NetSpend 2013 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2013 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

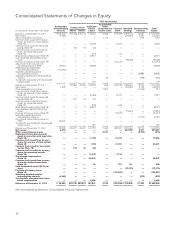

Consolidated Statements of Changes in Equity

TSYS Shareholders

Redeemable

Noncontrolling

Interests

Common Stock Additional

Paid-In

Capital

Accumulated

Other

Comprehensive

Income (Loss) Treasury

Stock Retained

Earnings Noncontrolling

Interests Total

Equity(in thousands, except per share data) Shares Dollars

Balance as of December 31, 2010 ...... $146,000 201,326 $ 20,133 119,722 (2,585) (115,449) 1,219,303 16,681 $ 1,257,805

Net income ......................... (1,364) — — — — — 220,559 3,467 224,026

Other comprehensive income .......... — — — — 2,112 — — 618 2,730

Common stock issued from treasury

shares for exercise of stock options

(Note 18) ......................... — — — (3,450) — 11,515 — — 8,065

Common stock issued for nonvested

awards (Note 18) .................. — 534 53 (53) — — — — —

Common stock issued from treasury

shares for nonvested awards

(Note 18) ......................... — — — (172) — 172 — — —

Share-based compensation (Note 18) . . . — — — 16,513 — — — — 16,513

Cash dividends declared ($0.31 per

share) ............................ — — — — — — (59,228) — (59,228)

Purchase of treasury shares (Note 19) . . . — — — — — (121,272) — — (121,272)

Adjustment to fair value of non-

controlling interest in TMS ........... 29,414 — — (6,828) — — — — (6,828)

Redemption of redeemable

noncontrolling interests ............. (174,050) — — — — — — — —

Subsidiary dividends paid to

noncontrolling interests ............. — — — — — — — (448) (448)

Subsidiary repurchase of noncontrolling

interests .......................... — — — 77 28 — — (598) (493)

Tax benefits associated with share-based

compensation ..................... — — — 139 — — — — 139

Balance as of December 31, 2011 ...... — 201,860 20,186 125,948 (445) (225,034) 1,380,634 19,720 1,321,009

Net income ......................... 1,505 — — — — — 244,280 4,138 248,418

Other comprehensive income .......... 1,853 (1,336) 517

Common stock issued from treasury

shares for exercise of stock options

(Note 18) ......................... — — — (2,386) — 12,377 — — 9,991

Common stock issued for nonvested

awards (Note 18) .................. — 611 61 (61) — — — — —

Common stock issued from treasury

shares for nonvested awards

(Note 18) ......................... — — — (628) — 628 — — —

Share-based compensation (Note 18) . . . — — — 18,623 — — — — 18,623

Cash dividends declared ($0.40 per

share) ............................ — — — — — — (75,851) — (75,851)

Purchase of treasury shares (Note 19) . . . — — — — — (75,272) — — (75,272)

Subsidiary dividends paid to

noncontrolling interests ............. — — — — — — — (2,797) (2,797)

Fair value of noncontrolling interest in

CPAY ............................ 38,000 — — — — — — — —

Tax benefits associated with share-based

compensation ..................... — — — 297 — — — — 297

Balance as of December 31, 2012 ...... 39,505 202,471 20,247 141,793 1,408 (287,301) 1,549,063 19,725 1,444,935

Net income ........................ 6,515 — — — — — 244,750 5,331 250,081

Other comprehensive income ......... — — — — 2,341 — — (2,754) (413)

Replacement share-based awards

issued in connection with acquisition

(Note 18) ........................ — — — (1,167) — 16,723 — — 15,556

Common stock issued from treasury

shares for exercise of stock options

(Note 18) ........................ — — — (700) — 41,391 — — 40,691

Common stock issued for nonvested

awards (Note 18) ................. — 319 32 (32) — — — — —

Common stock issued from treasury

shares for nonvested awards

(Note 18) ........................ — — — (5,747) — 5,747 — — —

Share-based compensation

(Note 18) ........................ — — — 28,972 — — — — 28,972

Common stock issued from treasury

shares for dividend equivalents

(Note 18) ........................ — — — 36 — 301 161 — 498

Cash dividends declared ($0.40 per

share) ........................... — — — — — — (75,770) — (75,770)

Purchase of treasury shares

(Note 19) ........................ — — — — — (103,857) — — (103,857)

Subsidiary dividends paid to

noncontrolling interests ............ (6,368) — — — — — — (953) (953)

Tax shortfalls associated with share-

based compensation .............. — — — 2,686 — — — — 2,686

Balance as of December 31, 2013 ..... $ 39,652 202,790 $20,279 165,841 3,749 (326,996) 1,718,204 21,349 $1,602,426

See accompanying Notes to Consolidated Financial Statements

36