OfficeMax 2009 Annual Report Download - page 34

Download and view the complete annual report

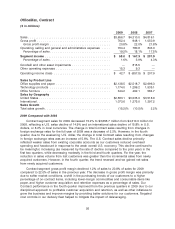

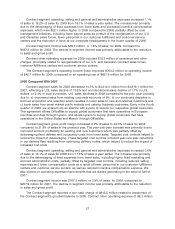

Please find page 34 of the 2009 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Retail segment operating, selling and general and administrative expenses increased 1.1% of

sales to 26.5% of sales for 2008 from 25.4% of sales a year earlier, primarily due to deleveraging of

expenses from the same-store sales volume decrease, as well as new stores which have not

ramped up to mature sales volumes, partially offset by reduced incentive compensation expense

and targeted cost controls, including the benefits from the reorganization of our Retail store

management in the second quarter and Retail field and ImPress management undertaken in the

first quarter.

Retail segment income was $61.2 million, or 1.5% of sales, for 2008, compared to

$173.7 million for 2007. The decline in segment income was primarily attributable to the reduction

in sales and gross profit.

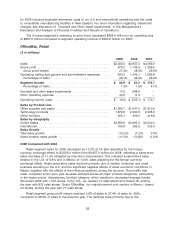

For 2008, the Retail segment recorded impairment charges of $548.9 million, consisting of

$386.0 million for impairment of goodwill, $107.1 million for impairment of trade names and

$55.8 million for impairment of store fixed assets, consisting primarily of leasehold improvements.

Retail other operating expense for 2008 included a $12.7 million charge for headcount reductions

primarily for the reorganization of our Retail field and store management and $4.7 million of charges

related to site and store lease terminations. For more information regarding impairment charges,

see the discussion of ‘‘Goodwill and Other Asset Impairments’’ that follows.

The Retail segment’s operating loss was $505.1 million for 2008, compared to operating

income of $173.7 million for 2007.

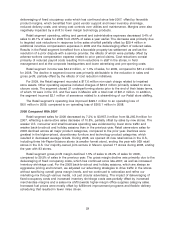

Corporate and Other

Corporate and Other expenses were $40.7 million for 2009 compared to $773.6 million for

2008. Expenses recorded in 2009 included a $0.7 million pre-tax charge for severance. Increased

incentive compensation expense ($3.8 million more in 2009) and pension costs more than offset

reduced payroll expense resulting from reductions in staff at the corporate headquarters in late

2008. Expenses recorded in 2008 included a $735.8 million charge related to the impairment of the

timber installment note guaranteed by Lehman, a $4.3 million severance charge related to a fourth

quarter reduction in force at our corporate headquarters and a $3.1 million gain, primarily related to

the release of a warranty escrow established at the time of sale of our legacy Voyageur Panel

business in 2004. During 2007, total Corporate and Other expenses were $37.4 million.

30