NetSpend 2013 Annual Report Download - page 42

Download and view the complete annual report

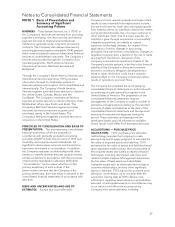

Please find page 42 of the 2013 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.EQUITY INVESTMENTS: TSYS’ 49% investment in

Total System Services de México, S.A. de C.V. (TSYS

de México), an electronic payment processing

support operation located in Toluca, Mexico, is

accounted for using the equity method of

accounting, as is TSYS’ 44.56% investment in China

UnionPay Data Co., Ltd. (CUP Data) headquartered in

Shanghai, China. TSYS’ equity investments are

recorded initially at cost and subsequently adjusted

for equity in earnings, cash contributions and

distributions, and foreign currency translation

adjustments.

GOODWILL: Goodwill results from the excess of

cost over the fair value of net assets of businesses

acquired.

Goodwill and intangible assets with indefinite useful

lives are tested for impairment at least annually in

accordance with the provisions of ASC 350. ASC 350

also requires that intangible assets with estimable

useful lives be amortized over their respective

estimated useful lives to their estimated residual

values.

The portion of the difference between the cost of an

investment and the amount of underlying equity in

net assets of an equity method investee that is

recognized as goodwill in accordance with the

provisions of ASC 323, “Investments — Equity

Method and Joint Ventures,” shall not be amortized.

However, equity method goodwill shall not be

reviewed for impairment in accordance with ASC 350,

but instead should continue to be reviewed for

impairment in accordance with paragraph 19(h) of

ASC 323. Equity method goodwill, which is not

reported as goodwill in the Company’s Consolidated

Balance Sheet, but is reported as a component of the

equity investment, was $52.7 million as of

December 31, 2013.

OTHER INTANGIBLE ASSETS: Identifiable

intangible assets relate primarily to customer

relationships, databases, channel relationships,

covenants-not-to-compete, trade names and trade

associations resulting from acquisitions. These

identifiable intangible assets are amortized using the

straight-line method over periods not exceeding the

estimated useful lives, which range from three to ten

years. ASC 350 requires that intangible assets with

estimable useful lives be amortized over their

respective estimated useful lives to their estimated

residual values, and reviewed for impairment in

accordance with ASC 360. Amortization expenses are

charged to selling, general and administrative

expenses in the Company’s Consolidated Statements

of Income.

FAIR VALUES OF FINANCIAL

INSTRUMENTS: The Company uses financial

instruments in the normal course of its business. The

carrying values of cash equivalents, accounts

receivable, accounts payable, accrued salaries and

employee benefits, and other current liabilities

approximate their fair value due to the short-term

maturities of these assets and liabilities. The fair value

of the Company’s long-term debt and obligations

under capital leases is not significantly different from

its carrying value.

Investments in equity investments are accounted for

using the equity method of accounting and pertain to

privately held companies for which fair value is not

readily available. The Company believes the fair

values of its investments in equity investments

exceed their respective carrying values.

IMPAIRMENT OF LONG-LIVED ASSETS: In

accordance with ASC 360, the Company reviews

long-lived assets, such as property and equipment

and intangibles subject to amortization, including

contract acquisition costs and certain computer

software, for impairment whenever events or changes

in circumstances indicate that the carrying amount of

an asset may not be recoverable. Recoverability of

assets to be held and used is measured by a

comparison of the carrying amount of an asset to

estimated undiscounted future cash flows expected

to be generated by the asset. If upon a triggering

event the Company determines that the carrying

amount of an asset exceeds its estimated

undiscounted future cash flows, an impairment

charge is recognized by the amount by which the

carrying amount of the asset exceeds the fair value of

the asset. Assets to be disposed of would be

separately presented in the balance sheet and

reported at the lower of the carrying amount or fair

value less costs to sell, and would no longer be

depreciated. The assets and liabilities of a disposed

group classified as held for sale would be presented

separately in the appropriate asset and liability

sections of the balance sheet.

TRANSACTION PROCESSING PROVISIONS: The

Company has recorded an accrual for contract

contingencies (performance penalties) and

processing errors. A significant number of the

Company’s contracts with large clients contain

service level agreements which can result in TSYS

incurring performance penalties if contractually

required service levels are not met. When providing

for these accruals, the Company takes into

consideration such factors as the prior history of

performance penalties and processing errors

40