OfficeMax 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and other long-lived assets of $1,364.4 million before taxes. These non-cash charges consisted of

$1,201.5 million of goodwill impairment in both the Contract ($815.5 million) and Retail

($386.0 million) segments; $107.1 million of impairment of trade names in our Retail segment and

$55.8 million of impairment related to fixed assets in our Retail segment.

Facility Closure Reserves

We conduct regular reviews of our real estate portfolio to identify underperforming facilities, and

close those facilities that are no longer strategically or economically viable. We record a liability for

the cost associated with a facility closure at its estimated fair value in the period in which the

liability is incurred, which is the location’s cease-use date. Upon closure, unrecoverable costs are

included in facility closure reserves in the Consolidated Balance Sheets, and include provisions for

the present value of future lease obligations, less contractual or estimated sublease income.

Accretion expense is recognized over the life of the payments.

During 2009, we recorded pre-tax charges of $31.2 million in our Retail segment related to the

closing of 21 underperforming stores prior to the end of their lease terms, of which sixteen were in

the U.S. and five were in Mexico. In 2008, we recorded $3.1 million of charges related principally to

the closure of five stores and we reduced rent and severance accruals by $3.4 million relating to

stores that had previously closed. Also in 2008, we recorded a charge of $8.7 million related to four

domestic retail stores for which we had signed lease commitments but decided not to open the

stores due to the current economic environment. This charge was partially offset by reduced rent

accruals of $4.0 million on other store lease obligations.

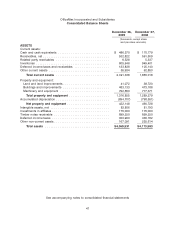

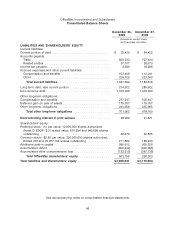

At December 26, 2009, the facility closure reserve was $61.6 million with $16.8 million included

in current liabilities, and $44.8 million included in long-term liabilities. The vast majority of the

reserve represents future lease obligations of $113 million, net of anticipated sublease income of

approximately $51 million. Cash payments relating to the integration and facility closures were

$24.6 million, $35.2 million and $48.3 million in 2009, 2008 and 2007, respectively.

In addition, we are the lessee of a non-operating, building materials manufacturing facility near

Elma, Washington. During 2006, we ceased operations at the facility, fully impaired the assets and

recorded a reserve for lease payments and other contract termination and closure costs. We have

not been successful in identifying a buyer for the business which would include the assumption of

the long term lease. The liabilities of the Elma facility ($14.1 million in total) are recorded in other

current liabilities and other long-term liabilities in the Consolidated Balance Sheets.

Environmental

As an owner and operator of real estate, we may be liable under environmental laws for the

cleanup of past and present spills and releases of hazardous or toxic substances on or from our

properties and operations. We can be found liable under these laws if we knew of, or were

responsible for, the presence of such substances. In some cases, this liability may exceed the value

of the property itself.

Environmental liabilities that relate to the operation of the paper and forest products businesses

and timberland assets prior to the closing of the sale of our paper, forest products and timberland

assets in 2004 continue to be our liabilities. We have been notified that we are a ‘‘potentially

responsible party’’ under the Comprehensive Environmental Response, Compensation and Liability

Act (CERCLA) or similar federal and state laws, or have received a claim from a private party, with

respect to certain sites where hazardous substances or other contaminants are or may be located.

These sites relate to operations either no longer owned by the Company or unrelated to its ongoing

operations. For sites where a range of potential liability can be determined, we have established

appropriate reserves. We cannot predict with certainty the total response and remedial costs, our

40