OfficeMax 2009 Annual Report Download - page 78

Download and view the complete annual report

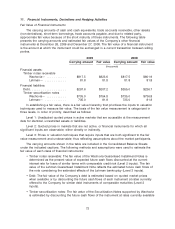

Please find page 78 of the 2009 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.to the Company for similar instruments of comparable maturities (Level 2 inputs). The

Securitization Notes supported by Lehman is estimated based on the future cash flows of the

Lehman Guaranteed Installment Note (the proceeds from which are the sole source of

payment of this note) in a bankruptcy proceeding (Level 3 inputs).

During 2009, there was no change in assets and liabilities measured at estimated fair value

using Level 3 inputs.

Derivatives and Hedging Activities

Changes in interest rates and currency exchange rates expose the Company to financial

market risk. Management occasionally uses derivative financial instruments, such as interest rate

swaps, forward purchase contracts and forward exchange contracts, to manage the Company’s

exposure to changes in interest rates on outstanding debt instruments and to manage the

Company’s exposure to changes in currency exchange rates. The Company generally does not

enter into derivative instruments for any purpose other than hedging the cash flows associated with

future interest payments on variable rate debt and hedging the exposure related to changes in the

fair value of certain outstanding fixed rate debt instruments due to changes in interest rates. The

Company occasionally hedges interest rate risk associated with anticipated financing transactions,

as well as commercial transactions and certain liabilities that are denominated in a currency other

than the currency of the operating unit entering into the underlying transaction. The Company does

not speculate using derivative instruments. The Company was not a party to any significant

derivative financial instruments in 2009 or 2008.

The Company uses a combination of fixed and variable rate debt to finance its operations. The

debt obligations with fixed cash flows expose the Company to variability in the fair value of

outstanding debt instruments due to changes in interest rates. The Company has from time to time

entered into interest rate swap agreements that effectively convert the interest rate on certain

fixed-rate debt to a variable rate. The Company has designated these interest rate swap

agreements as hedges of the changes in fair value of the underlying debt obligation attributable to

changes in interest rates and accounted for them as fair value hedges. Changes in the fair value of

interest rate swaps designated as hedging instruments that effectively offset the variability in the fair

value of outstanding debt obligations are reported in operations. These amounts offset the gain or

loss (that is, the change in fair value) of the hedged debt instrument that is attributable to changes

in interest rates (that is, the hedged risk) which is also recognized currently in operations. The

Company has also from time to time entered into interest rate swap agreements that effectively

convert floating rate debt to a fixed rate obligation. These swaps have been designated as hedges

of floating interest rate payments attributable to changes in interest rates and accounted for as cash

flow hedges, with changes in the fair value of the swap recorded to accumulated other

comprehensive income (loss) until the hedged transaction occurs, at which time it is reclassified to

operations. There were no swaps or other hedge transactions in 2009 or 2008.

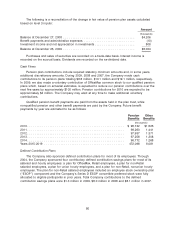

12. Retirement and Benefit Plans

Pension and Other Postretirement Benefit Plans

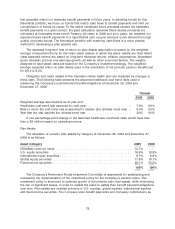

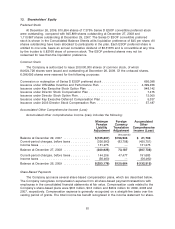

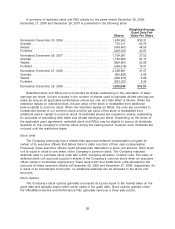

The Company sponsors noncontributory defined benefit pension plans covering certain

terminated employees, vested employees, retirees and some active OfficeMax, Contract employees.

The Company’s salaried pension plan was closed to new entrants on November 1, 2003, and on

December 31, 2003, the benefits of eligible OfficeMax, Contract participants were frozen.

Under the terms of the Company’s plans, the pension benefit for salaried employees was

based primarily on the employees’ years of service and highest five-year average compensation.

The pension benefit for hourly employees was generally based on a fixed amount per year of

74