NetSpend 2013 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2013 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

A portion of the Company’s business is conducted

through distributors that provide load and reload

services to cardholders at their locations. Members of

the Company’s distribution and reload network

collect cardholder funds and remit them by electronic

transfer to the Issuing Banks for deposit in the

cardholder accounts. The Company’s Issuing Banks

typically receive cardholders’ funds no earlier than

three business days after they are collected by the

distributor. If any distributor fails to remit

cardholders’ funds to the Company’s Issuing Banks,

the Company typically reimburses the Issuing Banks

for the shortfall created thereby. The Company

manages the risk associated with this process through

a formalized set of credit standards, volume limits

and deposit requirements for certain distributors and

by typically maintaining the right to offset any

settlement shortfall against the commissions payable

to the relevant distributor. To date, the Company has

not experienced any significant losses associated with

settlement failures and the Company had not

recorded a settlement guarantee liability as of

December 31, 2013. As of December 31, 2013, the

Company’s estimated gross settlement exposure was

$8.8 million.

GPR cardholders can incur charges in excess of the

funds available in their accounts and are liable for the

resulting overdrawn account balance. Although the

Company generally declines authorization attempts

for amounts that exceed the available balance in a

cardholder’s account, the application of the

Networks’ rules and regulations, the timing of the

settlement of transactions and the assessment of

subscription, maintenance or other fees can, among

other things, result in overdrawn card accounts. The

Company also provides, as a courtesy and in its

discretion, certain cardholders with a “cushion” that

allows them to overdraw their card accounts by up to

$10. In addition, eligible cardholders may enroll in

the Issuing Banks’ overdraft protection programs and

fund transactions that exceed the available balance in

their accounts. The Company generally provides the

funds used as part of these overdraft programs

(MetaBank will advance the first $1.0 million on

behalf of its cardholders) and is responsible to the

Issuing Banks for any losses associated with any

overdrawn account balances. As of December 31,

2013, cardholders’ overdrawn account balances

totaled $13.8 million. As of December 31, 2013, the

Company’s reserves for the losses it estimates will

arise from processing customer transactions, debit

card overdrafts, chargebacks for unauthorized card

use and merchant-related chargebacks due to non-

delivery of goods or services was $5.8 million.

The Company has not recorded a liability for

guarantees or indemnities in the accompanying

consolidated balance sheet since the maximum

amount of potential future payments under such

guarantees and indemnities is not determinable.

PRIVATE EQUITY INVESTMENTS: On May 31,

2011, the Company entered into a limited

partnership agreement in connection with its

agreement to invest in an Atlanta, Georgia-based

venture capital fund focused exclusively on investing

in technology-enabled financial services companies.

Pursuant to the limited partnership agreement, the

Company has committed to invest up to $20 million

in the fund so long as its ownership interest in the

fund does not exceed 50%. As of December 31,

2013, the Company had made investments in the

fund of $6.0 million and recognized a cumulative gain

of $1.8 million due to an increase in fair value.

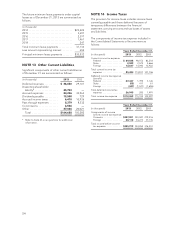

NOTE 16 Employee Benefit Plans

The Company provides benefits to its employees by

offering employees participation in certain defined

contribution plans. The employee benefit plans

through which TSYS provided benefits to its

employees during 2013 are described as follows:

TSYS RETIREMENT SAVINGS PLAN: TSYS

maintains a single plan, the Retirement Savings Plan,

which is designed to reward all team members of

TSYS U.S.-based companies with a uniform employer

contribution. The terms of the plan provide for the

Company to match 100% of the employee

contribution up to 4% of eligible compensation. The

Company can make discretionary contributions up to

another 4% based upon business conditions. The

Company’s contributions to the plan charged to

expense for the years ended December 31 are as

follows:

(in thousands) 2013 2012 2011

TSYS Retirement

Savings Plan ....... $14,506 13,421 15,951

STOCK PURCHASE PLAN: The Company

maintains a stock purchase plan for employees and

previously maintained a stock purchase plan for

directors. The Company contributes 15% of

employee contributions and contributed 15% of

director voluntary contributions. The funds are used

to purchase presently issued and outstanding shares

of TSYS common stock on the open market at fair

market value for the benefit of participants. The

Director Stock Purchase Plan was terminated on

58