OfficeMax 2009 Annual Report Download - page 28

Download and view the complete annual report

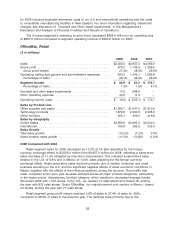

Please find page 28 of the 2009 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the impairment charge and the additional interest expense resulted in a reduction of net

income available to OfficeMax common shareholders of $462.0 million, or $6.08 per diluted

share. For information regarding this impairment charge see our discussion of the timber

notes under the heading ‘‘Timber Notes/Non-Recourse Debt’’ in this Management’s

Discussion and Analysis of Financial Condition and Results of Operations.

• We recorded a $23.9 million pre-tax severance charge related to various sales and field

reorganizations in our Retail and Contract segments as well as a significant reduction in force

at the corporate headquarters. We also recorded $4.7 million of pre-tax charges related to

store closings and lease terminations, and pre-tax charges of $2.4 million related to the

consolidation of the Contract segment’s manufacturing facilities in New Zealand. Offsetting

these charges was a $3.1 million pre-tax gain primarily related to the release of a warranty

escrow established at the time of sale of our legacy Voyageur Panel business in 2004.

• We recorded $20.5 million of pre-tax income related to a distribution received on the Boise

Investment. We receive distributions on the Boise Investment for the income tax liability

associated with allocated earnings. The distribution received was primarily related to the

income tax liability associated with the allocated gain on the sale by Boise Cascade, L.L.C.

of a majority interest in its paper and packaging and newsprint businesses during the first

quarter of 2008. This income was classified as non-operating and resulted in an increase in

after-tax income of $12.5 million, or $0.16 per diluted share.

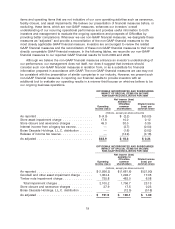

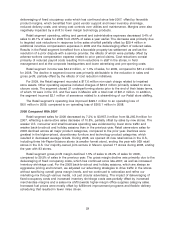

Interest expense was $113.6 million in 2008 compared to $121.3 million for 2007. The

year-over-year decrease in interest expense was a result of lower average borrowings and the

curtailment of interest accruals on certain of the timber securitization notes payable after the default

on the timber installment note guaranteed by Lehman on October 29, 2008 due to the Lehman

bankruptcy. Interest expense includes interest related to the affected timber securitization notes

payable of approximately $73.5 million and $80.5 million for 2008 and 2007, respectively. Per the

timber note agreements, the interest expense related to the timber securitization notes payable is to

be offset by interest income earned on the timber installment notes receivable. However, at the time

of the Lehman bankruptcy in September 2008, the Company reversed interest income accrued on

the installment note guaranteed by Lehman from the date of the last payment (April 29, 2008), and

has not recognized any additional interest income on this installment note. We did, however,

continue to record the ongoing interest expense on the related timber securitization notes payable

until the default date (October 29, 2008), resulting in $20.4 million of additional interest expense that

will only be paid if the corresponding interest income is collected. Total timber note related interest

income was $53.9 million in 2008. In 2007, the timber note related interest expense was offset by

timber note related interest income of $82.5 million.

Excluding the interest income earned on the timber notes receivable, interest income was

$3.7 million and $5.4 million for the years ended December 27, 2008 and December 29, 2007,

respectively.

For 2008, we recognized an income tax benefit of $306.5 million on our $1,972.4 million pre-tax

loss (effective tax benefit rate of 15.5%) compared to income tax expense of $125.3 million on

$337.5 million in pretax income (effective tax rate of 37.1%) for 2007. In the first quarter of 2008, the

Company effectively settled an audit with the Federal government for all tax years through 2005. As

a result of the settlement and other related filings, the Company recognized a $6.8 million benefit in

its tax provision for 2008. The goodwill, trade names and other long-lived assets impairment charge

of $1.4 billion unfavorably impacted the tax benefit rate as the book basis of these assets was

higher than the amortizable tax basis and resulted in a tax benefit of $63.2 million or approximately

4.6% of the tax charge. The Company also reviewed the realizability of state net operating loss

carryforwards and foreign tax credits in 2008, resulting in the recognition of approximately

24