OfficeMax 2009 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2009 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

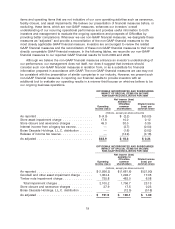

for 2008 included employee severance costs in our U.S and international operations and the costs

to consolidate manufacturing facilities in New Zealand. For more information regarding impairment

charges, see discussion of ‘‘Goodwill and Other Asset Impairments’’ in this Management’s

Discussion and Analysis of Financial Condition and Results of Operations.

The Contract segment’s operating income (loss) decreased $865.4 million to an operating loss

of $657.5 million compared to segment operating income of $207.9 million for 2007.

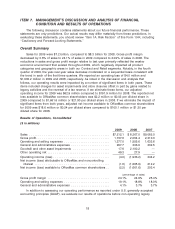

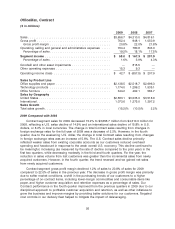

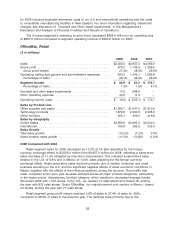

OfficeMax, Retail

($ in millions)

2009 2008 2007

Sales ............................................. $3,555.4 $3,957.0 $4,265.9

Gross profit ........................................ 975.2 1,106.3 1,259.5

Gross profit margin ................................. 27.4% 28.0% 29.5%

Operating, selling and general and administrative expenses ..... 930.3 1,045.1 1,085.8

Percentage of sales ................................. 26.1% 26.5% 25.4%

Segment income .................................... $ 44.9 $ 61.2 $ 173.7

Percentage of sales ................................. 1.3% 1.5% 4.1%

Goodwill and other asset impairments ..................... 17.6 548.9 —

Other operating expense ............................... 33.3 17.4 —

Operating income (loss) ............................... $ (6.0) $ (505.1) $ 173.7

Sales by Product Line

Office supplies and paper .............................. $1,392.7 $1,541.5 $1,610.6

Technology products ................................. 1,872.6 2,060.5 2,235.5

Office furniture ...................................... 290.1 355.0 419.8

Sales by Geography

United States ....................................... $3,369.6 $3,693.5 $4,030.0

International ........................................ 185.8 263.5 235.9

Sales Growth

Total sales growth .................................... (10.2)% (7.2)% 0.3%

Same-location sales growth ............................. (11.0)% (10.8)% (1.2)%

2009 Compared with 2008

Retail segment sales for 2009 decreased by 10.2% (9.1% after adjusting for the foreign

currency exchange effect) to $3,555.4 million from $3,957.0 million for 2008, reflecting a same-store

sales decrease of 11.0% mitigated by new store improvement. This included a same-store sales

decline in the U.S. of 9.6% and in Mexico of 13.9% (after adjusting for the foreign currency

exchange effect). Retail same-store sales declined primarily due to weaker consumer and small

business spending in the U.S. and the significant negative effects of weak economic conditions in

Mexico together with the effects of the influenza epidemic during the summer. Store traffic was

lower compared to the prior year as sales declined across all major product categories, particularly

in the higher-priced, discretionary furniture category, which resulted in decreased average tickets.

We ended 2009 with 1,010 stores. In the U.S., we opened 12 retail stores and closed 18, ending

the year with 933 retail stores. Grupo OfficeMax, our majority-owned joint venture in Mexico, closed

six stores, ending the year with 77 retail stores.

Retail segment gross profit margin declined 0.6% of sales to 27.4% of sales for 2009,

compared to 28.0% of sales in the previous year. The declines were primarily due to the

28