NetSpend 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

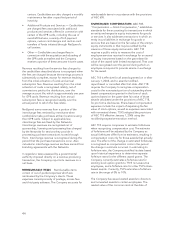

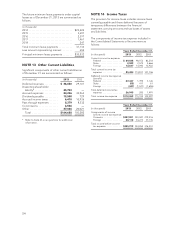

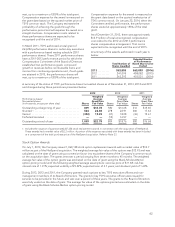

The future minimum lease payments under capital

leases as of December 31, 2013 are summarized as

follows:

(in thousands)

2014 ................................ $23,424

2015 ................................ 3,607

2016 ................................ 2,397

2017 ................................ 1,461

2018 ................................ 247

Total minimum lease payments .......... 31,136

Less amount representing interest ....... 604

Principal minimum lease payments ....... $30,532

NOTE 13 Other Current Liabilities

Significant components of other current liabilities as

of December 31 are summarized as follows:

(in thousands) 2013 2012

Deferred revenues .......... $ 36,850 29,101

Dissenting shareholder

liability* ................. 25,723 —

Accrued expenses .......... 24,236 30,963

Dividends payable .......... 19,508 729

Accrued income taxes ....... 6,410 10,936

Pass through expenses ...... 8,379 8,532

Commissions .............. 6,546 —

Other ..................... 37,036 20,021

Total ................... $164,688 100,282

* Refer to Note 23 on acquisitions for additional

information.

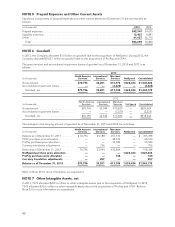

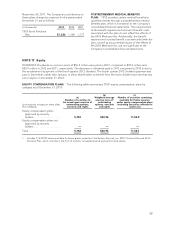

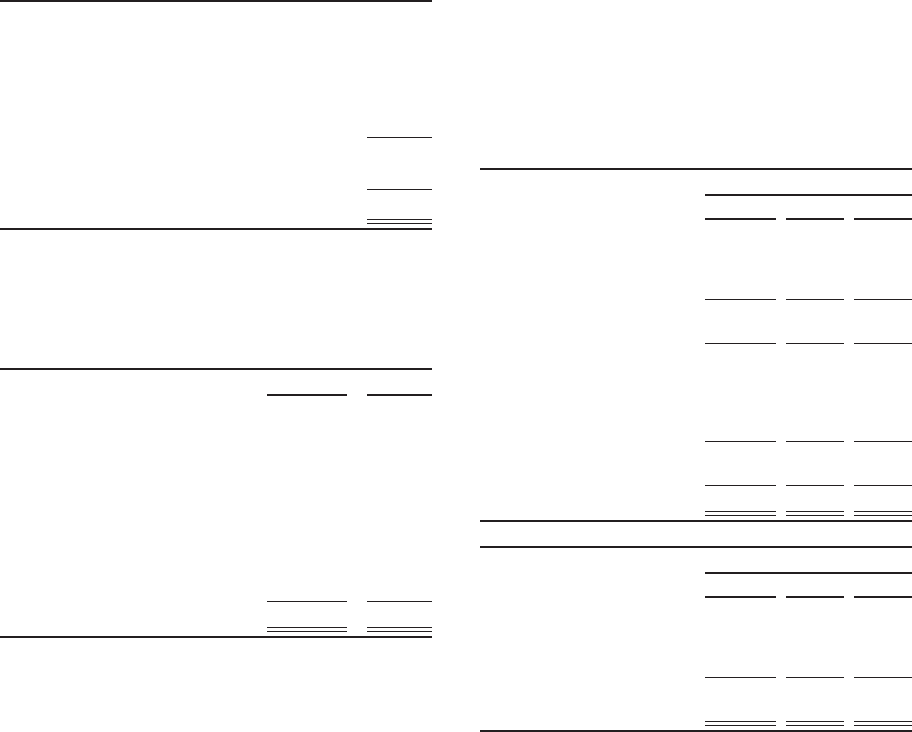

NOTE 14 Income Taxes

The provision for income taxes includes income taxes

currently payable and those deferred because of

temporary differences between the financial

statement carrying amounts and tax bases of assets

and liabilities.

The components of income tax expense included in

the Consolidated Statements of Income were as

follows:

Years Ended December 31,

(in thousands) 2013 2012 2011

Current income tax expense:

Federal ................. $ 69,838 98,153 83,518

State ................... 2,949 2,572 4,666

Foreign ................. 12,637 14,092 12,922

Total current income tax

expense ................ 85,424 114,817 101,106

Deferred income tax expense

(benefit): ................

Federal ................. 27,447 1,395 3,126

State ................... (55) 411 61

Foreign ................. (447) (1,521) (1,696)

Total deferred income tax

expense ................ 26,945 285 1,491

Total income tax expense . . . $112,369 115,102 102,597

Years Ended December 31,

(in thousands) 2013 2012 2011

Components of income

before income tax expense:

Domestic ............... $327,801 320,581 279,416

Foreign ................. 28,118 34,273 37,135

Total income before income

tax expense ............. $355,919 354,854 316,551

54