NetSpend 2013 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2013 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

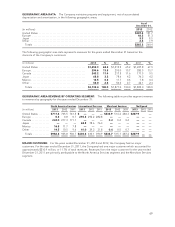

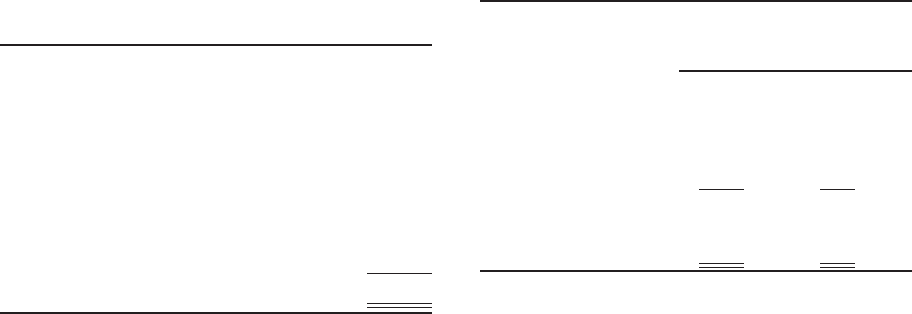

The following table summarizes the consideration

paid for TermNet and the recognized amounts of

identifiable assets acquired and liabilities assumed

effective May 2, 2011:

(in thousands)

Cash and restricted cash ............... $ 2,691

Accounts receivable ................... 10,253

Other assets ......................... 1,516

Identifiable intangible assets ............ 11,740

Goodwill ............................ 28,918

Accounts payable ..................... (5,578)

Accrued compensation ................. (2,683)

Deferred income tax liability ............ (4,506)

Other liabilities ....................... (351)

Total consideration .................. $42,000

The fair value of accounts receivable, accounts

payable, accrued compensation, and other liabilities

approximates the carrying amount of those assets

and liabilities at the acquisition date. The fair value of

accounts receivable due under agreements with

customers is $10.3 million. The gross amount due

under the agreements is $10.4 million, of which

approximately $100,000 is expected to be

uncollectible. Of the $42 million in consideration paid

for TermNet, $8.4 million was placed in escrow for a

period of 18 months to secure certain claims brought

against the escrowed consideration by TSYS pursuant

to the merger agreement. The maximum amount of

contingent consideration returnable to the Company

related to fundamental representations and

warranties made by TermNet is unlimited.

Identifiable intangible assets acquired in the TermNet

acquisition include customer relationships, channel

relationships, and non-compete agreements. The

identifiable intangible assets had no significant

estimated residual value. These intangible assets are

being amortized over their estimated useful lives of 2

to 10 years based on the pattern of expected future

economic benefit, which approximates a straight-line

basis over the useful lives of the assets. The fair value

of the acquired identifiable intangible assets of $11.7

million was estimated using the income approach

(discounted cash flow and relief from royalty

methods) and cost approach. The fair values and

useful lives of the identified intangible assets were

primarily determined using forecasted cash flows,

which included estimates for certain assumptions

such as revenues, expenses, attrition rates, and

royalty rates. The estimated fair value of identifiable

intangible assets acquired in the acquisition of

TermNet and the related estimated weighted

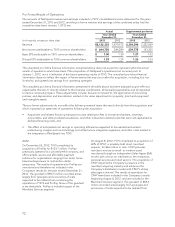

average useful lives are as follows:

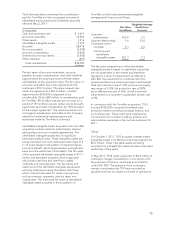

Fair Value

(in millions)

Weighted Average

Useful Lives

(in years)

Customer

relationships ........ $10.0 7.0

Channel relationships . . 1.6 10.0

Covenants-not-to-

compete ........... 0.1 2.0

Total acquired

identifiable

intangible assets . . . $11.7 7.3

The fair value measurement of the identifiable

intangible assets is based on significant inputs that

are not observable in the market and therefore,

represents a Level 3 measurement as defined in

ASC 820. Key assumptions include (a) cash flow

projections based on market participant and internal

data, (b) a discount rate of 14%, (c) a pre-tax royalty

rate range of 3-10%, (d) an attrition rate of 20%,

(e) an effective tax rate of 36%, and (f) a terminal

value based on a long-term sustainable growth rate

of 3%.

In connection with the TermNet acquisition, TSYS

incurred $192,000 in acquisition-related costs

primarily related to professional legal, finance, and

accounting costs. These costs were expensed as

incurred and are included in selling, general, and

administrative expenses in the income statement for

2011.

Other

On October 1, 2011, TSYS acquired contract-based

intangible assets in its Merchant Services segment for

$2.6 million. These intangible assets are being

amortized on a straight-line basis over their estimated

useful lives of five years.

In May 2011, TSYS made a payment of $6.0 million of

contingent merger consideration in connection with

the purchase of Infonox, which was accounted for

under ASC 805. The payment of the contingent

merger consideration by TSYS was recorded as

goodwill and had no impact on results of operations.

75