OfficeMax 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.measurements. This guidance was effective for fiscal years beginning after November 15, 2007, for

financial assets and liabilities, as well as for any other assets and liabilities that are carried at fair

value on a recurring basis in the financial statements. In November 2007, the FASB provided a one

year deferral for the implementation of this guidance for other nonfinancial assets and liabilities. The

Company adopted this guidance for financial assets and liabilities effective at the beginning of fiscal

year 2008 and for non-financial assets and liabilities effective at the beginning of fiscal year 2009.

The adoption of this guidance had no significant impact on our consolidated financial statements

for either fiscal year 2008 or 2009.

In December 2007, the FASB issued updated guidance which changed the presentation and

disclosure requirements for noncontrolling interests (previously referred to as minority interests).

This updated guidance is effective for periods beginning on or after December 15, 2008 and is to

be applied prospectively to all noncontrolling interests, including those that arose prior to the

effective date. While the accounting requirements are to be applied prospectively, prior period

financial information must be recast to attribute net income and other comprehensive income to

noncontrolling interests and provide other disclosures. The Company adopted this guidance for all

noncontrolling interests effective at the beginning of fiscal year 2009, and has revised its prior

period financial statements to reflect the required change in presentation and additional disclosures.

The adoption of this accounting change and the retrospective impact of the required presentation

and disclosure changes on the Company’s prior year financial statements was immaterial.

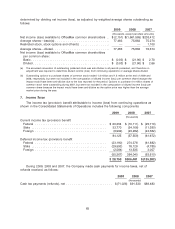

In December 2008, the FASB issued updated guidance related to an employer’s disclosures

about plan assets of a defined benefit pension or other postretirement plan. This updated guidance

requires enhanced disclosures about the fair value of plan assets including major categories of plan

assets, inputs and valuation techniques used to measure fair value, significant concentrations of

risk, the method used to allocate investments and the effect of fair value measurements using

significant unobservable inputs. The disclosures about plan assets must be provided for fiscal years

ending after December 15, 2009. The Company adopted this guidance prospectively for the period

ended December 26, 2009, and has included the required disclosure in Note 12, Retirement and

Benefit Plans.

In April 2009, the FASB issued updated guidance related to fair-value measurements to clarify

the considerations related to measuring fair-value in inactive markets, modify the recognition and

measurement of other-than-temporary impairments of debt securities, and require public companies

to disclose the fair values of financial instruments in interim periods. The updated guidance is

effective for interim and annual periods ended after June 15, 2009, with early adoption permitted for

periods ended after March 15, 2009. The Company adopted the updated guidance in the first

quarter of fiscal year 2009, which required certain additional disclosures regarding the fair value of

financial instruments in the financial statements.

In May 2009, the FASB issued guidance which establishes accounting and disclosure

requirements for subsequent events. This guidance details the period after the balance sheet date

during which the Company should evaluate events or transactions that occur for potential

recognition or disclosure in the financial statements, the circumstances under which the Company

should recognize events or transactions occurring after the balance sheet date in its financial

statements and the required disclosures for such events. The Company adopted this guidance

prospectively in the second quarter.

In June 2009, the FASB issued guidance which eliminates previous exceptions to rules

requiring the consolidation of qualifying special-purpose entities, which will result in more entities

being subject to consolidation assessments and reassessments. This guidance requires ongoing

reassessment of whether a company is the primary beneficiary of a variable interest entity (‘‘VIE’’)

and clarifies characteristics that identify a VIE. In addition, additional disclosures are required about

58