NetSpend 2013 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2013 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

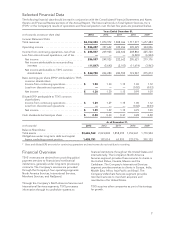

Selected Financial Data

The following financial data should be read in conjunction with the Consolidated Financial Statements and Notes

thereto and Financial Review sections of the Annual Report. The historical trends in Total System Services, Inc.’s

(TSYS’ or the Company’s) results of operations and financial position over the last five years are presented below.

Years Ended December 31,

(in thousands, except per share data) 2013 2012 2011 2010 2009

Income Statement Data:

Total revenues ............................... $2,132,353 1,870,972 1,808,966 1,717,577 1,677,483

Operating income ............................ $ 386,247 357,652 322,456 309,429 344,026

Income from continuing operations, net of tax .... $ 256,597 249,923 222,662 208,866 225,720

Loss from discontinued operations, net of tax ..... —— — (3,245) (6,544)

Net income ............................... 256,597 249,923 222,662 205,621 219,176

Net income attributable to noncontrolling

interests ................................ (11,847) (5,643) (2,103) (11,674) (3,963)

Net income attributable to TSYS common

shareholders ............................. $ 244,750 244,280 220,559 193,947 215,213

Basic earnings per share (EPS)* attributable to TSYS

common shareholders:

Income from continuing operations ............ $ 1.30 1.30 1.15 1.00 1.12

Loss from discontinued operations ............ —— — (0.02) (0.03)

Net income ............................... $ 1.30 1.30 1.15 0.99 1.09

Diluted EPS* attributable to TSYS common

shareholders:

Income from continuing operations ............ $ 1.29 1.29 1.15 1.00 1.12

Loss from discontinued operations ............ —— — (0.02) (0.03)

Net income ............................... $ 1.29 1.29 1.15 0.99 1.09

Cash dividends declared per share .............. $ 0.40 0.40 0.31 0.28 0.28

As of December 31,

(in thousands) 2013 2012 2011 2010 2009

Balance Sheet Data:

Total assets ............................... $3,686,568 2,023,838 1,858,392 1,952,261 1,710,954

Obligations under long-term debt and capital

leases, excluding current portion ............ 1,435,751 192,014 63,593 225,276 205,123

* Basic and diluted EPS amounts for continuing operations and net income do not total due to rounding.

Financial Overview

TSYS’ revenues are derived from providing global

payment services to financial and nonfinancial

institutions, generally under long-term processing

contracts. The Company’s services are provided

through the Company’s four operating segments:

North America Services, International Services,

Merchant Services, and NetSpend.

Through the Company’s North America Services and

International Services segments, TSYS processes

information through its cardholder systems to

financial institutions throughout the United States and

internationally. The Company’s North America

Services segment provides these services to clients in

the United States, Canada, Mexico and the

Caribbean. The Company’s International Services

segment provides services to clients in Europe, India,

Middle East, Africa, Asia Pacific and Brazil. The

Company’s Merchant Services segment provides

merchant services to merchant acquirers and

merchants in the United States.

TSYS acquires other companies as part of its strategy

for growth.

7