NetSpend 2013 Annual Report Download - page 41

Download and view the complete annual report

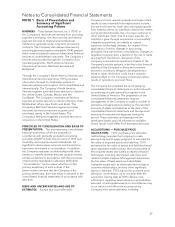

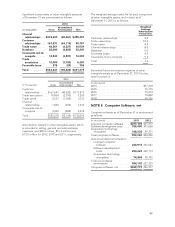

Please find page 41 of the 2013 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.generally not to exceed ten years. At each balance

sheet date, the Company evaluates impairment

losses on long-lived assets used in operations in

accordance with ASC 360.

ACQUISITION TECHNOLOGY INTANGIBLES:

These identifiable intangible assets are software

technology assets resulting from acquisitions. These

assets are amortized using the straight-line method

over periods not exceeding their estimated useful

lives, which range from five to nine years. The

provisions of ASC 350, “Intangibles — Goodwill and

Other,” require that intangible assets with estimated

useful lives be amortized over their respective

estimated useful lives to their residual values, and

reviewed for impairment in accordance with ASC 360.

Acquisition technology intangibles’ net book values

are included in computer software, net in the

accompanying balance sheets. Amortization

expenses are charged to cost of services in the

Company’s Consolidated Statements of Income.

SOFTWARE DEVELOPMENT COSTS: In

accordance with the provisions of ASC 985,

“Software,” software development costs are

capitalized once technological feasibility of the

software product has been established. Costs

incurred prior to establishing technological feasibility

are expensed as incurred. Technological feasibility is

established when the Company has completed a

detailed program design and has determined that a

product can be produced to meet its design

specifications, including functions, features and

technical performance requirements. Capitalization of

costs ceases when the product is generally available

to clients. At each balance sheet date, the Company

evaluates the unamortized capitalized costs of

software development as compared to the net

realizable value of the software product which is

determined by future undiscounted net cash flows.

The amount by which the unamortized software

development costs exceed the net realizable value is

written off in the period that such determination is

made. Software development costs are amortized

using the greater of (1) the straight-line method over

its estimated useful life, which ranges from three to

ten years or (2) the ratio of current revenues to total

anticipated revenue over its useful life.

The Company also develops software that is used

internally. These software development costs are

capitalized based upon the provisions of ASC 350.

Internal-use software development costs are

capitalized once: (1) the preliminary project stage is

completed, (2) management authorizes and commits

to funding a computer software project, and (3) it is

probable that the project will be completed and the

software will be used to perform the function

intended. Costs incurred prior to meeting the

qualifications are expensed as incurred. Capitalization

of costs ceases when the project is substantially

complete and ready for its intended use. Internal-use

software development costs are amortized using the

straight-line method over its estimated useful life

which ranges from three to ten years. Software

development costs may become impaired in

situations where development efforts are abandoned

due to the viability of the planned project becoming

doubtful or due to technological obsolescence of the

planned software product.

CONTRACT ACQUISITION COSTS: The Company

capitalizes contract acquisition costs related to

signing or renewing long-term contracts. The

Company capitalizes internal conversion costs in

accordance with the provisions of Staff Accounting

Bulletin (SAB) No. 104, “Revenue Recognition” and

ASC 605, “Revenue Recognition.” The capitalization

of costs related to cash payments for rights to

provide processing services is capitalized in

accordance with the provisions of ASC 605. All costs

incurred prior to a signed agreement are expensed

as incurred.

Contract acquisition costs are amortized using the

straight-line method over the expected customer

relationship (contract term) beginning when the

client’s cardholder accounts are converted and

producing revenues. The amortization of contract

acquisition costs associated with cash payments for

client incentives is included as a reduction of

revenues in the Company’s Consolidated Statements

of Income. The amortization of contract acquisition

costs associated with conversion activity is recorded

as cost of services in the Company’s Consolidated

Statements of Income.

The Company evaluates the carrying value of contract

acquisition costs associated with each customer for

impairment on the basis of whether these costs are

fully recoverable from either contractual minimum

fees (contractual costs) or from expected

undiscounted net operating cash flows of the related

contract (cash incentives paid). The determination of

expected undiscounted net operating cash flows

requires management to make estimates. These costs

may become impaired with the loss of a contract, the

financial decline of a client, termination of conversion

efforts after a contract is signed, diminished

prospects for current clients or if the Company’s

actual results differ from its estimates of future cash

flows. The amount of the impairment is written off in

the period that such a determination is made.

39