OfficeMax 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

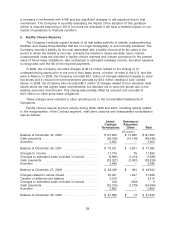

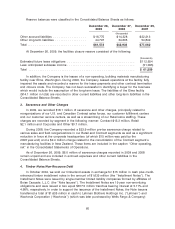

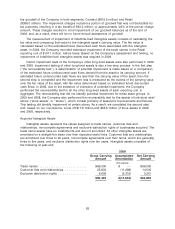

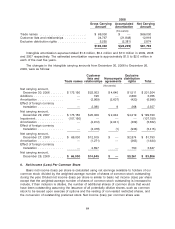

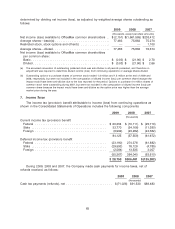

Reserve balances were classified in the Consolidated Balance Sheets as follows:

December 26, December 27, December 29,

2009 2008 2007

(thousands)

Other accrued liabilities .................. $16,775 $14,328 $22,213

Other long-term liabilities ................. 44,797 34,605 54,849

Total ................................ $61,572 $48,933 $77,062

At December 26, 2009, the facilities closure reserve consisted of the following:

(thousands)

Estimated future lease obligations ..................................... $112,654

Less: anticipated sublease income ..................................... (51,095)

Total .......................................................... $ 61,559

In addition, the Company is the lessee of a non-operating, building materials manufacturing

facility near Elma, Washington. During 2006, the Company ceased operations at the facility, fully

impaired the assets and recorded a reserve for the lease payments and other contract termination

and closure costs. The Company has not been successful in identifying a buyer for the business

which would include the assumption of the long-term lease. The liabilities of the Elma facility

($14.1 million in total) are recorded in other current liabilities and other long-term liabilities in the

Consolidated Balance Sheets.

3. Severance and Other Charges

In 2009, we recorded $18.1 million of severance and other charges, principally related to

reorganizations of our U.S. and Canadian Contract sales forces, our customer fulfillment centers

and our customer service centers, as well as a streamlining of our Retail store staffing. These

charges are recorded by segment in the following manner: Contract $15.3 million, Retail

$2.1 million and Corporate and Other $0.7 million.

During 2008, the Company recorded a $23.9 million pre-tax severance charge related to

various sales and field reorganizations in our Retail and Contract segments as well as a significant

reduction in force at the corporate headquarters (of which $15 million was paid by the

2008 year-end) and a $2.4 million charge related to the consolidation of the Contract segment’s

manufacturing facilities in New Zealand. These items are included in the caption ‘‘Other operating,

net’’ in the Consolidated Statements of Operations.

As of December 26, 2009, $6.0 million of severance charges recorded in 2009 and 2008

remain unpaid and are included in accrued expenses and other current liabilities in the

Consolidated Balance Sheets.

4. Timber Notes/Non-Recourse Debt

In October 2004, we sold our timberland assets in exchange for $15 million in cash plus credit-

enhanced timber installment notes in the amount of $1,635 million (the ‘‘Installment Notes’’). The

Installment Notes were issued by single-member limited liability companies formed by affiliates of

Boise Cascade, L.L.C. (the ‘‘Note Issuers’’). The Installment Notes are 15-year non-amortizing

obligations and were issued in two equal $817.5 million tranches bearing interest at 5.11% and

4.98%, respectively. In order to support the issuance of the Installment Notes, the Note Issuers

transferred a total of $1,635 million in cash to Lehman Brothers Holdings Inc. (‘‘Lehman’’) and

Wachovia Corporation (‘‘Wachovia’’) (which was later purchased by Wells Fargo & Company)

60