NetSpend 2013 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2013 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

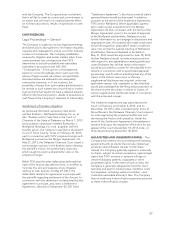

CHANGES IN TSYS’ OWNERSHIP INTEREST IN

SUBSIDIARIES: TSYS’ subsidiary GP Net

repurchased 400 common shares on December 29,

2011 from its noncontrolling interest. As a result of

the transaction, TSYS’ ownership increased to 54.08%

from 53.00%. The following table presents the effect

on TSYS’ shareholders’ equity from GP Net’s

acquisition of treasury shares:

(in thousands) Year Ended

December 31, 2011

Increase in OCI ............... $ 28

Increase in additional paid in

capital .................... 77

Effect from change in

noncontrolling interests ...... $105

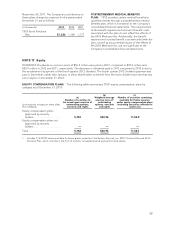

NOTE 18 Share-Based Compensation

General Description of Share-Based

Compensation Plans

TSYS has various long-term incentive plans under

which the Compensation Committee of the Board of

Directors has the authority to grant share-based

compensation to TSYS employees.

Employee stock options granted during or after 2006

(other than performance-based stock options)

generally become exercisable in three equal annual

installments on the anniversaries of the date of grant

and expire ten years from the date of grant. Vesting

for stock options granted during the years 2006

through 2009 (other than performance-based stock

options) accelerate upon retirement for employees

who have reached age 62 and who also have no less

than fifteen years of service, or are 65, at the date of

their election to retire. For stock options granted

during the years 2006 through 2009, share-based

compensation expense is fully recognized for plan

participants upon meeting the retirement eligibility

requirements of age and service. Employees not

retirement eligible who terminate employment only

received the shares for the full vesting periods

completed.

Stock options granted during 2010 and 2011

generally become exercisable in three equal annual

installments on the anniversaries of the date of grant

and expire ten years from the date of grant. These

options vest on a pro-rata basis upon retirement

based upon the number of months employed during

the year of retirement. For stock options granted

during 2010 and 2011, share-based compensation

expense is fully recognized for plan participants upon

meeting the retirement eligibility requirements of age

and service. Employees not retirement eligible who

terminate employment only received the shares for

the full vesting periods completed.

Stock options granted subsequent to 2011 generally

become exercisable in three equal annual

installments on the anniversaries of the date of grant

and expire ten years from the date of grant. For

employees who retire during the first 18 months of

the options term, the options vest on a pro-rata basis

based upon the number of months employed during

the year of retirement. If the employee retires after

the 18-month period, vesting is accelerated upon

retirement. When an employee meets the

requirements for retirement eligibility after the 18-

month period but before the final vesting period, the

employee is fully vested in the options at that time.

Employees not retirement eligible who terminate

employment only received the shares for the full

vesting periods completed.

Stock options granted prior to 2006 generally

become exercisable at the end of a two to three-year

period and expire ten years from the date of grant.

Vesting for stock options granted prior to 2006

accelerates upon retirement for plan participants who

have reached age 50 and who also have no less than

fifteen years of service at the date of their election to

retire. Following adoption of ASC 718, share-based

compensation expense is recognized in income over

the remaining nominal vesting period with

consideration for retirement eligibility.

Long-Term Incentive Plans

TSYS maintains the Total System Services, Inc. 2012

Omnibus Plan, Total System Services, Inc. 2007

Omnibus Plan, Total System Services, Inc. 2002 Long-

Term Incentive Plan, Total System Services, Inc. 2000

Long-Term Incentive Plan and the Amended and

Restated NetSpend Holdings, Inc. 2004 Equity

Incentive Plan for Options and Restricted Shares

Assumed by Total System Services, Inc. to advance

the interests of TSYS and its shareholders through

awards that give employees and directors a personal

stake in TSYS’ growth, development and financial

success. Awards under these plans are designed to

motivate employees and directors to devote their

best efforts to the business of TSYS. Awards will also

help TSYS attract and retain the services of

employees and directors who are in a position to

make significant contributions to TSYS’ success.

The plans are administered by the Compensation

Committee of the Company’s Board of Directors and

enable the Company to grant nonqualified and

incentive stock options, stock appreciation rights,

restricted stock and restricted stock units,

performance units or performance shares, cash-based

awards, and other stock-based awards.

60