OfficeMax 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

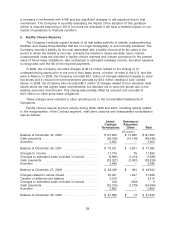

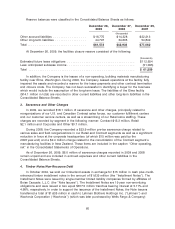

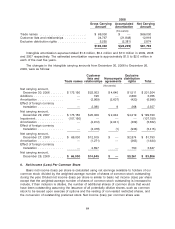

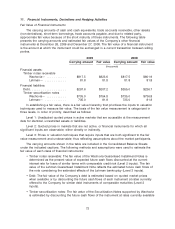

The income tax provision attributable to income (loss) from continuing operations for the years

ended December 26, 2009, December 27, 2008 and December 29, 2007 differed from the amounts

computed by applying the statutory U.S. Federal income tax rate of 35% to pre-tax income (loss)

from continuing operations as a result of the following:

2009 2008 2007

(thousands)

Tax (provision) benefit at statutory rate .................. $10,617 $ 690,340 $ (118,184)

State taxes, net of federal effect ....................... 2,516 29,041 (11,030)

Foreign tax provision differential ....................... 1,085 (3,283) 106

Impact of goodwill impairment ........................ — (418,920) —

Net operating loss valuation allowance and credits .......... (2,484) 1,291 434

Change in tax contingency liability ..................... (3,390) (3,394) 755

Tax settlement, net of other charges .................... 14,880 6,830 1,582

Repatriation of foreign earnings, net .................... 3,428 — —

ESOP dividend deduction ............................ 944 1,166 1,317

Other, net ....................................... 1,162 3,410 (262)

$28,758 $ 306,481 $(125,282)

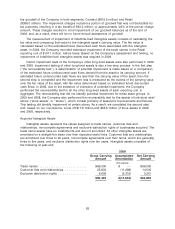

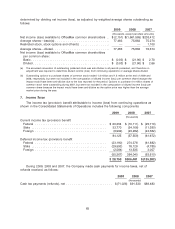

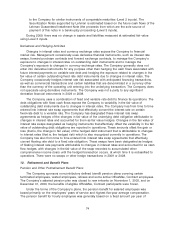

The tax effects of temporary differences that give rise to significant portions of the deferred tax

assets and deferred tax liabilities at year-end are presented in the following table:

2009 2008

(thousands)

Impairment of note receivable ................................. $ 286,207 $ 286,207

Minimum tax and other credits carryover ......................... 237,897 28,303

Net operating loss carryovers ................................. 104,605 27,801

Deferred gain on Boise Investment ............................. 69,925 69,925

Compensation obligations ................................... 154,400 220,045

Operating reserves and accrued expenses ....................... 59,682 64,563

Investments and deferred charges ............................. 18,110 25,681

Property and equipment ..................................... 15,942 47,899

Allowances for receivables ................................... 14,253 18,219

Inventory ................................................ 8,699 11,863

Tax goodwill ............................................. 6,788 9,774

Other .................................................. 3,064 10,207

Total deferred tax assets .................................... 979,572 820,487

Valuation allowance on NOLs and credits ........................ (16,117) (13,633)

Total deferred tax assets after valuation allowance ................ $ 963,455 $ 806,854

Timberland installment gain related to Wachovia Note ............... $(266,798) $ (266,798)

Timberland installment gain related to Lehman Note ................ (276,965) —

Undistributed earnings ...................................... (4,606) (4,606)

Total deferred tax liabilities ................................... (548,369) (271,404)

Total net deferred tax assets ................................ $ 415,086 $ 535,450

66