OfficeMax 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

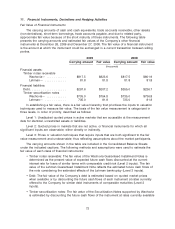

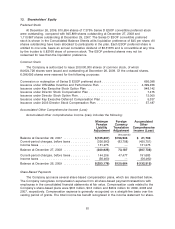

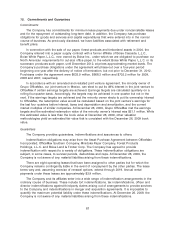

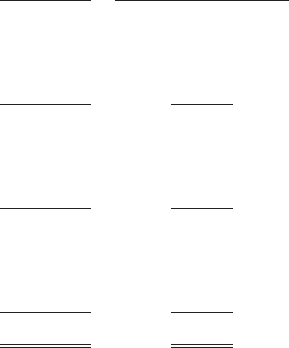

A summary of restricted stock and RSU activity for the years ended December 26, 2009,

December 27, 2008 and December 29, 2007 is presented in the following table:

Weighted-Average

Grant Date Fair

Shares Value Per Share

Nonvested, December 30, 2006 ......................... 1,679,552 $30.31

Granted .......................................... 770,211 50.72

Vested ........................................... (476,451) 48.50

Forfeited .......................................... (249,031) 40.91

Nonvested, December 29, 2007 ......................... 1,724,281 37.50

Granted .......................................... 1,742,860 23.17

Vested ........................................... (859,661) 22.65

Forfeited .......................................... (348,519) 15.01

Nonvested, December 27, 2008 ......................... 2,258,961 31.07

Granted .......................................... 800,828 5.08

Vested ........................................... (496,813) 5.65

Forfeited .......................................... (633,031) 5.24

Nonvested, December 26, 2009 ......................... 1,929,945 $16.24

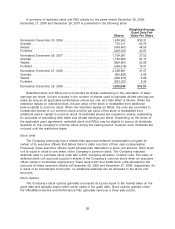

Restricted stock and RSUs are not included as shares outstanding in the calculation of basic

earnings per share, but are included in the number of shares used to calculate diluted earnings per

share as long as all applicable performance criteria are met, and their effect is dilutive. When the

restriction lapses on restricted stock, the par value of the stock is reclassified from additional

paid-in-capital to common stock. When the restriction lapses on RSUs, the units are converted to

unrestricted shares of our common stock and the par value of the stock is reclassified from

additional paid-in-capital to common stock. Unrestricted shares are included in shares outstanding

for purposes of calculating both basic and diluted earnings per share. Depending on the terms of

the applicable grant agreement, restricted stock and RSUs may be eligible to accrue all dividends

declared on the Company’s common stock during the vesting period; however, such dividends are

not paid until the restrictions lapse.

Stock Units

The Company previously had a shareholder approved deferred compensation program for

certain of its executive officers that allows them to defer a portion of their cash compensation.

Previously, these executive officers could allocate their deferrals to a stock unit account. Each stock

unit is equal in value to one share of the Company’s common stock. The Company matched

deferrals used to purchase stock units with a 25% Company allocation of stock units. The value of

deferred stock unit accounts is paid in shares of the Company’s common stock when an executive

officer retires or terminates employment. There were 5,337 and 8,008 stock units allocated to the

accounts of these executive officers at December 26, 2009 and December 27, 2008, respectively. As

a result of an amendment to the plan, no additional deferrals can be allocated to the stock unit

accounts.

Stock Options

The Company’s stock options generally are issued at a price equal to fair market value on the

grant date and typically expire within seven years of the grant date. Stock options granted under

the OfficeMax Incentive and Performance Plan generally vest over a three year period.

83