the Company’s plans are estimates of factors

including, among other things, the amount and timing of future benefit payments. The following

table presents the key assumptions used in the measurement of the Company’s benefit obligations:

Pension Benefits Other Benefits

United States Canada

2009 2008 2007 2009 2008 2007 2009 2008 2007

Weighted average

assumptions as of

year-end:

Discount rate ............ 6.15% 6.20% 6.30% 5.10% 6.10% 5.90% 6.40% 7.30% 5.50%

The following table presents the assumptions used in the measurement of net periodic benefit

cost:

Pension Benefits Other Benefits

United States Canada

2009 2008 2007 2009 2008 2007 2009 2008 2007

Weighted average

assumptions:

Discount rate ............ 6.20% 6.30% 5.80% 6.10% 5.90% 5.60% 7.30% 5.50% 5.00%

Expected long-term return on

plan assets ........... 7.50% 8.00% 8.00% ——————

In 2009, the assumed discount rate (which is required to be the rate at which the projected

benefit obligation could be effectively settled as of the measurement date) is based on the rates of

return for a theoretical portfolio of high-grade corporate bonds (rated Aa1 or better) with cash flows

77