OfficeMax 2009 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2009 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

a company’s involvement with a VIE and any significant changes in risk exposure due to that

involvement. The Company is currently evaluating the impact of the adoption of this guidance

(which is required beginning in 2010) but does not anticipate it will have a material impact on our

results of operations or financial condition.

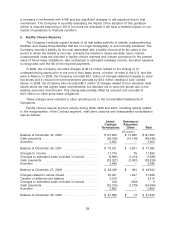

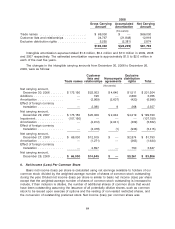

2. Facility Closure Reserves

The Company conducts regular reviews of its real estate portfolio to identify underperforming

facilities, and closes those facilities that are no longer strategically or economically beneficial. The

Company records a liability for the cost associated with a facility closure at its fair value in the

period in which the liability is incurred, primarily the location’s cease-use date. Upon closure,

unrecoverable costs are included in facility closure reserves and include provisions for the present

value of future lease obligations, less contractual or estimated sublease income. Accretion expense

is recognized over the life of the required payments.

In 2009, the Company recorded charges of $31.2 million related to the closing of 21

underperforming stores prior to the end of their lease terms, of which 16 were in the U.S. and five

were in Mexico. In 2008, the Company recorded $3.1 million of charges related principally to close

five stores and it reduced rent and severance accruals by $3.4 million relating to prior closed

stores. In 2008, the Company also recorded $8.7 million of charges related to four domestic retail

stores where we had signed lease commitments, but decided not to open the stores due to the

existing economic environment. This charge was partially offset by reduced rent accruals of

$4.0 million on other store lease obligations.

These charges were included in other operating net, in the Consolidated Statements of

Operations.

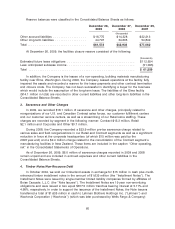

Facility closure reserve account activity during 2009, 2008 and 2007, including activity related

to the reorganization of the Contract segment, retail store closures and headquarters consolidation

was as follows:

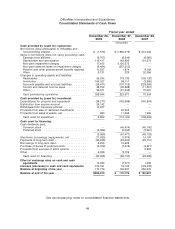

Lease\ Severance\

Contract Retention\

Terminations Other Total

(thousands)

Balance at December 30, 2006 ................... $107,824 $ 13,980 $ 121,804

Cash payments ............................... (38,196) (10,149) (48,345)

Accretion ................................... 3,603 — 3,603

Balance at December 29, 2007 ................... $ 73,231 $ 3,831 $ 77,062

Charges to income ............................ 11,774 79 11,853

Changes to estimated costs included in income ....... (5,982) (1,414) (7,396)

Cash payments ............................... (33,227) (2,002) (35,229)

Accretion ................................... 2,643 — 2,643

Balance at December 27, 2008 ................... $ 48,439 $ 494 $ 48,933

Charges related to stores closed .................. 30,001 1,207 31,208

Transfer of deferred rent balance .................. 3,214 — 3,214

Changes to estimated costs included in income ....... 418 (409) 9

Cash payments ............................... (23,315) (1,279) (24,594)

Accretion ................................... 2,802 — 2,802

Balance at December 26, 2009 ................... $ 61,559 $ 13 $ 61,572

59