OfficeMax 2009 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2009 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

there was no impairment of this investment. The Company will continue to monitor and assess this

investment.

The non-voting securities of Boise Cascade Holdings, L.L.C. accrue dividends daily at the rate

of 8% per annum on the liquidation value plus accumulated dividends. Dividends accumulate

semiannually to the extent not paid in cash on the last day of June and December. The Company

recognized dividend income on this investment of $6.7 million in 2009, $6.2 million in 2008 and

$6.1 million in 2007. These amounts were recorded as reductions of general and administrative

expenses in the Consolidated Statements of Operations. The dividend receivable was $22.9 million

at December 26, 2009, and was recorded in other non-current assets in the Consolidated Balance

Sheets.

The Company receives distributions on the Boise Investment for the income tax liability

associated with its share of allocated earnings. During 2009 and 2008, the Company received

tax-related distributions of $2.6 million and $23.0 million, respectively. The larger distribution in 2008

reflected the gain on the sale by Boise Cascade, L.L.C. of a majority interest in its paper and

packaging and newsprint businesses. The distributions are reported as other income (expense), net

in the Consolidated Statements of Operations.

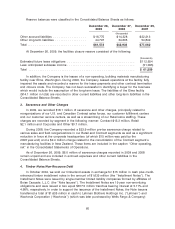

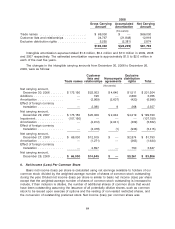

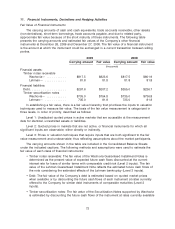

10. Debt

The Company’s debt, almost all of which is unsecured, consists of both recourse and

non-recourse obligations as follows at year-end:

2009 2008

(thousands)

Recourse debt:

9.45% debentures, paid in 2009 ............................. $ — $ 35,707

6.50% notes, due in 2010 .................................. 13,680 13,680

7.35% debentures, due in 2016 .............................. 17,967 17,967

Medium-term notes, Series A, with interest rates averaging 7.9% and

7.8%, due in varying amounts periodically through 2013 .......... 36,900 51,900

Revenue bonds, with interest rates averaging 6.4% and 6.4%, due in

varying amounts periodically through 2029 .................... 189,930 189,930

American & Foreign Power Company Inc. 5% debentures, due in 2030 . 18,526 18,526

Grupo OfficeMax installment loans, due in monthly installments through

2014 ................................................ 16,085 11,202

Other indebtedness, with interest rates averaging 7.0% and 10.9%, due

in varying amounts annually through 2016 .................... 4,528 16,058

297,616 354,970

Less unamortized discount ................................. 564 596

Less current portion ...................................... 22,430 64,452

$ 274,622 $ 289,922

Non-recourse debt:

5.42% securitized timber notes, due in 2019 ..................... 735,000 735,000

5.54% securitized timber notes, due in 2019 ..................... 735,000 735,000

$1,470,000 $1,470,000

70