OfficeMax 2009 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2009 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

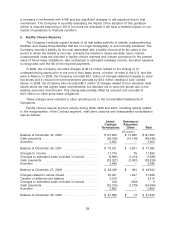

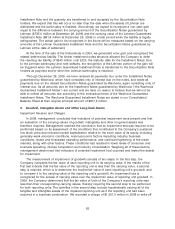

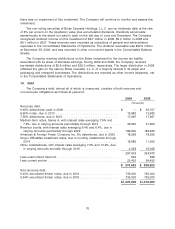

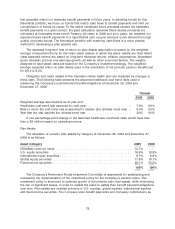

Pre-tax income (loss) related to continuing operations from domestic and foreign sources is as

follows:

2009 2008 2007

(thousands)

Domestic ....................................... $(69,386) $(1,953,946) $272,169

Foreign ........................................ 39,053 (18,454) 65,358

Total pre-tax income (loss) ........................... $(30,333) $(1,972,400) $337,527

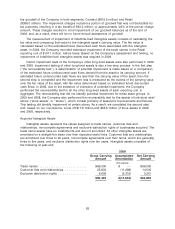

Total gross unrecognized tax benefits at December 26, 2009 represent the amount of

unrecognized tax benefits that, if recognized, would favorably affect the effective income tax rate in

future periods. Any adjustments would result from the effective settlement of tax positions with

various tax authorities. The Company does not anticipate any tax settlements to occur within the

next twelve months. The recorded income tax benefit for 2009 includes a $14.9 million decrease in

unrecognized benefits due to the resolution of an issue under IRS appeal related to the deductibility

of interest on the Company’s industrial revenue bonds. The recorded income tax benefit for 2008

includes the recognition of $6.8 million in previously unrecognized tax benefits due to the

settlement of a federal income tax audit through the 2005 tax year. As of December 26, 2009, the

Company had $8.2 million of total gross unrecognized tax benefits. The reconciliation of the

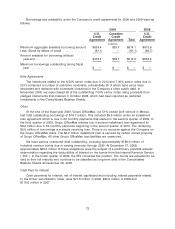

beginning and ending gross unrecognized tax benefits is as follows:

Amount

(thousands)

Balance at December 27, 2008 .......................................... $20,380

Increase related to prior year tax positions ................................. 1,710

Decrease related to prior year tax positions ................................. (14,369)

Increase related to current year tax positions ................................ 1,420

Settlements ........................................................ (894)

Balance at December 26, 2009 .......................................... $ 8,247

The Company or its subsidiaries file income tax returns in the U.S. Federal jurisdiction, and

multiple state and foreign jurisdictions. Years prior to 2006 are no longer subject to U.S. Federal

income tax examination. The Company is no longer subject to state income tax examinations by tax

authorities in its major state jurisdictions for years before 2003.

The Company recognizes accrued interest and penalties associated with uncertain tax positions

as part of income tax expense. As of December 26, 2009, the Company had $2.1 million of accrued

interest and penalties associated with uncertain tax positions. Income tax benefit for 2009 includes

a benefit of $0.1 million related to interest and penalties, reflecting interest accrued less the effect of

adjustments on settlement.

Deferred taxes are not recognized for temporary differences related to investments in foreign

subsidiaries because such earnings are considered to be indefinitely reinvested in the business.

The determination of the amount of the unrecognized deferred tax liability related to the

undistributed earnings is not practicable because of the complexities associated with its

hypothetical calculation.

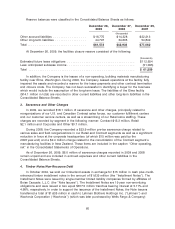

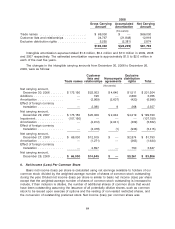

8. Leases

The Company leases its retail stores as well as certain other property and equipment under

operating leases. These leases are noncancelable and generally contain multiple renewal options

for periods ranging from three to five years, and require the Company to pay all executory costs

68