NetSpend 2013 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2013 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

On January 28, 2014, TSYS announced that its Board

had approved an increase in the number of shares

that may be repurchased under its current share

repurchase plan from up to 20 million shares to up to

28 million shares of TSYS stock. With the increase,

TSYS has 12.0 million shares available to be

repurchased. In addition, the expiration date of the

plan was extended to April 30, 2015.

Dividends

Dividends on common stock of $56.5 million were

paid in 2013, compared to $94.0 million and

$53.9 million in 2012 and 2011, respectively. The

Company paid dividends of $0.30 per share in 2013,

$0.50 per share in 2012 and $0.28 per share in 2011.

The decrease in dividends paid in 2013 compared to

2012 is due to the acceleration of payment of the

fourth quarter 2012 dividend. The fourth quarter

2012 dividend payment was paid in December,

rather than January, to allow shareholders to benefit

from the lower dividend tax rate that was set to

expire on December 31, 2012. In October 2011,

TSYS announced that its Board of Directors approved

a 42.9% increase in the regular quarterly dividend

payable on the Company’s common stock from

$0.07 per share to $0.10 per share.

Significant Noncash Transactions

During 2013, 2012 and 2011, the Company issued

1.7 million, 311,000, and 206,000 shares of common

stock, respectively, to certain key employees and

non-management members of its Board of Directors.

The grants to certain key employees were issued in

the form of nonvested stock bonus awards for

services to be provided in the future by such officers

and employees. The grants to the Board of Directors

were fully vested on the date of grant. The market

value of the common stock at the date of issuance is

amortized as compensation expense over the vesting

period of the awards.

The Company acquired computer equipment and

software under capital lease in the amount of

$14.8 million, $5.3 million and $8.1 million in 2013,

2012 and 2011, respectively.

Refer to Notes 18 and 22 in the consolidated financial

statements for more information on share-based

compensation and significant noncash transactions.

Additional Cash Flow Information

Off-Balance Sheet Financing

TSYS uses various operating leases in its normal

course of business. These “off-balance sheet”

arrangements obligate TSYS to make payments for

computer equipment, software and facilities. These

computer and software lease commitments may be

replaced with new lease commitments due to new

technology. Management expects that, as these

leases expire, they will be evaluated and renewed or

replaced by similar leases based on need.

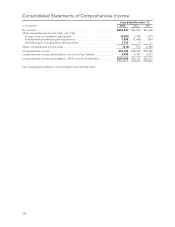

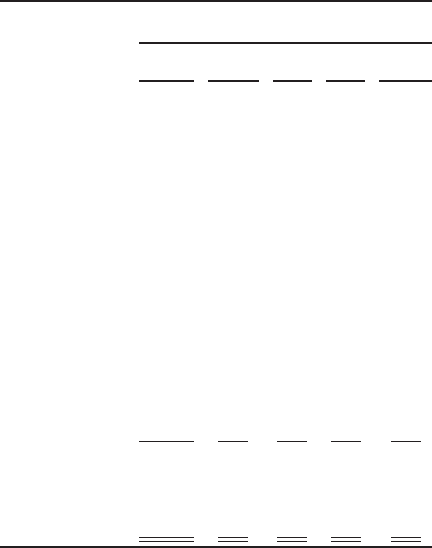

The following table summarizes future contractual

cash obligations, including lease payments and

software arrangements, as of December 31, 2013, for

the next five years and thereafter:

Contractual Cash Obligations

Payments Due By Period

(in millions) Total 1 Year

or Less 2-3

Years 3-5

Years After

5 Years

Debt

obligations

(principal) . . . $1,466 34 67 815 550

Debt

obligations

(interest) . . . 270 38 75 64 93

Operating

leases ...... 466 124 233 67 42

Redeemable

noncontrolling

interest .... 40 40 — — —

Capital lease

obligations . 31 23 6 2 —

Dissenting

shareholder

liability ..... 26 26 — — —

Total

contractual

cash

obligations . $2,299 285 381 948 685

Income Taxes

The total liability for uncertain tax positions under

ASC 740, “Income Taxes,” as of December 31, 2013

is $2.7 million. Refer to Note 14 in the consolidated

financial statements for more information on income

taxes. The Company is not able to reasonably

estimate the amount by which the liability will

increase or decrease over time; however, at this time,

the Company does not expect any significant

changes related to these obligations within the next

twelve months.

28