OfficeMax 2009 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2009 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

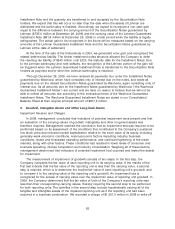

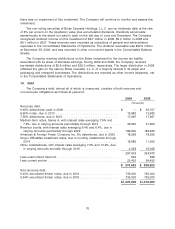

Borrowings and availability under the Company’s credit agreements for 2009 and 2008 were as

follows:

2009 2008

U.S. Canadian U.S.

Credit Credit Credit

Agreement Agreement Total Agreement

(millions)

Maximum aggregate available borrowing amount $534.4 $39.7 $574.1 $613.6

Less: Stand-by letters of credit ............. (61.1) — (61.1) (66.7)

Amount available for borrowing at fiscal

year-end ............................ $473.3 $39.7 $513.0 $546.9

Maximum borrowings outstanding during fiscal

year ............................... $ — $ — $ — $ —

Note Agreements

The indentures related to the 6.50% senior notes due in 2010 and 7.00% senior notes due in

2013 contained a number of restrictive covenants, substantially all of which have since been

eliminated and replaced with covenants contained in the Company’s other public debt. In

November 2008, we repurchased all of the outstanding 7.00% senior notes using proceeds from

pledged instruments that matured in October 2008, which had been reported as restricted

investments in the Consolidated Balance Sheets.

Other

At the end of the fiscal year 2009, Grupo OfficeMax, our 51%-owned joint venture in Mexico,

had total outstanding borrowings of $16.7 million. This included $9.9 million under an installment

loan agreement which is due in 60 monthly payments that started in the second quarter of 2009. In

the third quarter of 2009, Grupo OfficeMax entered into a second installment loan agreement for

$6.2 million due in 54 monthly payments beginning in the second quarter of 2010. The remaining

$0.6 million of borrowings is a simple revolving loan. There is no recourse against the Company on

the Grupo OfficeMax loans. The $6.2 million installment loan is secured by certain owned property

of Grupo OfficeMax. All other Grupo OfficeMax loan facilities are unsecured.

We have various unsecured debt outstanding, including approximately $189.9 million of

industrial revenue bonds due in varying amounts through 2029. At December 27, 2008,

approximately $69.2 million of these obligations were the subject of a preliminary potential adverse

determination regarding the deductibility of interest on the bonds from the Internal Revenue Service

(‘‘IRS’’). In the fourth quarter of 2009, the IRS conceded the position. The bonds are expected to be

held to their full maturity and continue to be classified as long-term debt in the Consolidated

Balance Sheets at December 26, 2009.

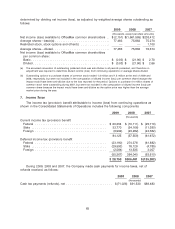

Cash Paid for Interest

Cash payments for interest, net of interest capitalized and including interest payments related

to the timber securitization notes, were $71.8 million in 2009, $90.0 million in 2008 and

$116.6 million in 2007.

72