NetSpend 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

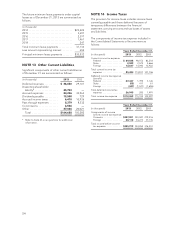

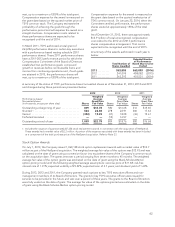

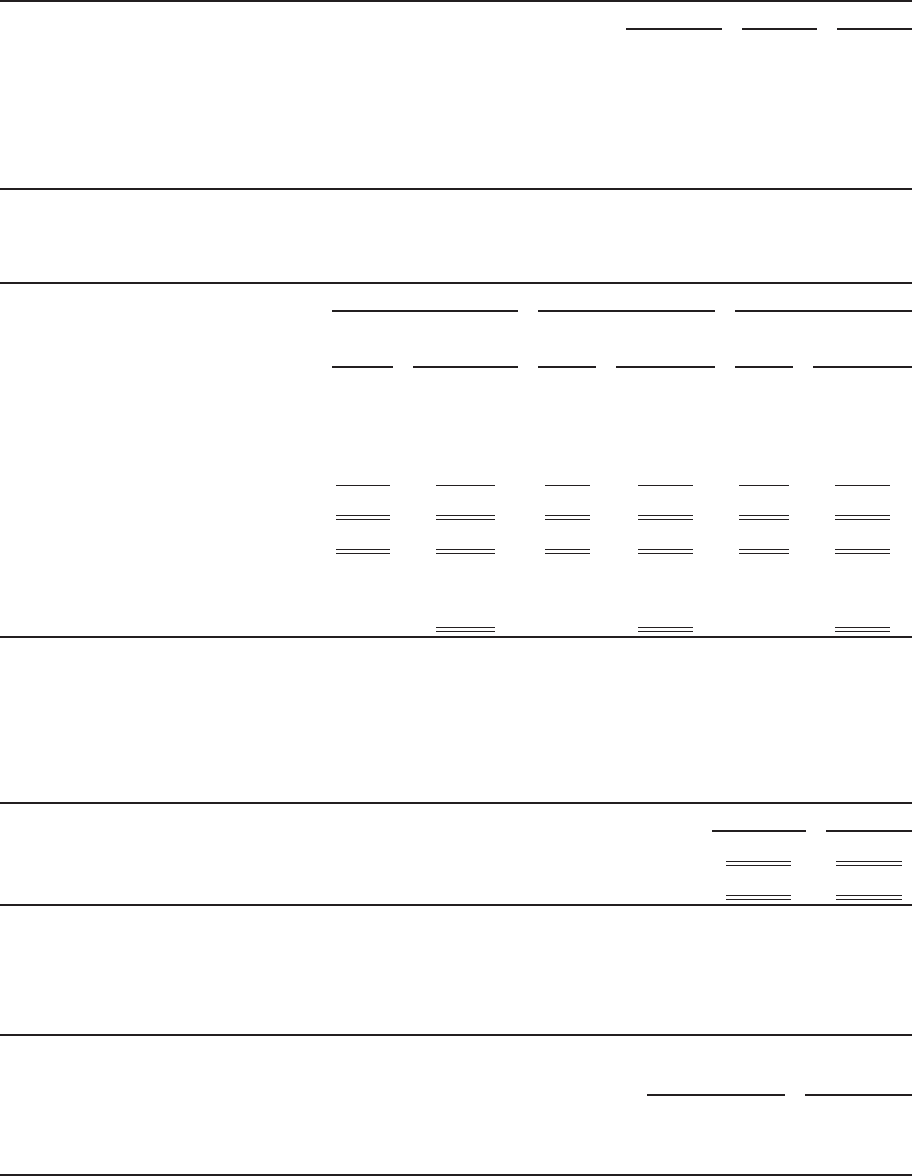

The following table summarizes the weighted average assumptions, and the weighted average fair value of the

options:

2013 2012 2011

Number of options granted ........................................ 1,939,796 818,090 716,508

Weighted average exercise price ................................... $ 17.42 $ 22.95 $ 17.61

Risk-free interest rate ............................................. 1.31% 1.69% 2.96%

Expected volatility ................................................ 26.81% 24.11% 29.98%

Expected term (years) ............................................. 6.0 7.9 8.5

Dividend yield ................................................... 1.64% 1.75% 1.59%

Weighted average fair value ........................................ $ 9.48 $ 5.27 $ 5.78

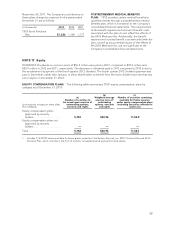

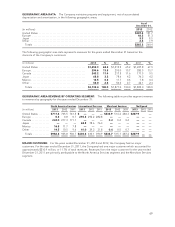

A summary of TSYS’ stock option activity as of December 31, 2013, 2012 and 2011, and changes during the years

ended on those dates is presented below:

2013 2012 2011

(in thousands,

except per share data) Options

Weighted

Average

Exercise Price Options

Weighted

Average

Exercise Price Options

Weighted

Average

Exercise Price

Options:

Outstanding at beginning of year . . 6,065 $21.27 6,082 $20.61 8,810 $23.40

Granted 1...................... 1,940 17.42 818 22.95 717 17.61

Exercised ...................... (2,177) 18.75 (619) 16.15 (597) 13.51

Forfeited/canceled .............. (76) 16.78 (216) 23.73 (2,848) 29.96

Outstanding at end of year ........ 5,752 $20.96 6,065 $21.27 6,082 $20.61

Options exercisable at year-end .... 3,232 $23.02 3,235 $24.12 3,122 $25.00

Weighted average fair value of

options granted during the

year ......................... $ 9.48 $ 5.27 $ 5.78

1 Includes the issuance of approximately 1.1 million stock option replacement awards in connection with the acquisition of

NetSpend. These awards had a market value of $13.7 million. A portion of the expense associated with these awards has

been included as a component of the total purchase price of the NetSpend acquisition. Refer to Note 23.

As of December 31, 2013, the average remaining contractual life and intrinsic value of TSYS’ outstanding and

exercisable stock options were as follows:

Outstanding Exercisable

Average remaining contractual life (in years) ................................... 6.5 4.5

Aggregate intrinsic value (in thousands) ....................................... $70,851 $33,143

Shares Issued for Options Exercised

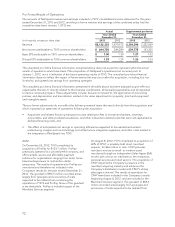

During 2013, 2012 and 2011, employees of the Company exercised options for shares of TSYS common stock

that were issued from treasury. The table below summarizes these stock option exercises by year:

(in thousands)

Options Exercised

and Issued from

Treasury Intrinsic Value

2013 ............................................................. 2,177 $16,580

2012 ............................................................. 619 4,243

2011 ............................................................. 597 3,627

64