NetSpend 2013 Annual Report Download - page 45

Download and view the complete annual report

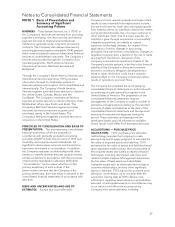

Please find page 45 of the 2013 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.inability to reliably verify relevant standalone

competitor prices. When there is insufficient evidence

of VSOE and TPE, the Company has made its best

estimate of the standalone selling price (ESP) of that

service for purposes of allocating revenue to each

unit of accounting. When determining ESP, TSYS uses

limited standalone sales data that do not meet the

Company’s criteria to establish VSOE, management

pricing strategies, residual selling price data when

VSOE exists for a group of elements, and margin

objectives. Consideration is also given to

geographies in which the services are sold or

delivered, customer classifications, and market

conditions including competitor pricing strategies

and benchmarking studies. Revenue is recognized

when the revenue recognition criteria for each unit of

accounting have been met.

As business and service offerings change in the

future, the determination of the number of

deliverables in an arrangement and related units of

accounting and the future pricing practices may result

in changes in the estimates of VSOE and ESP, which

may change the ratio of fees allocated to each

service or unit of accounting in a given customer

arrangement. There were no material changes or

impact to revenue in revenue recognition in the year

ended December 31, 2013 due to any changes in the

determination of the number of deliverables in an

arrangement, units of accounting, or estimates of

VSOE or ESP.

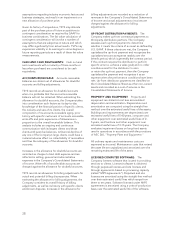

In many situations, the Company enters into

arrangements with customers to provide conversion

or implementation services in addition to processing

services where the conversion or implementation

services do not have standalone value. In these

situations, the deliverables do not meet the criteria of

ASC 605-25 for separation and the deliverables are

combined as a single unit of accounting for revenue

recognition. For these arrangements, conversion or

implementation services that do not have standalone

value, are recognized over the expected customer

relationship (contract term) contract term as the

related processing services are performed.

The Company’s other services generally have

standalone value and constitute separate units of

accounting for revenue recognition purposes.

However, customer arrangements entered into prior

to January 1, 2011 often included services for which

sufficient objective and reliable evidence of fair value

did not exist. In certain situations, sufficient objective

and reliable evidence of fair value did not exist for

multiple undelivered services, and the deliverables

were combined and recognized as a single unit of

accounting based on the proportional performance

for the combined unit. Beginning on January 1, 2011,

services in new or materially modified arrangements

of this nature are now divided into separate units of

accounting and revenue is allocated to each unit

based on the relative selling price method. As the

services in these arrangements are generally

delivered over the same term with consistent patterns

of performance, there is no change in the timing or

pattern of revenue recognition upon adoption of

Accounting Standard Update (ASU) 2009-13,

“Multiple-Deliverable Revenue Arrangements,” an

update to ASC Topic 605, “Revenue Recognition,”

and formerly known as EITF 08-1, “Revenue

Arrangements with Multiple Deliverables”, nor does

it have a material effect on revenue recognition for

these arrangements in future periods.

The Company’s multiple element arrangements may

include one or more elements that are subject to

other topics including software revenue recognition

and leasing guidance. The consideration for these

multiple element arrangements is allocated to each

group of deliverables – those subject to ASC 605-25

and those subject to other topics based on the

revised guidance in ASU 2009-13. Arrangement

revenue for each group of deliverables is then further

separated, allocated, and recognized based on

applicable guidance.

The Company’s NetSpend revenues principally

consist of a portion of the service fees and

interchange revenues received by the Issuing Banks

in connection with the programs NetSpend manages.

Revenue is recognized when there is persuasive

evidence of an arrangement, the relevant services

have been rendered, the price is fixed or

determinable and collectability is reasonably assured.

Cardholders are charged fees in connection with

NetSpend’s products and services as follows:

• Transactions — Cardholders are typically

charged a fee for each PIN and signature-based

purchase transaction made using their GPR

cards, unless the cardholder is on a monthly or

annual service plan, in which case the cardholder

is instead charged a monthly or annual

subscription fee, as applicable. Cardholders are

also charged fees for ATM withdrawals and other

transactions conducted at ATMs.

• Customer Service and Maintenance —

Cardholders are typically charged fees for

balance inquiries made through NetSpend’s call

43