NetSpend 2013 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2013 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

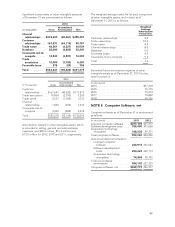

The Company allocated approximately $78.7 million

to acquisition technology intangibles during 2013

due to the acquisition of NetSpend. Refer to Note 23

for more information on this acquisition.

Amortization expense related to licensed computer

software costs was $36.9 million, $37.4 million and

$37.1 million for the years ended December 31,

2013, 2012 and 2011, respectively. Amortization

expense includes amounts for computer software

acquired under capital lease. Amortization of

software development costs was $21.6 million,

$23.3 million and $24.4 million for the years ended

December 31, 2013, 2012 and 2011, respectively.

Amortization expense related to acquisition

technology intangibles was $15.9 million, $9.7 million

and $10.3 million for the years ended December 31,

2013, 2012 and 2011, respectively.

The weighted average useful life for each component

of computer software, and in total, as of December 31,

2013, is as follows:

Weighted

Average

Amortization

Period (Yrs)

Licensed computer software ......... 5.7

Software development costs ........ 5.8

Acquisition technology intangibles . . . 6.8

Total ............................ 5.9

Estimated future amortization expense of licensed

computer software, software development costs and

acquisition technology intangibles as of

December 31, 2013 for the next five years is:

(in thousands)

Licensed

Computer

Software

Software

Development

Costs

Acquisition

Technology

Intangibles

2014 ...... $48,293 26,396 19,715

2015 ...... 38,847 20,532 16,670

2016 ...... 27,964 15,925 15,202

2017 ...... 20,312 11,198 13,718

2018 ...... 12,805 7,994 11,243

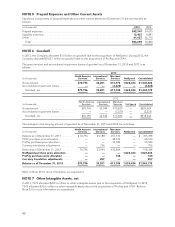

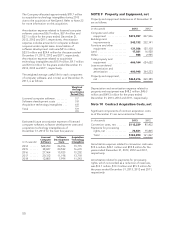

NOTE 9 Property and Equipment, net

Property and equipment balances as of December 31

are as follows:

(in thousands) 2013 2012

Computer and other

equipment .............. $274,987 247,506

Buildings and

improvements ........... 242,132 232,141

Furniture and other

equipment .............. 131,036 125,100

Land ..................... 17,021 16,920

Other ..................... 988 2,955

Total property and

equipment .............. 666,164 624,622

Less accumulated

depreciation and

amortization ............. 400,948 364,233

Property and equipment,

net ..................... $265,216 260,389

Depreciation and amortization expense related to

property and equipment was $48.2 million, $46.3

million and $49.3 million for the years ended

December 31, 2013, 2012 and 2011, respectively.

Note 10 Contract Acquisition Costs, net

Significant components of contract acquisition costs

as of December 31 are summarized as follows:

(in thousands) 2013 2012

Conversion costs, net ....... $112,239 85,402

Payments for processing

rights, net ............... 72,651 75,865

Total ................... $184,890 161,267

Amortization expense related to conversion costs was

$19.6 million, $24.1 million and $18.8 million for the

years ended December 31, 2013, 2012 and 2011,

respectively.

Amortization related to payments for processing

rights, which is recorded as a reduction of revenues,

was $13.1 million, $13.3 million and $15.9 million for

the years ended December 31, 2013, 2012 and 2011,

respectively.

50