OfficeMax 2009 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2009 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

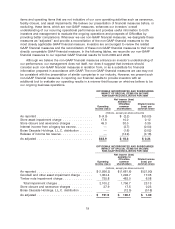

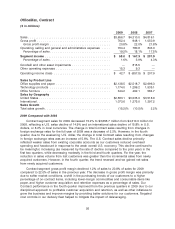

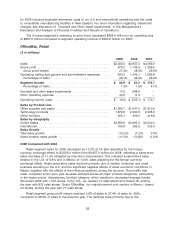

OfficeMax, Contract

($ in millions)

2009 2008 2007

Sales ............................................. $3,656.7 $4,310.0 $4,816.1

Gross profit ........................................ 762.4 948.1 1,050.9

Gross profit margin ................................. 20.8% 22.0% 21.8%

Operating, selling and general and administrative expenses ..... 704.4 780.8 843.0

Percentage of sales ................................. 19.2% 18.1% 17.5%

Segment income .................................... $ 58.0 $ 167.3 $ 207.9

Percentage of sales ................................. 1.6% 3.9% 4.3%

Goodwill and other asset impairments ..................... — 815.5 —

Other operating expenses .............................. 15.3 9.3 —

Operating income (loss) ............................... $ 42.7 $ (657.5) $ 207.9

Sales by Product Line

Office supplies and paper .............................. $2,138.5 $2,518.7 $2,696.3

Technology products ................................. 1,174.0 1,299.2 1,535.1

Office furniture ...................................... 344.2 492.1 584.7

Sales by Geography

United States ....................................... $2,583.1 $3,035.0 $3,518.9

International ........................................ 1,073.6 1,275.0 1,297.2

Sales Growth

Total sales growth .................................... (15.2)% (10.5)% 2.2%

2009 Compared with 2008

Contract segment sales for 2009 decreased 15.2% to $3,656.7 million from $4,310.0 million for

2008, reflecting a U.S. sales decline of 14.9% and an international sales decline of 15.8% in U.S.

dollars, or 8.2% in local currencies. The change in total Contract sales resulting from changes in

foreign exchange rates for the full year of 2009 was a decrease of 2.2%. However, in the fourth

quarter, due to the weakening U.S. dollar, the change in total Contract sales resulting from changes

in foreign exchange rates was an increase of 5.6%. The U.S. Contract sales decline primarily

reflected weaker sales from existing corporate accounts as our customers reduced overhead

spending and headcount in response to the weak overall U.S. economy. This decline continued to

be meaningful, increasing (as measured by the rate of decline compared to the prior year) in the

first two quarters, while decreasing modestly in the third and fourth quarters. For the year, the

reduction in sales volume from lost customers was greater than the incremental sales from newly

acquired customers. However, in the fourth quarter, the trend reversed and we gained net sales

from newly acquired customers.

Contract segment gross profit margin declined 1.2% of sales to 20.8% of sales for 2009

compared to 22.0% of sales in the previous year. The decrease in gross profit margin was primarily

due to softer market conditions, a shift in the purchasing trends of our customers to a higher

percentage of on-contract items, including lower-margin commodities and consumable items like

paper, and higher customer acquisition and retention expenses as a percentage of sales. Our

Contract performance in the fourth quarter improved from the previous quarters in 2009 due to our

disciplined approach to profitable customer acquisition and retention, as well as other initiatives to

grow the business and improve margins by providing better solutions for our customers. Targeted

cost controls in our delivery fleet helped to mitigate the impact of deleveraging.

26