OfficeMax 2009 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2009 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and take action, where appropriate, in terms of setting investment strategy and agreed contribution

levels.

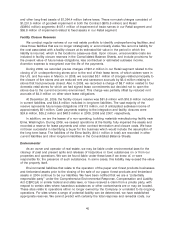

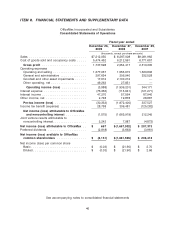

($ in millions)

Fiscal year-ended

2009 2008

Expected Payments There- Fair Fair

2010 2011 2012 2013 2014 after Total Value Total Value

Recourse debt

Fixed-rate debt payments .......... $18.4 $0.8 $35.4 $1.9 $0.2 $224.2 $280.9 $190.8 $332.1 $214.6

Average interest rates ........... 6.3% 7.1% 7.9% 8.0% 5.4% 6.4% 6.6% —% 6.9% —%

Variable-rate debt payments ........ $4.0 $3.7 $3.7 $3.7 $1.6 $ 0 $ 16.7 $ 16.4 $ 22.9 $ 22.1

Average interest rates ........... 7.5% 7.5% 7.5% 7.5% 8.1% —% 7.5% —% 10.9% —%

Non-recourse debt:

Timber securitization notes

Wachovia ................. $ — $— $ — $— $— $735.0 $735.0 $754.8 $735.0 $736.8

Average interest rates .......... 5.4% 5.4% —% 5.4% —%

Lehman .................. $ — $— $ — $— $— $735.0 $735.0 $ 81.8 $735.0 $ 81.8

Average interest rates .......... 5.5% 5.5% —% 5.5% —%

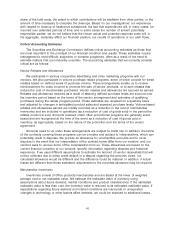

2009 2008

Carrying amount Fair value Carrying amount Fair value

(millions)

Financial assets:

Timber notes receivable

Wachovia— ............. $817.5 $823.6 $817.5 $801.9

Lehman— .............. 81.8 81.8 81.8 81.8

Financial liabilities:

Debt .................... $297.6 $207.2 $355.0 $236.7

Timber securitization notes

Wachovia— ............. $735.0 $754.8 $735.0 $736.8

Lehman— .............. 735.0 81.8 735.0 81.8

Goodwill and Other Asset Impairments

We are required for accounting purposes to assess the carrying value of goodwill and other

intangible assets annually or whenever circumstances indicate that a decline in value may have

occurred. In 2008, we fully impaired our goodwill balances. We review other intangible assets

annually at year-end.

For other long lived assets, we are also required to assess the carrying value when

circumstances indicate that a decline in value may have occurred. Based on the operating

performance of several of our stores due to the macroeconomic factors and market specific change

in expected demographics, we determined that there were indicators of potential impairment

relating to our stores. Therefore, in 2009, we recorded a non-cash charge of $17.6 million to impair

long lived assets pertaining to certain stores.

During 2008, based on our sustained low stock price and reduced market capitalization relating

to the book value of equity as well as the macroeconomic factors impacting industry business

conditions, actual and forecasted operating performance and continued tightening of the credit

markets, we determined indicators of potential impairment were present in the second quarter of

2008. In the fourth quarter of 2008, due to a further decline in market capitalization and worsening

economic conditions and performance, we concluded further impairment was indicated. As a result,

during 2008, we recorded non-cash impairment charges associated with goodwill, intangible assets

39