OfficeMax 2009 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2009 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

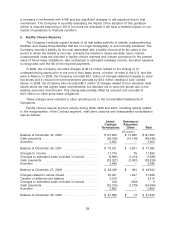

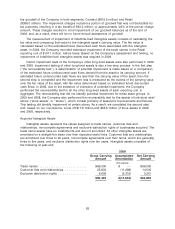

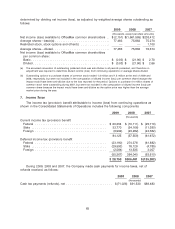

Deferred tax assets and liabilities in our Consolidated Balance Sheets were as follows:

(thousands)

Deferred income taxes and receivables ........................... $114,186 $ 99,268

Deferred income taxes ....................................... 300,900 436,182

$415,086 $535,450

As discussed in Note 4, ‘‘Timber Notes/Non-Recourse Debt’’ at the time of the sale of the

timberlands in 2004, we generated a tax gain and recognized the related deferred tax liability. The

timber installment notes structure allowed the Company to defer the resulting tax liability of

$543 million until 2020, the maturity date for the Lehman Guaranteed Installment Notes. Due to the

Lehman bankruptcy and note defaults, we initially concluded that approximately half of this gain

would be accelerated into 2008 for tax purposes and we estimated and paid taxes on this gain in

2008. In estimating the cash taxes, we considered our available alternative minimum tax credits, a

portion of which resulted from prior tax payments related to the sale of the timberlands in 2004,

which were used to reduce the net cash payments. After extensive review with our outside tax

advisors, we concluded that the recognition of the Lehman portion of the gain was not triggered in

2008, but instead will be triggered when the Installment Note is transferred to the Securitization

Note holders as payment and/or when the Lehman bankruptcy is resolved. Accordingly, we

appropriately modified our position as we finalized the 2008 tax return, and have received refunds

of taxes paid in 2008 from the federal and state government. Accordingly, in the Consolidated

Balance Sheets as of December 26, 2009, the Company has reestablished both the deferred tax

liability related to the full deferred gain from the sale of the timberlands and the deferred tax assets

relative to available alternative minimum tax credits.

In assessing the realizability of deferred tax assets, management considers whether it is more

likely than not that some portion or all of the deferred tax assets will not be realized. The ultimate

realization of deferred tax assets is dependent upon the generation of future taxable income during

the periods in which those temporary differences become deductible. Management considers the

scheduled reversal of deferred tax liabilities, projected future taxable income, and tax planning

strategies in making the assessment of whether it is more likely than not that some portion or all of

the deferred tax assets will not be realized. Management believes it is more likely than not that the

Company will realize the benefits of these deductible differences, except for certain state net

operating losses and other credit carryforwards as noted below. The amount of the deferred tax

assets considered realizable, however, could be reduced if estimates of future taxable income

during the carryforward period are reduced.

The Company has a deferred tax asset related to net operating loss carryforwards for Federal

income tax purposes of $78 million which expire in 2020, and alternative minimum tax credit

carryforwards of approximately $207 million, which are available to reduce future regular Federal

income taxes, if any, over an indefinite period. The Company also has deferred tax assets related to

various state net operating losses of $33 million, net of the valuation allowance, that expire between

2010 and 2029.

The Company has established a valuation allowance related to net operating loss carryforwards

and other credit carryforwards in jurisdictions where the Company has substantially reduced

operations because management believes it is more likely than not that these items will expire

before the Company is able to realize their benefits. The valuation allowance was $16.1 million and

$13.6 million at December 26, 2009 and December 27, 2008, respectively. Annually, the valuation

allowance is reviewed and adjusted based on management’s assessments of realizable deferred tax

assets.

67