NetSpend 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

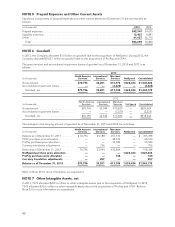

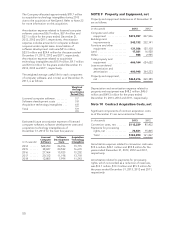

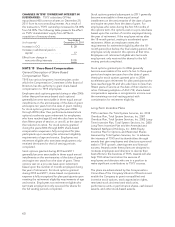

The weighted average useful life for each component

of contract acquisition costs, and in total, as of

December 31, 2013 is as follows:

Weighted

Average

Amortization

Period (Yrs)

Payments for processing rights ....... 12.8

Conversion costs .................. 8.3

Total ............................ 11.4

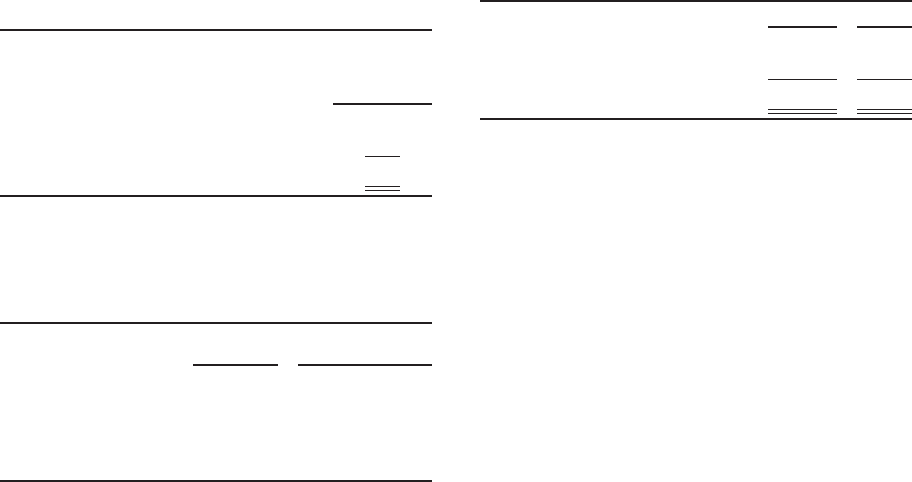

Estimated future amortization expense of conversion

costs and payments for processing rights as of

December 31, 2013 for the next five years is:

(in thousands) Conversion

Costs Payments for

Processing Rights

2014 ............. $20,537 13,925

2015 ............. 28,201 13,358

2016 ............. 26,036 10,969

2017 ............. 20,678 8,917

2018 ............. 18,705 7,952

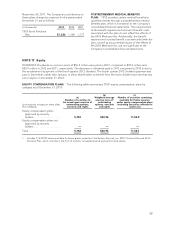

NOTE 11 Equity Investments

The Company has an equity investment in TSYS de

México and records its 49% ownership using the

equity method of accounting. The operation prints

statements and provides card-issuing support

services to the equity investment clients and others.

The Company has an equity investment in CUP Data

and records its 44.56% ownership using the equity

method of accounting. CUP Data is sanctioned by the

People’s Bank of China, China’s central bank, and has

become one of the world’s largest and fastest-

growing payments networks. CUP Data currently

provides transaction processing, disaster recovery

and other services for banks and bankcard issuers in

China.

TSYS’ equity investments are recorded initially at cost

and subsequently adjusted for equity in earnings,

cash contributions and distributions, and foreign

currency translation adjustments. TSYS believes the

carrying value approximates the underlying assets of

the equity investments.

TSYS’ equity in income of equity investments (net of

tax) for the years ended December 31, 2013, 2012

and 2011 was $13.0 million, $10.2 million and $8.7

million, respectively.

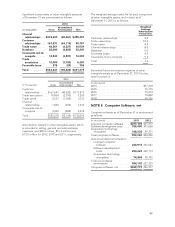

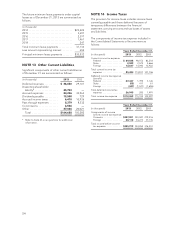

A summary of TSYS’ equity investments as of

December 31 is as follows:

(in thousands) 2013 2012

CUP Data ................... $86,549 79,859

TSYS de México .............. 7,584 7,905

Total ....................... $94,133 87,764

NOTE 12 Long-term Debt and Capital

Lease Obligations

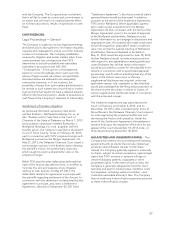

On February 19, 2013, the Company and its wholly-

owned merger subsidiary entered into an Agreement

and Plan of Merger (as amended on May 29, 2013,

the “Merger Agreement”) with NetSpend, pursuant

to which, upon the terms and subject to the

conditions set forth in the Merger Agreement, the

merger subsidiary merged with and into NetSpend

on July 1, 2013, with NetSpend continuing as the

surviving corporation and as a wholly-owned

subsidiary of TSYS (the “Merger”). Refer to Note 23

for more information about the acquisition.

On April 8, 2013, the Company entered into a Credit

Agreement (the “Credit Agreement”) with JPMorgan

Chase Bank, N.A., as Administrative Agent, The Bank

of Tokyo-Mitsubishi UFJ, Ltd., as Syndication Agent,

Regions Bank and U.S. Bank National Association, as

Documentation Agents, and other lenders party

thereto, with J.P. Morgan Securities LLC, The Bank of

Tokyo Mitsubishi UFJ, Ltd., Regions Capital Markets,

and U.S. Bank National Association as joint lead

arrangers and joint bookrunners. The Credit

Agreement provides for a five-year term loan to the

Company in the amount of $200.0 million (the “Term

Loan”) and bears interest at LIBOR plus 1.125%,

which are subject to adjustment based on changes in

the Company’s credit ratings, with margins ranging

from 1.00 to 1.75%. As of December 31, 2013, the

outstanding balance on the Credit Agreement was

$195.0 million.

Concurrently with entering into the Merger

Agreement, TSYS obtained commitments for a

$1.2 billion 364-day bridge term loan facility from

JPMorgan Chase Bank, N.A., J.P. Morgan Securities

LLC and The Bank of Tokyo-Mitsubishi UFJ, Ltd.

Thereafter, JPMorgan Chase Bank, N.A. and The

Bank of Tokyo-Mitsubishi UFJ, Ltd. assigned portions

of their commitments to other bridge facility lenders.

The Company paid fees associated with the bridge

term loan of approximately $5.9 million. The total

commitments under the bridge term loan facility

were eliminated in May 2013 after the issuance of the

Notes described below.

51