OfficeMax 2009 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2009 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to Selected Financial Data

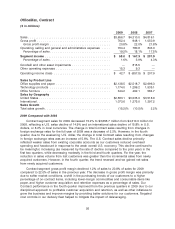

(a) 2009 included the following items:

•$17.6 million pre-tax charge for impairment of fixed assets associated with certain of our Retail stores in the

U.S. and Mexico. Our minority partner’s share of this charge of $1.2 million is included in joint venture results

attributable to noncontrolling interest.

•$31.2 million pre-tax charge for costs related to Retail store closures in the U.S. and Mexico. Our minority

partner’s share of this charge of $0.5 million is included in joint venture results attributable to noncontrolling

interest.

•$18.1 million pre-tax charge for severance and other costs incurred in connection with various company

reorganizations.

•$2.6 million pre-tax gain related to the Company’s Boise Investment.

•$4.4 million pre-tax gain related to interest earned on a tax escrow balance established in a prior period in

connection with our legacy Voyageur Panel business.

•$14.9 million of income tax benefit from the resolution of an issue under Internal Revenue Service (‘‘IRS’’)

appeal regarding the deductibility of interest on certain of our industrial revenue bonds and the release of the

related tax uncertainty reserves.

(b) 2008 included the following pre-tax items:

•$1,364.4 million charge for impairment of goodwill, trade names and fixed assets. Our minority partner’s

share of this charge of $6.5 million is included in joint venture results attributable to noncontrolling interest.

•$735.8 million charge for non-cash impairment of the timber installment note receivable due from Lehman

Brothers Holdings, Inc. and $20.4 million of related interest expense.

•$27.9 million charge for severance and costs associated with the termination of certain store and site leases.

•$20.5 million gain related to the Company’s Boise Investment, primarily attributable to the sale of a majority

interest in its paper and packaging and newsprint businesses.

(c) 2007 included the following items:

•$32.4 million pre-tax income related to a paper agreement with affiliates of Boise Cascade Holdings, L.L.C.

we entered into in connection with the Sale. This agreement was terminated in early 2008.

•$1.1 million after-tax loss related to the sale of OfficeMax’s Contract operations in Mexico to Grupo OfficeMax,

our 51%-owned joint venture.

(d) 2006 included the following pre-tax items:

•$89.5 million charge related to the closing of 109 underperforming domestic retail stores.

•$46.4 million charge related to the relocation and consolidation of our corporate headquarters.

•$10.3 million charge primarily related to a reorganization of our Contract segment.

•$18.0 million charge primarily for contract termination and other costs related to the closure of our Elma,

Washington manufacturing facility.

•$48.0 million of income from a paper agreement with affiliates of Boise Cascade Holdings, L.L.C. we entered

into in connection with the Sale.

(e) 2005 included the following pre-tax items:

•$25.0 million charge related to the relocation and consolidation of our corporate headquarters.

•$31.9 million charge primarily for one-time severance payments, professional fees and asset write-downs.

•$17.9 million related to the write-down of impaired assets, primarily related to retail store closures.

•$5.4 million charge related to the restructuring of our international operations.

•$9.8 million charge related to a legal settlement with the Department of Justice.

•$14.4 million loss related to our early retirement of debt.

•$28.2 million for the write-down of impaired assets at our Elma, Washington manufacturing facility.

The Company’s fiscal year-end is the last Saturday in December. There were 53 weeks in 2005 for the Retail

operations.

(f) Due to the losses reported in 2009, 2008, and 2005, the computation of diluted income (loss) per common

share was antidilutive in these years and therefore, the amounts reported for basic and diluted income (loss) per

common share are the same.

17