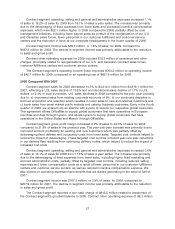

OfficeMax 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Liquidity and Capital Resources

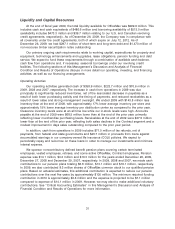

At the end of fiscal year 2009, the total liquidity available for OfficeMax was $999.6 million. This

includes cash and cash equivalents of $486.6 million and borrowing availability of $513.0 million

(availability includes $473.3 million and $39.7 million relating to our U.S. and Canadian revolving

credit agreements, respectively). As of December 26, 2009, the Company was in compliance with

all covenants under the credit agreements, both of which expire on July 12, 2012. As of

December 26, 2009, we had $297.1 million of short-term and long-term debt and $1,470 million of

non-recourse timber securitization notes outstanding.

Our primary ongoing cash requirements relate to working capital, expenditures for property and

equipment, technology enhancements and upgrades, lease obligations, pension funding and debt

service. We expect to fund these requirements through a combination of available cash balance,

cash flow from operations and, if necessary, seasonal borrowings under our revolving credit

facilities. The following sections of this Management’s Discussion and Analysis of Financial

Condition and Results of Operations discuss in more detail our operating, investing, and financing

activities, as well as our financing arrangements.

Operating Activities

Our operating activities generated cash of $358.9 million, $223.7 million and $70.6 million in

2009, 2008 and 2007, respectively. The increase in cash from operations in 2009 was due

principally to significantly reduced inventories, net of the associated decrease in payables as a

result of both lower purchasing activity and the timing of payments, and reduced receivables as a

result of lower sales and strong management oversight. We ended 2009 with $143.8 million less

inventory than at the end of 2008, with approximately 17% lower average inventory per store and

approximately 15% lower average inventory per distribution center as compared to the prior year.

Clearance inventory levels were at an all time low while our in-stock levels were high. Accounts

payable at the end of 2009 were $68.5 million lower than at the end of the prior year, primarily

reflecting lower merchandise purchasing levels. Receivables at the end of 2009 were $27.5 million

lower than at the end of the prior year, reflecting both sales declines in the Contract segment and a

modest improvement in days sales outstanding compared to the prior year period.

In addition, cash from operations in 2009 includes $71.0 million of tax refunds, net of

payments, from federal and state governments and $45.7 million in proceeds from loans against

accumulated earnings in our company-owned life insurance (COLI) policies. We expect to

periodically repay and re-borrow on these loans in order to manage our investments and minimize

interest expense.

We sponsor noncontributory defined benefit pension plans covering certain terminated

employees, vested employees, retirees, and some active OfficeMax, Contract employees. Pension

expense was $14.1 million, $4.2 million and $10.0 million for the years ended December 26, 2009,

December 27, 2008 and December 29, 2007, respectively. In 2009, 2008 and 2007, we made cash

contributions to our pension plans totaling $6.8 million, $13.1 million and $19.1 million, respectively.

In 2009, we also contributed 8.3 million shares of OfficeMax common stock to our qualified pension

plans. Based on actuarial estimates, this additional contribution is expected to reduce our pension

contributions over the next five years by approximately $100 million. The minimum required funding

contribution in 2010 is approximately $3.8 million and the expense is projected to be $7.1 million

compared to expense of $14.1 million in 2009. However, we may elect to make additional voluntary

contributions. See ‘‘Critical Accounting Estimates’’ in this Management’s Discussion and Analysis of

Financial Condition and Results of Operations for more information.

31