NetSpend 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

vest, up to a maximum of 200% of the total grant.

Compensation expense for the award is measured on

the grant date based on the quoted market price of

TSYS common stock. The Company estimates the

probability of achieving the goals through the

performance period and will expense the award on a

straight-line basis. Compensation costs related to

these performance shares are expected to be

recognized until the end of 2014.

In March 2011, TSYS authorized a total grant of

263,292 performance shares to certain key executives

with a performance based vesting schedule (2011

performance shares). These 2011 performance shares

have a 2011-2013 performance period for which the

Compensation Committee of the Board of Directors

established two performance goals: compound

growth in revenues before reimbursable items and

income from continuing operations and, if such goals

are attained in 2013, the performance shares will

vest, up to a maximum of 200% of the total grant.

Compensation expense for the award is measured on

the grant date based on the quoted market price of

TSYS common stock. On January 22, 2014, when the

Committee certified performance, the performance

shares vested at approximately 153% of the total

grant.

As of December 31, 2013, there was approximately

$13.9 million of total unrecognized compensation

cost related to the 2012 and 2013 performance

shares compensation arrangement. That cost is

expected to be recognized until the end of 2015.

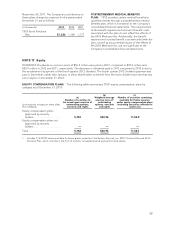

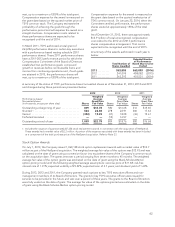

A summary of the awards authorized in each year is

below:

Total Number of

Shares Awarded

Potential Number

of Performance-

Based Shares to be

Vested

2013 ......... 563,803 563,803 (2016)

2012 ......... 241,095 458,082 (2015)

2011 ......... 263,292 403,521 (2014)

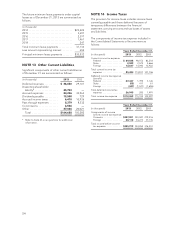

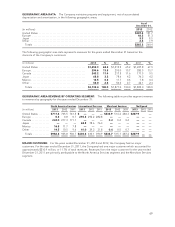

A summary of the status of TSYS’ performance-based nonvested shares as of December 31, 2013, 2012 and 2011

and changes during those periods are presented below:

2013 2012 2011

Performance-based

Nonvested shares

(in thousands, except per share data) Shares

Weighted

Average

Grant Date

Fair Value Shares

Weighted

Average

Grant Date

Fair Value Shares

Weighted

Average

Grant Date

Fair Value

Outstanding at beginning of year ............. 809 $18.76 580 $16.68 316 $15.65

Granted 1................................. 564 24.88 278 22.91 300 17.63

Vested ................................... (324) 15.93 (37) 18.08 (36) 15.61

Forfeited/canceled ......................... ——(12) 16.57 — —

Outstanding at end of year .................. 1,049 $22.75 809 $18.76 580 $16.68

1 Includes the issuance of approximately 87,356 stock replacement awards in connection with the acquisition of NetSpend.

These awards had a market value of $2.2 million. A portion of the expense associated with these awards has been included

as a component of the total purchase price of the NetSpend acquisition. Refer to Note 23.

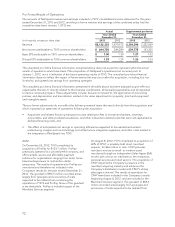

Stock Option Awards

On July 1, 2013, the Company issued 1,060,148 stock option replacement awards with a market value of $13.7

million as part of the NetSpend acquisition. The weighted average fair value of the options was $12.93 and was

calculated on the date of grant using a conversion factor into equivalent shares of the Company’s common stock

on the acquisition date. The grants vest over a period ranging from seven months to 45 months. The weighted

average fair value of the option grants was estimated on the date of grant using the Black-Scholes-Merton

option-pricing model with the following weighted average assumptions: exercise price of $11.68; risk-free

interest rate of 1.31%; expected volatility of 29.22%; expected term of 4.7 years; and dividend yield of 1.63%.

During 2013, 2012 and 2011, the Company granted stock options to key TSYS executive officers and non-

management members of its Board of Directors. The grants to key TSYS executive officers were issued for

services to be provided in the future and vest over a period of three years. The grants to the Board of Directors

were fully vested on the date of grant. The average fair value of the options granted was estimated on the date

of grant using the Black-Scholes-Merton option-pricing model.

63