OfficeMax 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

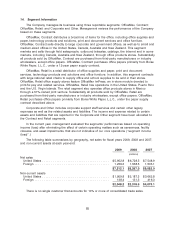

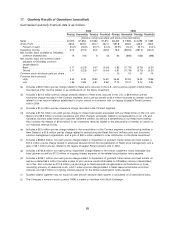

14. Segment Information

The Company manages its business using three reportable segments: OfficeMax, Contract;

OfficeMax, Retail; and Corporate and Other. Management reviews the performance of the Company

based on these segments.

OfficeMax, Contract distributes a broad line of items for the office, including office supplies and

paper, technology products and solutions, print and document services and office furniture.

OfficeMax, Contract sells directly to large corporate and government offices, as well as to small and

medium-sized offices in the United States, Canada, Australia and New Zealand. This segment

markets and sells through field salespeople, outbound telesales, catalogs, the Internet and in some

markets, including Canada, Australia and New Zealand, through office products stores. Substantially

all products sold by OfficeMax, Contract are purchased from third-party manufacturers or industry

wholesalers, except office papers. OfficeMax, Contract purchases office papers primarily from Boise

White Paper, L.L.C., under a 12-year paper supply contract.

OfficeMax, Retail is a retail distributor of office supplies and paper, print and document

services, technology products and solutions and office furniture. In addition, this segment contracts

with large national retail chains to supply office and school supplies to be sold in their stores.

OfficeMax, Retail office supply stores feature OfficeMax ImPress, an in-store module devoted to

print-for-pay and related services. OfficeMax, Retail has operations in the United States, Puerto Rico

and the U.S. Virgin Islands. The retail segment also operates office products stores in Mexico

through a 51%-owned joint venture. Substantially all products sold by OfficeMax, Retail are

purchased from third-party manufacturers or industry wholesalers, except office papers. OfficeMax,

Retail purchases office papers primarily from Boise White Paper, L.L.C., under the paper supply

contract described above.

Corporate and Other includes corporate support staff services and certain other legacy

expenses as well as the related assets and liabilities. The income and expense related to certain

assets and liabilities that are reported in the Corporate and Other segment have been allocated to

the Contract and Retail segments.

In the current year, management evaluated the segments’ performances based on operating

income (loss) after eliminating the effect of certain operating matters such as severances, facility

closures, and asset impairments, that are not indicative of our core operations (‘‘segment income

(loss)’’.)

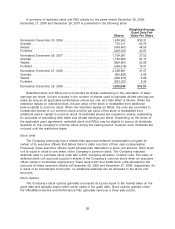

The following table summarizes by geography, net sales for fiscal years 2009, 2008 and 2007,

and non-current assets at each year-end:

2009 2008 2007

(millions)

Net sales

United States ..................................... $5,952.8 $ 6,728.5 $ 7,548.9

Foreign ......................................... 1,259.3 1,538.5 1,533.1

$7,212.1 $8,267.0 $9,082.0

Non-current assets

United States ..................................... $1,909.8 $ 2,187.3 $ 3,662.8

Foreign ......................................... 138.4 131.3 416.3

$2,048.2 $2,318.6 $4,079.1

There is no single customer that accounts for 10% or more of consolidated trade sales.

85