OfficeMax 2009 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2009 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

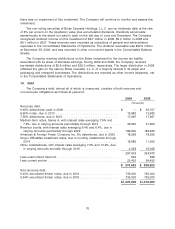

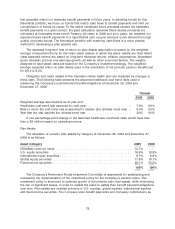

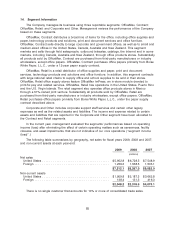

The following table shows the amounts recognized in the Consolidated Balance Sheets related

to the Company’s defined benefit pension and other postretirement benefit plans at year-end:

Pension Benefits Other Benefits

2009 2008 2009 2008

(thousands)

Noncurrent assets ........................ $ 2,355 $ — $ — $ —

Current liabilities ......................... (3,773) (4,359) (1,526) (1,746)

Noncurrent liabilities ....................... (208,744) (430,646) (18,811) (15,836)

Net amount recognized .................... $(210,162) (435,005) $(20,337) $(17,582)

Amounts recognized in accumulated other comprehensive income consist of:

Net loss (gain) ............................ $440,206 $ 590,213 $ 3,520 $ 2,227

Prior service cost (credit) .................... — — (30,148) (34,123)

Total ................................... $440,206 $590,213 $(26,628) $(31,896)

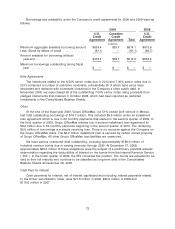

The accumulated benefit obligation for all defined benefit pension plans was $1,260.5 million

and $1,275.9 million for December 26, 2009 and December 27, 2008, respectively.

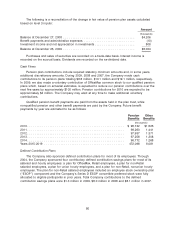

Information for pension plans with an accumulated benefit obligation in excess of plan assets:

Pension Benefits

2009 2008

(thousands)

Projected benefit obligation ................................. $1,225,972 $1,276,209

Accumulated benefit obligation ............................... 1,225,762 1,275,895

Fair value of plan assets ................................... 1,013,455 841,204

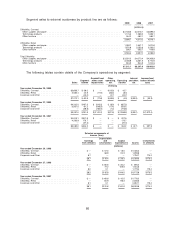

Components of Net Periodic Benefit Cost (Income)

The components of net periodic benefit cost (income) are as follows:

Pension Benefits Other Benefits

2009 2008 2007 2009 2008 2007

(thousands)

Service cost ................ $ 4,506 $ 2,132 $ 1,676 $ 184 $ 237 $ 341

Interest cost ................ 75,858 78,041 77,084 1,137 1,164 1,353

Expected return on plan assets . . (76,623) (90,078) (89,018) — — —

Recognized actuarial loss ...... 10,330 11,775 20,220 147 269 512

Participant settlement expense . . . — 2,331 ————

Amortization of prior service costs

and other ................———(4,001) (3,997) (4,009)

Net periodic benefit cost (income) $ 14,071 $ 4,201 $ 9,962 $(2,533) $(2,327) $(1,803)

76