NetSpend 2013 Annual Report Download - page 48

Download and view the complete annual report

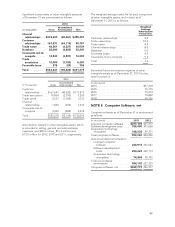

Please find page 48 of the 2013 NetSpend annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The two-class method is an earnings allocation

method for computing EPS when an entity’s capital

structure includes two or more classes of common

stock or common stock and participating securities. It

determines EPS based on dividends declared on

common stock and participating securities and

participation rights of participating securities in any

undistributed earnings.

Basic EPS is calculated by dividing net income by the

weighted average number of common shares

outstanding during the period. Diluted EPS is

calculated to reflect the potential dilution that would

occur if stock options or other contracts to issue

common stock were exercised. Diluted EPS is

calculated by dividing net income by weighted

average common and common equivalent shares

outstanding. Common equivalent shares are

calculated using the treasury stock method.

RECLASSIFICATIONS: Certain reclassifications

have been made to the 2012 and 2011 financial

statements to conform to the presentation adopted

in 2013.

NOTE 2 Fair Value Measurement

ASC 820, “Fair Value Measurements and Disclosure,”

requires disclosure about how fair value is

determined for assets and liabilities and establishes a

hierarchy for which these assets and liabilities must

be grouped, based on significant level of inputs. The

three-tier fair value hierarchy, which prioritizes the

inputs used in the valuation methodologies, is as

follows:

Level 1 — Quoted prices for identical assets and

liabilities in active markets.

Level 2 — Observable inputs other than quoted

prices included in Level 1, such as quoted prices for

similar assets and liabilities in active markets, quoted

prices for identical or similar assets and liabilities in

markets that are not active, or other inputs that are

observable or can be corroborated by observable

market data.

Level 3 — Unobservable inputs for the asset or

liability.

Goodwill is assessed annually for impairment in the

second quarter of each year using fair value

measurement techniques. Specifically, goodwill

impairment is determined using a two-step test. The

first step of the goodwill impairment test is used to

identify potential impairment by comparing the fair

value of a reporting unit (RU) with its book value,

including goodwill. If the fair value of the RU exceeds

its book value, goodwill is considered not impaired

and the second step of the impairment test is

unnecessary. If the book value of the RU exceeds its

fair value, the second step of the goodwill

impairment test is performed to measure the amount

of impairment loss, if any. The second step of the

goodwill impairment test compares the implied fair

value of the RU’s goodwill with the book value of that

goodwill. If the book value of the RU’s goodwill

exceeds the implied fair value of that goodwill, an

impairment loss is recognized in an amount equal to

that excess. The fair value of the RU is allocated to all

of the assets and liabilities of that unit as if the RU

had been acquired in a business combination and the

fair value of the RU was the purchase price paid to

acquire the RU.

The estimate of fair value of the Company’s RUs is

determined using various valuation techniques,

including using an equally weighted combination of

the market approach and the income approach. The

market approach, which contains Level 2 inputs,

utilizes readily available market valuation multiples to

estimate fair value. The income approach is a

valuation technique that utilizes the discounted cash

flow (DCF) method, which includes Level 3 inputs.

Under the DCF method, the fair value of the RU

reflects the present value of the projected earnings

that will be generated by each RU after taking into

account the revenues and expenses associated with

the asset, the relative risk that the cash flows will

occur, the contribution of other assets, and an

appropriate discount rate to reflect the value of the

invested capital. Cash flows are estimated for future

periods based upon historical data and projections

by management.

As of December 31, 2013, the Company had

recorded goodwill in the amount of $1.5 billion. The

Company performed its annual impairment test of its

goodwill balances as of May 31, 2013, and this test

did not indicate any impairment. The fair value of the

RUs substantially exceeds the carrying value. Refer to

Note 6 for more information regarding goodwill.

The fair value of the Company’s long-term debt and

obligations under capital leases is not significantly

different from its carrying value.

NOTE 3 Relationships with Affiliated

Companies

The Company provides electronic payment

processing and other services to the Company’s

46