OfficeMax 2009 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2009 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The estimated fair values of our other financial instruments, including cash and cash

equivalents and receivables are the same as their carrying values. In the opinion of management,

we do not have any significant concentration of credit risks. Concentration of credit risks with

respect to trade receivables is limited due to the wide variety of vendors, customers and channels

to and through which our products are sourced and sold, as well as their dispersion across many

geographic areas.

Changes in interest rates and currency exchange rates expose us to financial market risk. We

occasionally use derivative financial instruments, such as interest rate swaps, forward purchase

contracts and forward exchange contracts, to manage our exposure to changes in currency

exchange rates. We generally do not enter into derivative instruments for any purpose other than

hedging the cash flows associated with future interest payments on variable rate debt and hedging

the exposure related to changes in the fair value of certain outstanding fixed rate debt instruments

due to changes in interest rates. We occasionally hedge interest rate risk associated with

anticipated financing transactions, as well as commercial transactions and certain liabilities that are

denominated in a currency other than the currency of the operating unit entering into the underlying

transaction. We do not speculate using derivative instruments. We were not a party to any

significant derivative financial instruments in 2009 or 2008.

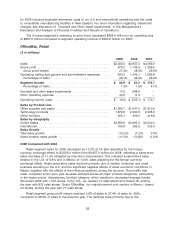

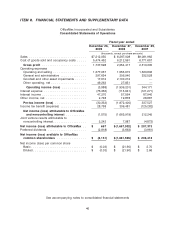

The following table provides information about our financial instruments outstanding at

December 26, 2009 that are sensitive to changes in interest rates. For debt obligations, the table

presents principal cash flows and related weighted average interest rates by expected maturity

dates. For obligations with variable interest rates, the table sets forth payout amounts based on

rates as of December 26, 2009 and does not attempt to project future rates. The following table

does not include our obligations for pension plans and other post retirement benefits, although

market risk also arises within our defined benefit pension plans to the extent that the obligations of

the pension plans are not fully matched by assets with determinable cash flows. We sponsor

noncontributory defined benefit pension plans covering certain terminated employees, vested

employees, retirees, and some active OfficeMax employees. As our plans were frozen in 2003, our

active employees and all inactive participants who are covered by the plans are no longer accruing

additional benefits. However, the pension plan obligations are still subject to change due to

fluctuations in long-term interest rates as well as factors impacting actuarial valuations, such as

retirement rates and pension plan participants’ increased life expectancies. In addition to changes

in pension plan obligations, the amount of plan assets available to pay benefits, contribution levels

and expense are also impacted by the return on the pension plan assets. The pension plan assets

include OfficeMax common stock, U.S. equities, international equities, global equities and fixed-

income securities, the cash flows of which change as equity prices and interest rates vary. The risk

is that market movements in equity prices and interest rates could result in assets that are

insufficient over time to cover the level of projected obligations. This in turn could result in

significant changes in pension expense and funded status, further impacting future required

contributions. Management, together with the trustees who act on behalf of the pension plan

beneficiaries, assess the level of this risk using reports prepared by independent external actuaries

38