OfficeMax 2009 Annual Report Download - page 27

Download and view the complete annual report

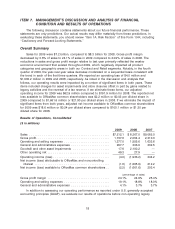

Please find page 27 of the 2009 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2008 Compared with 2007

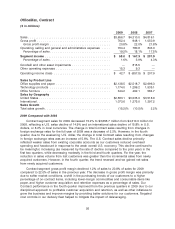

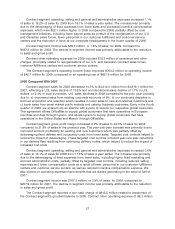

Sales for 2008 decreased 9.0% to $8,267.0 million from $9,082.0 million for 2007. The

year-over-year sales decrease was largely the result of the weaker global economic environment

and our more disciplined analysis-driven approach to sales generation and retention. The

year-over-year sales decrease reflects a 10.7% decrease in comparable sales, and both our

Contract and Retail segments experienced double-digit sales declines in 2008 as compared to

2007. In addition, the rate of sales decline (on a percentage basis) increased in each quarter of

2008 compared to the comparable quarters of 2007. Foreign exchange rate changes had only a

minor effect on sales for full year 2008. However, they negatively impacted sales comparisons late

in the year. For the year, sales increased $9.4 million due to the impact of foreign exchange rates,

however, fourth quarter 2008 sales were reduced by $81.1 million due to the effect of foreign

exchange rates.

Gross profit margin decreased by 0.5% of sales to 24.9% of sales in 2008 compared to 25.4%

of sales in 2007. The gross profit margins declined in our Retail segment compared to the previous

year but improved for our Contract segment. The Retail margin decline was primarily due to the

deleveraging of fixed costs, resulting from the lower sales, as well as the impact of opening new

stores which require several years to ramp up to mature sales volumes and higher inventory

shrinkage results. The decline was partially offset by a sales-mix shift towards higher-margin office

supplies category sales. The Contract segment margin improvement was due primarily to a higher

margin customer mix resulting from our more disciplined approach to contractual sales generation

and retention.

Operating and selling expenses increased by 0.8% of sales to 18.8% of sales in 2008 from

18.0% of sales a year earlier. The increases in operating and selling expenses as a percent of sales

were primarily the result of deleveraging fixed costs due to lower sales, which were partially offset

by reduced incentive compensation expense and targeted cost reductions, including reduced

selling expenses in the Contract segment and reduced store payroll in the Retail segment resulting

from the management reorganizations completed in the first and second quarters of 2008.

General and administrative expenses were 3.7% of sales for both 2008 and 2007. The effect of

deleveraging of expense resulting from lower sales was offset primarily by a reduction in incentive

compensation.

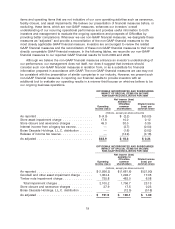

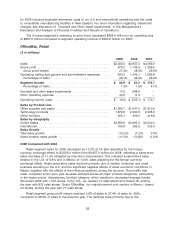

As noted above, our results for 2008 included several significant items, as follows:

• We recorded pre-tax impairment charges of $1,364.4 million related to goodwill, trade names

and other long-lived assets. These non-cash charges consisted of $1,201.5 million of

goodwill impairment in both the Contract ($815.5 million) and Retail ($386.0 million)

segments; $107.1 million of impairment of trade names in our Retail segment and

$55.8 million of impairment related to store fixed assets in our Retail segment. These

non-cash charges resulted in a reduction in net income available to OfficeMax common

shareholders of $1,294.7 million, or $17.05 per diluted share For information regarding these

impairment charges see ‘‘Goodwill and Other Asset Impairments’’ in this Management’s

Discussion and Analysis of Financial Condition and Results of Operations.

• We recognized a pre-tax impairment charge of $735.8 million on the timber installment note

guaranteed by Lehman as a result of the Lehman bankruptcy. This impairment charge was

recorded in the Corporate and Other segment. We also stopped accruing the interest income

on the timber installment note guaranteed by Lehman as of the date of the last interest

payment (April 29, 2008), while continuing to accrue interest expense on the related

securitization notes payable until the date of default (October 29, 2008). The interest expense

for this time period (from April 29 to October 29) was $20.4 million. The cumulative effect of

23