NetSpend 2013 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2013 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

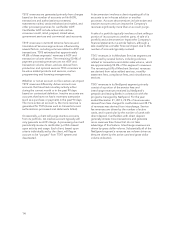

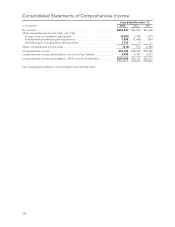

Revenues Before Reimbursable Items and

Operating Margin Excluding Reimbursable

Items

Years Ended December 31,

(in thousands except per

share data) 2013 2012 2011

Operating income (a) . . . $ 386,247 357,652 322,456

Total revenues (b) ...... $2,132,353 1,870,972 1,808,966

Less reimbursable

items ............... 240,598 252,481 268,268

Revenues before

reimbursable

items (c) ............ $1,891,755 1,618,491 1,540,698

Operating margin (as

reported) (a)/(b) ...... 18.11% 19.12% 17.83%

Operating margin

excluding

reimbursables (a)/(c) . . 20.42% 22.10% 20.93%

Projected Outlook for 2014

As compared to 2013, TSYS expects its 2014 total

revenues to increase by 17%-19%, its revenues

before reimbursable items to increase by 19%-21%,

its adjusted EBITDA to increase by 17%-20%, and its

adjusted cash EPS attributable to TSYS common

shareholders to increase by 11%-13%, based on the

following assumptions with respect to 2014: (1) there

will be no significant movements in the London

Interbank Offered Rate (LIBOR) and TSYS will not

make any significant draws on the remaining balance

of its revolving credit facility; (2) there will be no

significant movement in foreign currency exchange

rates related to TSYS’ business; (3) TSYS will not incur

significant expenses associated with the conversion

of new large clients other than included in the 2014

estimate, additional acquisitions, or any significant

impairment of goodwill or other intangibles; (4) there

will be no deconversions of large clients during the

year; (5) there will be minimal synergies from the

NetSpend acquisition for 2014; and (6) the economy

will not worsen.

Financial Position, Liquidity

and Capital Resources

The Consolidated Statements of Cash Flows detail

the Company’s cash flows from operating, investing

and financing activities. TSYS’ primary methods for

funding its operations and growth have been cash

generated from current operations, the use of leases

and the occasional use of borrowed funds to

supplement financing of capital expenditures.

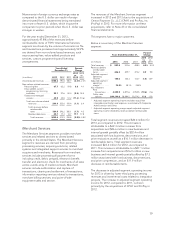

Cash Flows from Operating Activities

Years Ended December 31,

(in thousands) 2013 2012 2011

Net income ............ $256,597 249,923 222,662

Depreciation and

amortization ......... 205,351 170,610 169,165

Other noncash items and

charges, net ......... 76,744 20,593 25,811

Net change in current

and other assets and

current and other

liabilities ............ (86,294) 14,627 18,681

Net cash provided by

operating activities .... $452,398 455,753 436,319

TSYS’ main source of funds is derived from operating

activities, specifically net income. The decrease in

2013, as compared to 2012, in net cash provided by

operating activities was primarily the result of the net

change in current and other assets and current and

other liabilities. The increase in 2012, as compared to

2011, in net cash provided by operating activities was

primarily the result of increased earnings.

Net change in current and other assets and current

and other liabilities include accounts receivable,

prepaid expenses, other current assets and other

assets, accounts payable, accrued salaries and

employee benefits and other liabilities. The change in

accounts receivable between the years is the result of

timing of collections compared to billings. The

change in accounts payable and other liabilities

between years is the result of the timing of payments

and funding of performance-based incentives.

24