OfficeMax 2009 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2009 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Leasing Arrangements

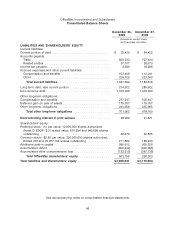

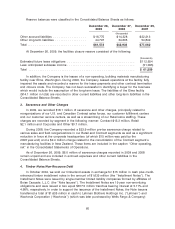

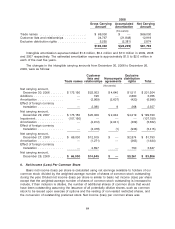

The Company conducts a substantial portion of its business in leased properties. Some of the

Company’s leases contain escalation clauses and renewal options. The Company recognizes rental

expense for leases that contain predetermined fixed escalation clauses on a straight-line basis over

the expected term of the lease. The difference between the amounts charged to expense and the

contractual minimum lease payment is recorded in other long-term liabilities in the Consolidated

Balance Sheets. At December 26, 2009 and December 27, 2008, other long-term liabilities included

approximately $68.2 million and $74.3 million, respectively, related to these future escalation

clauses.

The expected term of a lease is calculated from the date the Company first takes possession of

the facility, including any periods of free rent and any option or renewal periods management

believes are probable of exercise. This expected term is used in the determination of whether a

lease is capital or operating and in the calculation of straight-line rent expense. Rent abatements

and escalations are considered in the calculation of minimum lease payments in the Company’s

capital lease tests and in determining straight-line rent expense for operating leases. Straight-line

rent expense is also adjusted to reflect any allowances or reimbursements provided by the lessor.

Derivative Instruments and Hedging Activities

The Company records all derivative instruments on the balance sheet at fair value. Changes in

the fair value of derivative instruments are recorded in current earnings or deferred in accumulated

other comprehensive loss, depending on whether a derivative is designated as, and is effective as,

a hedge and on the type of hedging transaction. Changes in fair value of derivatives that are

designated as cash flow hedges are deferred in accumulated other comprehensive loss until the

underlying hedged transactions are recognized in earnings, at which time any deferred hedging

gains or losses are also recorded in earnings. If a derivative instrument is designated as a fair value

hedge, changes in the fair value of the instrument are reported in current earnings and offset the

change in fair value of the hedged assets, liabilities or firm commitments. The ineffective portion of

an instrument’s change in fair value is immediately recognized in earnings. Instruments that do not

meet the criteria for hedge accounting and contracts for which the Company has not elected hedge

accounting, are marked to fair value with unrealized gains or losses reported in earnings. The

Company has no significant outstanding derivative instruments at December 26, 2009 and did not

have any significant hedge transactions in 2009, 2008 or 2007.

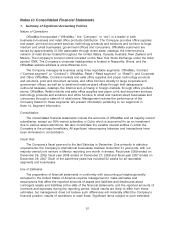

Recently Issued or Newly Adopted Accounting Standards

Following are summaries of recently issued accounting pronouncements that have either been

recently adopted or that may become applicable to the preparation of our consolidated financial

statements in the future.

In June 2009, the Financial Accounting Standards Board (‘‘FASB’’) issued a statement

establishing the FASB Accounting Standards Codification (‘‘the ASC’’ or ‘‘the Codification’’).

Effective for interim and annual periods ended after September 15, 2009, the Codification became

the source of authoritative U.S. generally accepted accounting principles (‘‘GAAP’’) recognized by

the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the SEC

under authority of federal securities laws are also sources of authoritative GAAP for SEC registrants.

The FASB statement establishing the ASC is not intended to change existing GAAP and as such

did not have an impact on the consolidated financial statements of the Company. The Company

has updated its references to reflect the Codification.

In September 2006, the FASB issued guidance which defines fair value, establishes a

framework for measuring fair value in GAAP and expands disclosures about fair value

57