NetSpend 2013 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2013 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Pro forma Results of Operations

The pro forma revenue and earnings of TSYS’

acquisitions other than NetSpend are not material to

the consolidated financial statements.

NOTE 24 Collaborative Arrangement

TSYS has a 45% ownership interest in an enterprise

jointly owned with two other entities which operates

aircraft for the owners’ internal use. The arrangement

allows each entity access to the aircraft and each

entity pays for its usage of the aircraft. Each quarter,

the net operating results of the enterprise are shared

among the owners based on their respective

ownership percentage.

TSYS records its usage of the aircraft and its share of

net operating results of the enterprise in selling,

general and administrative expenses.

NOTE 25 Earnings Per Share

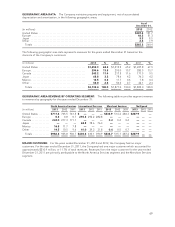

The following table illustrates basic and diluted EPS under the guidance of ASC 260:

December 31, 2013 December 31, 2012 December 31, 2011

(in thousands, except per share data)

Common

Stock Participating

Securities Common

Stock Participating

Securities Common

Stock Participating

Securities

Basic EPS:

Net income ................................ $244,750 244,280 220,559

Less income allocated to nonvested awards ..... (1,595) 1,595 (800) 800 (805) 805

Net income allocated to common stock for

EPS calculation(a) ....................... $243,155 1,595 243,480 800 219,754 805

Average common shares outstanding(b) ........ 187,145 1,246 187,403 627 191,239 707

Basic EPS(a)/(b) ............................ $ 1.30 1.28 1.30 1.28 1.15 1.14

Diluted EPS:

Net income ................................ $244,750 244,280 220,559

Less income allocated to nonvested awards ..... (1,585) 1,585 (796) 796 (804) 804

Net income allocated to common stock for

EPS calculation(c) ....................... $243,165 1,585 243,484 796 219,755 804

Average common shares outstanding .......... 187,145 1,246 187,403 627 191,239 707

Increase due to assumed issuance of shares

related to common equivalent shares

outstanding ............................. 1,648 1,262 345

Average common and common equivalent

shares outstanding(d) ..................... 188,793 1,246 188,665 627 191,584 707

Diluted EPS(c)/(d) ........................... $ 1.29 1.27 1.29 1.27 1.15 1.14

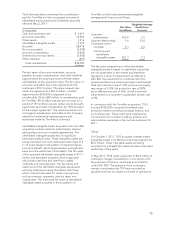

The diluted EPS calculation excludes stock options and nonvested awards that are convertible into 1.9 million,

2.9 million and 3.6 million common shares for the years ended December 31, 2013, 2012 and 2011, respectively,

because their inclusion would have been anti-dilutive.

NOTE 26 Subsequent Events

On February 11, 2014, with cash on hand, the

Company acquired an additional 15% equity interest

in CPAY from CPC Holding Company, LLC, a

California limited liability company. This purchase

reduced the remaining redeemable noncontrolling

interest in CPAY to 25% of its total outstanding

equity.

76