NetSpend 2013 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2013 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The core services include housing an account on

TSYS’ system (AOF), authorizing transactions

(authorizations), accumulating monthly transactional

activity (transactions) and providing a monthly

statement (statement generation). From these core

services, TSYS’ clients also have the option to use

fraud and portfolio management services.

Collectively, these services are considered volume-

based revenues.

Non-volume related revenues include processing

fees which are not directly associated with AOF and

transactional activity, such as value added products

and services, custom programming and certain other

services, which are only offered to TSYS’ processing

clients.

Value added products and services, which includes

services such as data analytics and application

processing, are primarily non-volume related, are only

offered to TSYS’ processing clients (i.e., indirectly

derived from accounts on file). These ancillary

products and services, along with offerings such as

card production, statement production, managed

services, customized reporting and custom

programming provided to clients at an hourly rate, are

considered non-volume based products and services.

Additionally, certain clients license the Company’s

processing systems and process in-house. Since the

accounts are processed outside of TSYS for licensing

arrangements, the AOF and other volumes are not

available to TSYS. Thus, volumes reported by TSYS

do not include volumes associated with licensing.

A summary of each segment’s results follows:

North America Services

The North America Services segment provides issuer

account solutions for financial institutions and other

organizations primarily based in North America.

Growth in revenues and operating profit in this

segment is derived from retaining and growing the

core business and improving the overall cost

structure. Growing the core business comes primarily

from an increase in account usage, growth from

existing clients (also referred to as organic growth)

and sales to new clients and the related account

conversions.

This segment has one major customer. Below is a

summary of the North America Services segment:

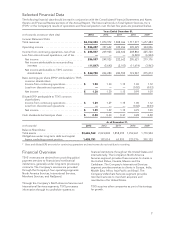

Years Ended

December 31, Percent

Change

(in millions) 2013 2012 2011

2013

vs.

2012

2012

vs.

2011

Total revenues ........ $1,000.1 965.4 954.6 3.6% 1.1%

Revenues before

reimbursable items . . . 860.6 826.8 809.1 4.1 2.2

Adjusted segment

operating income1... 314.6 289.5 254.6 8.7 13.7

Adjusted segment

operating margin2... 36.6% 35.0% 31.5%

Key indicators:

AOF ............... 481.9 424.8 351.4 13.4 20.9

Transactions ........ 9,132.8 8,102.3 7,218.4 12.7 12.2

1 Adjusted segment operating income excludes acquisition

intangible amortization and expenses associated with Corporate

Administration and Other.

2 Adjusted segment operating margin equals adjusted segment

operating income divided by revenues before reimbursable

items.

Total segment revenues increased $34.7 million for

2013, as compared to 2012. The increase is

attributable to an $80.0 million increase in new

business, internal growth and reimbursable items,

partially offset by $45.3 million decrease related to

client deconversion, price reductions and other

adjustments. Total segment revenues increased

$10.8 million for 2012, as compared to 2011. The

increase is attributable to $67.3 million increase in

new business and internal growth partially offset by

$49.7 million decrease related to client

deconversions, price reductions and termination fees

and a $6.9 million decrease in reimbursable items

due to lost business. The decreases in 2013 and 2012

caused by price reductions are related to a tiered-

pricing arrangement signed in the third quarter of

2012.

The increase in adjusted segment operating income

for 2013, as compared to 2012, is driven by an

increase in revenues while total operating expenses

decreased. The increase in adjusted segment

operating income for 2012, as compared to 2011, is

driven by an increase in revenues while expenses

remained flat.

17