OfficeMax 2009 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2009 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.These items are described in more detail in this Management’s Discussion and Analysis.

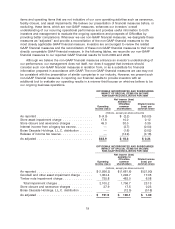

At the end of the 2009 fiscal year, we had $486.6 million in cash and cash equivalents and

$513.0 million in available (unused) borrowing capacity under our revolving credit facilities. The

combination of cash and cash equivalents and available borrowing capacity yields approximately

$1 billion of overall liquidity. The Company has strengthened its balance sheet, cash position and

liquidity greatly during 2009. At year-end, we had outstanding recourse debt of $297.1 million (both

current and long-term) and non-recourse obligations of $1,470.0 million related to the timber

securitization notes. There is no recourse against OfficeMax on the securitized timber notes payable

as recourse is limited to proceeds from the applicable pledged installment notes receivable and

underlying guarantees. There were no borrowings on our revolving credit facilities in 2009.

The funded status of our pension plans also improved in 2009. Our pension obligations

exceeded the assets held in trust to fund them by $210.2 million at year-end 2009, a decrease of

$224.8 million compared to the $435.0 million under funding that existed at year-end 2008. This

reduction was due to strong returns on plan investments in the year coupled with our voluntary

excess contribution of 8.3 million shares of OfficeMax common stock to the plans in the fourth

quarter of 2009.

For the full year 2009, we generated $358.9 million of cash from operations reflecting our focus

on cash generation. Working capital improved $219.0 million as a result of significant management

oversight, which yielded reduced days outstanding for accounts receivable and a decrease in

inventory per location along with an improved accounts payable leverage ratio. We also collected

$71.0 million of tax refunds, net of payments, and borrowed $45.7 million on accumulated earnings

held in company-owned life insurance policies. In addition, we received $41.1 million from

investment activities, including $25.1 million from a prior tax escrow settlement and $15.0 million in

additional company-owned life insurance withdrawals.

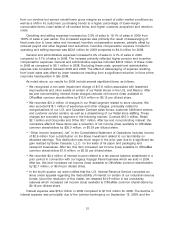

Outlook

Given the continued weak economic environment, we are cautious in our expectations for

2010. We expect that U.S. unemployment trends will continue to unfavorably impact us in the

near-term, with improvement occurring in the later part of the year. We anticipate that for the full

year 2010, total sales, including the impact of foreign currency translation, and adjusted operating

income margin will be slightly higher than they were in 2009. We expect positive cash flow from

operations, although lower than 2009, due to a larger-than-expected incentive compensation payout

during the first quarter and higher working capital needs due to the increased sales. We also

believe that our liquidity position will remain strong and our need to access our revolving line of

credit will be limited to seasonal periods.

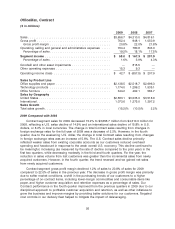

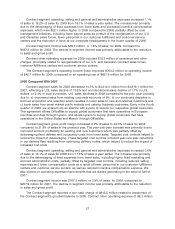

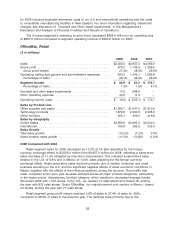

2009 Compared with 2008

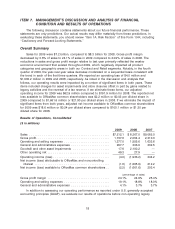

Sales for 2009 decreased 12.8% to $7,212.1 million from $8,267.0 million for 2008. The

year-over-year sales decreases occurred in both our Contract and Retail segments and resulted

primarily from the weaker economic environment that existed throughout all of 2009. The change in

sales resulting from changes in foreign exchange rates for the full year of 2009 was a decrease of

1.7%. However, in the fourth quarter, due to the weakening U.S. dollar, the change in total sales

resulting from changes in foreign exchange rates was an increase of 2.8%.

Gross profit margin decreased by 0.8% of sales to 24.1% of sales in 2009 compared to 24.9%

of sales in 2008. The gross profit margins declined in both our Contract and Retail segments. The

Retail segment experienced strong cost support from our vendors and reduced inventory shrinkage,

the benefits of which were entirely offset by deleveraging of fixed occupancy costs and a mix shift

to less profitable technology products. The Contract segment also experienced strong cost support

20